Three Growth Companies With Insider Ownership As High As 28%

As global markets navigate through fluctuating interest rates and mixed economic signals, investors continue to seek stable yet promising opportunities. High insider ownership in growth companies often signals strong confidence from those who know the business best, making these stocks potentially attractive in the current uncertain market environment.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Medley (TSE:4480) | 34% | 28.7% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 11.9% | 59.8% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

We're going to check out a few of the best picks from our screener tool.

Grupo Aeroportuario del Sureste S. A. B. de C. V

Simply Wall St Growth Rating: ★★★★☆☆

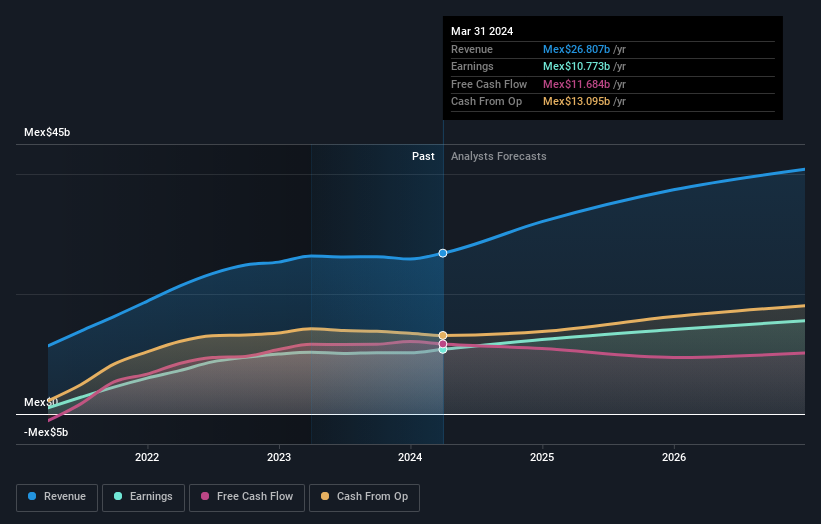

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V., operates as an airport group in Mexico and has a market capitalization of approximately MX$162.49 billion.

Operations: The company's revenue is primarily derived from its airport operations in Cancun, which generated MX$15.74 billion, followed by SAN Juan, Puerto Rico, US with MX$4.20 billion, Colombia at MX$2.71 billion, Merida contributing MX$1.34 billion, and Villahermosa at MX$0.57 billion.

Insider Ownership: 28.3%

Grupo Aeroportuario del Sureste, S.A.B. de C.V. has demonstrated a solid growth trajectory with earnings increasing by 23% annually over the past five years. Recent traffic results show year-over-year increases, supporting a positive outlook despite some fluctuations in monthly figures. The company's revenue and earnings are forecasted to grow at 12.3% and 12.4% per year respectively, outpacing the broader Mexican market's growth rates. However, its dividend track record remains unstable, suggesting potential concerns for yield-focused investors.

Saudi Automotive Services

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saudi Automotive Services Company operates a network of vehicle service stations across Saudi Arabia, with a market capitalization of SAR 3.95 billion.

Operations: The company's revenue is primarily generated from Retail and Operating activities, including oil company petroleum services, which contributed SAR 9.35 billion, alongside smaller contributions from Saudi Club and Fleet Transport segments totaling approximately SAR 79.10 million.

Insider Ownership: 12.5%

Saudi Automotive Services has shown promising growth with earnings forecasted to increase by 28.41% annually. Despite this, the company's return on equity is expected to remain low at 17.7% in three years, and recent dividends have been unstable, reflecting potential financial management issues. Recent corporate governance changes and a new auditor appointment suggest proactive steps towards addressing these challenges, yet the interest payments poorly covered by earnings indicate ongoing financial stress.

Shenzhen Envicool Technology

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd., operating in China, specializes in the production and sale of temperature control solutions and products, with a market capitalization of approximately CN¥16.07 billion.

Operations: The company generates its revenue from the production and sale of temperature control solutions and products within China.

Insider Ownership: 19.7%

Shenzhen Envicool Technology, a company with high insider ownership, has demonstrated strong financial performance and growth potential. Recently added to an index, the company announced significant increases in both quarterly and annual earnings, with sales rising to CNY 745.64 million in Q1 2024 from CNY 527.47 million the previous year. Analysts expect substantial above-market growth in revenue and earnings over the next three years, forecasting a revenue increase of 28% per year and earnings growth of 31.44% annually. Despite these positives, there is no recent data on substantial insider buying which might temper investor enthusiasm slightly.

Summing It All Up

Reveal the 1446 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BMV:ASUR BSASE:4050 SZSE:002837

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance