Three Growth Companies With High Insider Ownership On Chinese Exchange Boasting 60% Earnings Growth

As global markets navigate through various economic signals, Chinese stocks have shown some vulnerability with slight declines amid concerns about the slowing economy. In this context, identifying growth companies with high insider ownership on Chinese exchanges can offer investors a unique blend of growth potential and aligned interests between shareholders and management. High insider ownership often suggests that company leaders have significant confidence in the business's future, making such stocks potentially attractive during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 28.5% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 23% | 33.1% |

Let's explore several standout options from the results in the screener.

Beijing Tricolor Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tricolor Technology Co., Ltd, a global manufacturer and seller of professional audio and video products, has a market capitalization of approximately CN¥6.26 billion.

Operations: The company generates revenue primarily from the display control industry, totaling approximately CN¥498.28 million.

Insider Ownership: 39.2%

Earnings Growth Forecast: 60.9% p.a.

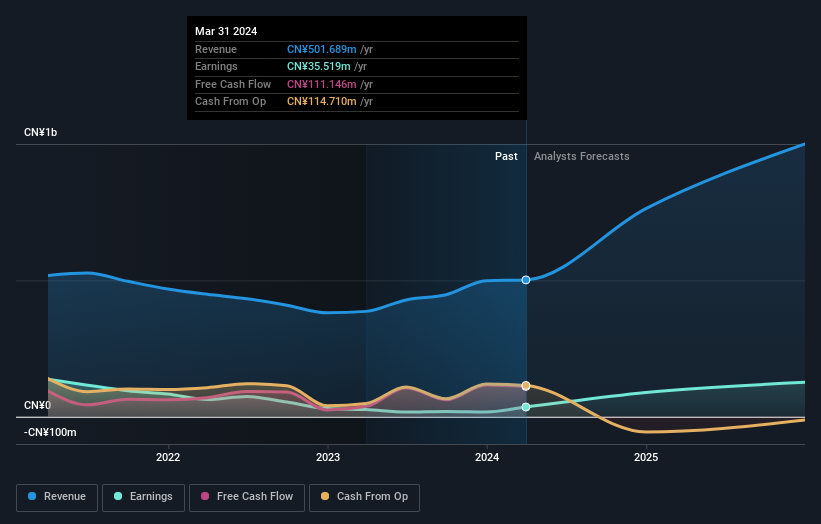

Beijing Tricolor Technology has demonstrated robust growth with a revenue increase to CNY 74.79 million and a shift from a net loss of CNY 12.04 million to a net income of CNY 5.99 million in the first quarter of 2024. The company's earnings are expected to grow by over 60% annually, outpacing the Chinese market's average. Despite this strong performance and high insider ownership, potential investors should note the company's share dilution over the past year and its highly volatile share price.

Zhejiang XCC GroupLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang XCC Group Co., Ltd specializes in the research, development, manufacturing, and sales of bearings globally, with a market capitalization of approximately CN¥6.01 billion.

Operations: The company generates revenue primarily through the development, manufacture, and sale of bearings across various international markets including the United States, Japan, Korea, and Brazil.

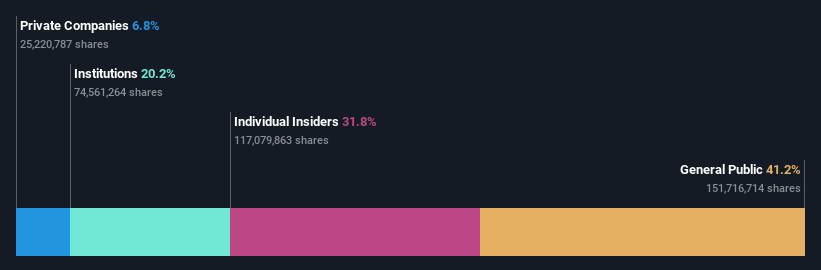

Insider Ownership: 31.8%

Earnings Growth Forecast: 44.8% p.a.

Zhejiang XCC Group Co., Ltd has shown promising financial trends with earnings forecasted to grow at 44.76% annually, surpassing the Chinese market's average growth rate. Revenue is also expected to increase significantly by 27.8% per year, outperforming the market expectation of 13.7%. However, investors should be cautious of the company’s unstable dividend track record and recent shareholder dilution. Recent financial reports indicate a slight decline in quarterly sales and net income compared to the previous year.

Konfoong Materials International

Simply Wall St Growth Rating: ★★★★★☆

Overview: Konfoong Materials International Co., Ltd. is a company specializing in high-purity metals and materials, primarily serving the electronics and semiconductor industries, with a market capitalization of approximately CN¥12.61 billion.

Operations: The company generates CN¥2.81 billion from its segment focused on manufacturing for computer, communications, and other electronic equipment.

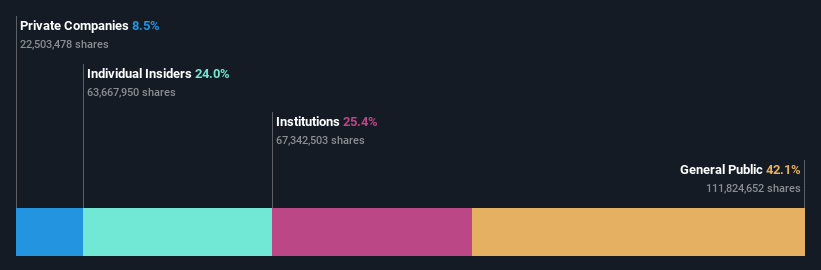

Insider Ownership: 24%

Earnings Growth Forecast: 22.8% p.a.

Konfoong Materials International Co. Ltd. is positioned for robust growth with earnings and revenue both expected to outpace the Chinese market significantly, at rates of 22.8% and 21.9% respectively per year. Despite a lower-than-industry-average Price-To-Earnings ratio of 47.6x, concerns arise from a forecasted low return on equity of 9% in three years and recent reductions in dividends, signaling potential challenges in sustaining shareholder returns amidst aggressive expansion efforts.

Next Steps

Navigate through the entire inventory of 368 Fast Growing Chinese Companies With High Insider Ownership here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603516 SHSE:603667 and SZSE:300666.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance