Three German Exchange Growth Companies With Insider Ownership And Earnings Growth Up To 47%

Amid a backdrop of political stability and economic growth, Germany's market has shown resilience, with the DAX index gaining 1.32% recently. In such an environment, growth companies with high insider ownership can be particularly compelling as they often demonstrate a strong alignment between management’s interests and shareholder returns.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

Deutsche Beteiligungs (XTRA:DBAN) | 39.1% | 31.6% |

YOC (XTRA:YOC) | 24.8% | 21.8% |

NAGA Group (XTRA:N4G) | 14.1% | 79.2% |

Exasol (XTRA:EXL) | 25.3% | 105.4% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stratec (XTRA:SBS) | 30.9% | 21.9% |

elumeo (XTRA:ELB) | 25.8% | 99.1% |

Redcare Pharmacy (XTRA:RDC) | 17.7% | 47.2% |

Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

We're going to check out a few of the best picks from our screener tool.

Hypoport

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE is a technology-based financial service provider in Germany with a market capitalization of approximately €2.07 billion.

Operations: The company generates revenue through its Credit Platform and Insurance Platform, contributing €155.60 million and €66.29 million respectively.

Insider Ownership: 35.1%

Earnings Growth Forecast: 31.9% p.a.

Hypoport SE, a German company with high insider ownership, shows promising growth potential despite some challenges. Its earnings have surged by 240.5% over the past year, significantly outpacing the market. Looking ahead, earnings are expected to grow at 31.9% annually, faster than Germany's average of 18.7%. However, its revenue growth forecast of 13.4% per year is modest compared to some peers but still exceeds the national market forecast of 5.2%. Recent financial results reflect robust gains with first-quarter sales rising to €107.47 million and net income increasing to €3.04 million from €0.503 million year-over-year.

Redcare Pharmacy

Simply Wall St Growth Rating: ★★★★☆☆

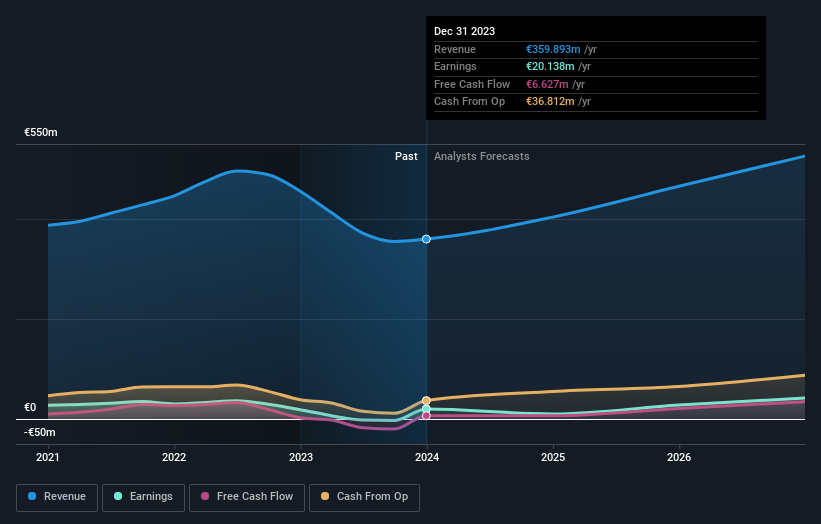

Overview: Redcare Pharmacy NV is a company that operates an online pharmacy business across several European countries including the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France, with a market capitalization of approximately €2.88 billion.

Operations: The company generates revenue primarily from two segments: €1.62 billion from the DACH region and €0.37 billion internationally.

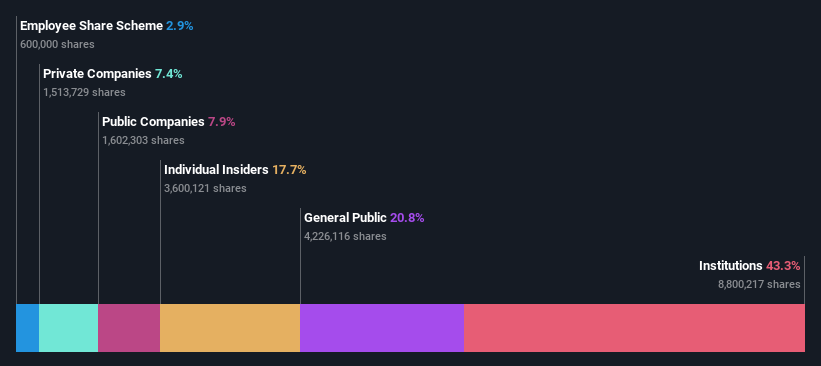

Insider Ownership: 17.7%

Earnings Growth Forecast: 47.2% p.a.

Redcare Pharmacy, a German growth company with high insider ownership, is trading at 71.5% below its estimated fair value, suggesting potential undervaluation. The company's revenue is expected to grow by 17.1% annually, outpacing the German market's 5.2%. Although earnings are forecasted to rise significantly at 47.17% per year and profitability is anticipated within three years, shareholder dilution occurred over the past year and the return on equity is projected to be low at 7.5%. Recent financials show an improvement with a reduced net loss and increased sales from €372.05 million to €560.22 million in Q1 2024.

Click to explore a detailed breakdown of our findings in Redcare Pharmacy's earnings growth report.

Our valuation report unveils the possibility Redcare Pharmacy's shares may be trading at a premium.

Zalando

Simply Wall St Growth Rating: ★★★★☆☆

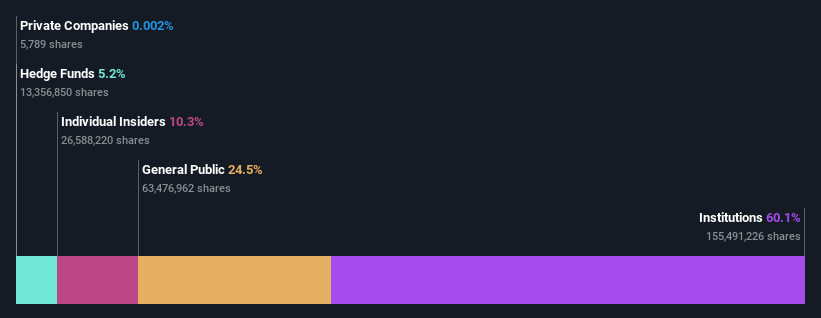

Overview: Zalando SE is an online retailer specializing in fashion and lifestyle products, with a market capitalization of approximately €6.12 billion.

Operations: The company generates €10.40 billion from its primary operations in the online fashion and lifestyle market.

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.4% p.a.

Zalando SE, a German growth company, is poised for substantial earnings growth, expected at 26.42% annually over the next three years, outstripping the broader German market's forecast of 18.7%. Despite trading at 52.8% below its fair value estimate and showing robust past earnings growth of 184.3%, Zalando's projected return on equity remains modest at 12.6%. Recent guidance anticipates modest sales growth between 0% and 5% for 2024 with an operating profit expected, indicating cautious optimism amidst aggressive expansion strategies showcased in multiple international conferences recently.

Click here and access our complete growth analysis report to understand the dynamics of Zalando.

Our expertly prepared valuation report Zalando implies its share price may be too high.

Turning Ideas Into Actions

Click through to start exploring the rest of the 15 Fast Growing German Companies With High Insider Ownership now.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:HYQ XTRA:RDC and XTRA:ZAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance