Those Who Purchased Laredo Petroleum (NYSE:LPI) Shares Three Years Ago Have A 96% Loss To Show For It

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Laredo Petroleum, Inc. (NYSE:LPI); the share price is down a whopping 96% in the last three years. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 81% in the last year. The falls have accelerated recently, with the share price down 79% in the last three months.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Laredo Petroleum

Laredo Petroleum isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

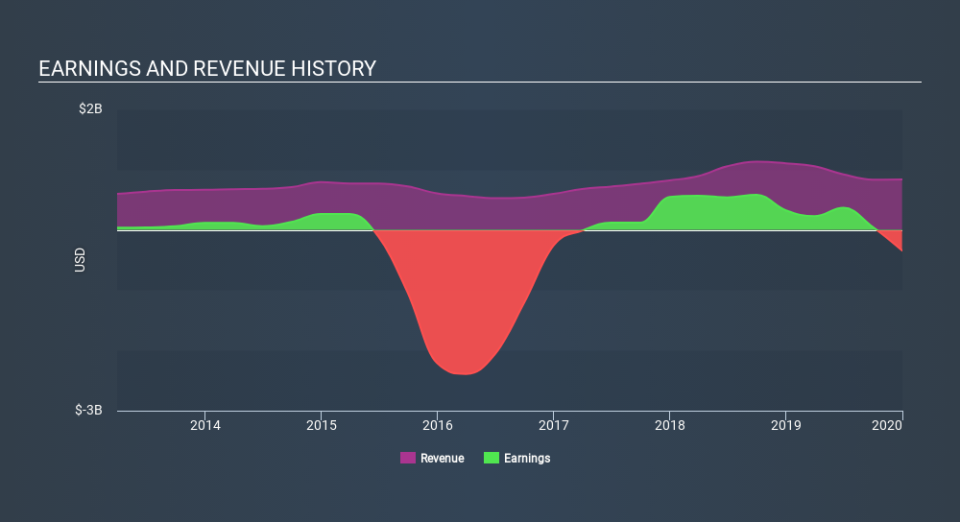

In the last three years, Laredo Petroleum saw its revenue grow by 12% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 65% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Laredo Petroleum

A Different Perspective

We regret to report that Laredo Petroleum shareholders are down 81% for the year. Unfortunately, that's worse than the broader market decline of 1.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 45% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Laredo Petroleum better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Laredo Petroleum you should know about.

Laredo Petroleum is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance