Those Who Purchased Indigo Books & Music (TSE:IDG) Shares Three Years Ago Have A 75% Loss To Show For It

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Indigo Books & Music Inc. (TSE:IDG) investors who have held the stock for three years as it declined a whopping 75%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 68% in the last year. The falls have accelerated recently, with the share price down 38% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Indigo Books & Music

Because Indigo Books & Music is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Indigo Books & Music saw its revenue grow by 0.7% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 37%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

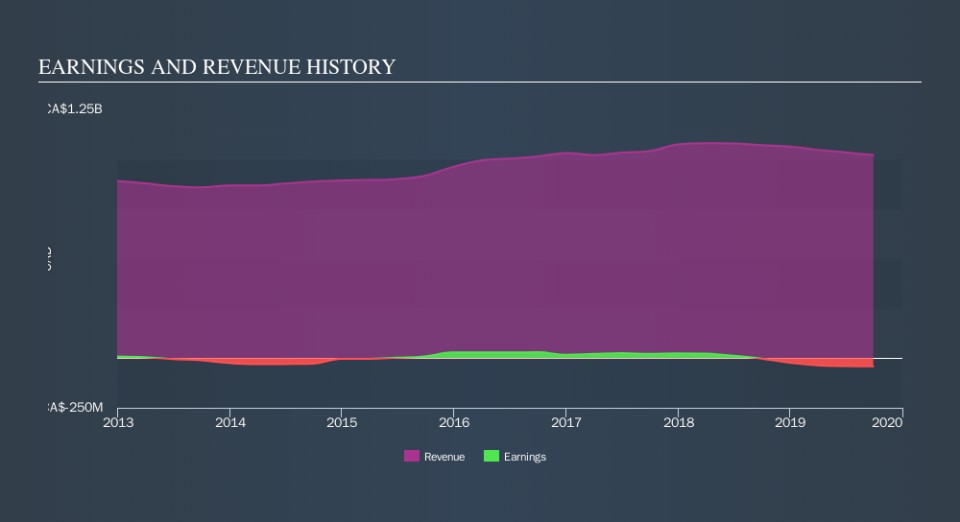

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Indigo Books & Music had a tough year, with a total loss of 68%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 19% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Indigo Books & Music's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Indigo Books & Music may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance