We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Omni Bridgeway Limited's (ASX:OBL) CEO For Now

Despite positive share price growth of 13% for Omni Bridgeway Limited (ASX:OBL) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 29 November 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Omni Bridgeway

How Does Total Compensation For Andrew Saker Compare With Other Companies In The Industry?

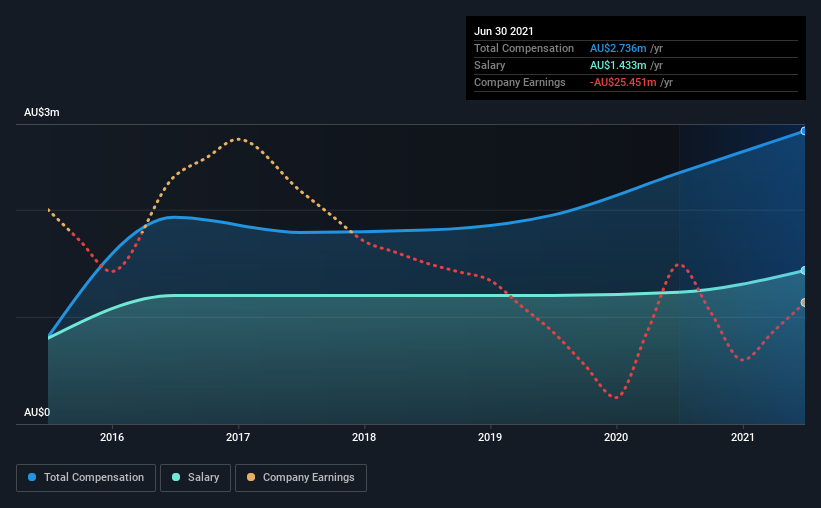

Our data indicates that Omni Bridgeway Limited has a market capitalization of AU$824m, and total annual CEO compensation was reported as AU$2.7m for the year to June 2021. We note that's an increase of 17% above last year. Notably, the salary which is AU$1.43m, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from AU$276m to AU$1.1b, the reported median CEO total compensation was AU$1.4m. This suggests that Andrew Saker is paid more than the median for the industry. Moreover, Andrew Saker also holds AU$566k worth of Omni Bridgeway stock directly under their own name.

Component | 2021 | 2020 | Proportion (2021) |

Salary | AU$1.4m | AU$1.2m | 52% |

Other | AU$1.3m | AU$1.1m | 48% |

Total Compensation | AU$2.7m | AU$2.3m | 100% |

On an industry level, roughly 79% of total compensation represents salary and 21% is other remuneration. It's interesting to note that Omni Bridgeway allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Omni Bridgeway Limited's Growth

Over the last three years, Omni Bridgeway Limited has shrunk its earnings per share by 6.9% per year. In the last year, its revenue is down 38%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Omni Bridgeway Limited Been A Good Investment?

Omni Bridgeway Limited has served shareholders reasonably well, with a total return of 13% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Omni Bridgeway (1 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance