Thermo Fisher (TMO) Unveils New Research Laboratory in WI

Thermo Fisher Scientific Inc. TMO has announced a new clinical research laboratory building at its good manufacturing practices (GMP) lab in Middleton, WI, under its PPD clinical research business.

The addition of a 72,500-square-foot building is likely to improve the company’s clinical development and laboratory services by expanding the site’s chemistry, manufacturing and control (CMC) analytical capabilities. This, in turn, should help its customers provide high quality and safety standards for patients.

This latest development by TMO is likely to help develop biohealth sector in WI by creating a greater workforce, boosting economic activities and giving an opportunity to improve patient health outcomes across the state.

More on the News

The project involves a $58 million investment. The latest addition to the GMP campus provides a multi-use and flexible biosafety level 2 laboratory that includes a purpose-built liquid chromatography-mass spectrometry and protein characterization space, two large molecular suites with access controlled pre- and post-amplification labs, and two large general-use labs.

The GMP site offers high-quality analytical services for small molecules and biologics, including biopharmaceuticals, inhaled pharmaceuticals and device testing, cell and gene therapy, protein characterization and mass spectrometry analysis for all phases of drug development.

The set-up will have 350 new scientists and laboratory support professionals.

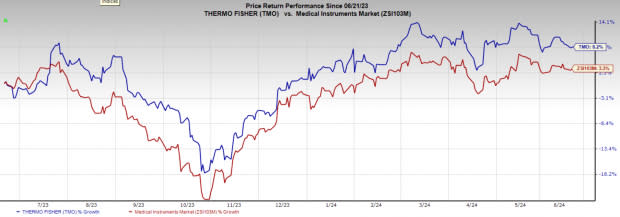

Image Source: Zacks Investment Research

Industry Prospects

Per a Mordor Intelligence report, the GMP Testing Service market is valued at $1.44 billion in 2024, and expected to reach $2 billion by 2029, at a CAGR of 6.84% during the time frame. The primary factors that influence the growth of the market are the expanding pharmaceutical industry and increased drug and device development.

Hence, Thermo Fisher’s latest addition to the GMP campus has turned out to be beneficial for the GMP Testing Service market.

Other Recent Developments

Last month, Thermo Fisher introduced the Gibco CTS OpTmizer One Serum-Free Medium (CTS OpTmizer One SFM), a novel animal origin-free formulation designed specifically for clinical and commercial cell therapy manufacturing, to deliver increased scalability and performance of T cell expansion. Its ready-to-use, one-part medium can help cell therapy manufacturers scale their manufacturing from process development to clinical trials and commercial manufacturing while maintaining consistent performance.

In May 2024, Thermo Fisher introduced the Applied BiosystemsAxiom BloodGenomiX Array and Software, a first-of-its-kind solution for more precise blood genotyping in clinical research. The new array detects most extended and rare blood groups, tissue (HLA) and platelet (HPA) types in a single, high-throughput assay, supporting future advancements in donor blood matching for extended phenotypes.

Price Performance

Shares of TMO have risen 8.2% in the past year compared with the industry’s 3.3% growth.

Zacks Rank and Key Picks

Thermo Fisher currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hims & Hers Health, Inc. HIMS, The Joint Corp. JYNT and Lantheus Holdings, Inc. LNTH. While Hims & Hers and The Joint currently sport a Zacks Rank #1 (Strong Buy) each, Lantheus carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hims & Hers Heath stock has surged 194.4% in the past year. Estimates for the company’s earnings have moved north 5.6% to 19 cents for 2024 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for The Joint’s 2024 earnings per share (EPS) have moved up 61.5% to 21 cents in the past 60 days. Shares of JYNT have surged 45.4% year to date against the industry’s 7.6% decline.

In the last reported quarter, JYNT delivered an earnings surprise of 300%. It has a trailing four-quarter average earnings surprise of 18.75%.

Estimates for Lantheus’ fiscal 2024 EPS have moved north 8.4% to $7.11 in the past 60 days. Shares of the company have risen 30.9% year to date compared with the industry’s growth of 3%.

LNTH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.6%. In the last reported quarter, it delivered an earnings surprise of 9.03%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

The Joint Corp. (JYNT) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance