The very hot economy is cooling from great to good

A version of this article was published on TKer.co.

Stocks ticked higher last week, with the S&P 500 rising 0.2% to close at 4,604.37. The index is now up 19.9% year to date, up 28.7% from its October 12, 2022 closing low of 3,577.03, and down 4% from its January 3, 2022 record closing high of 4,796.56.

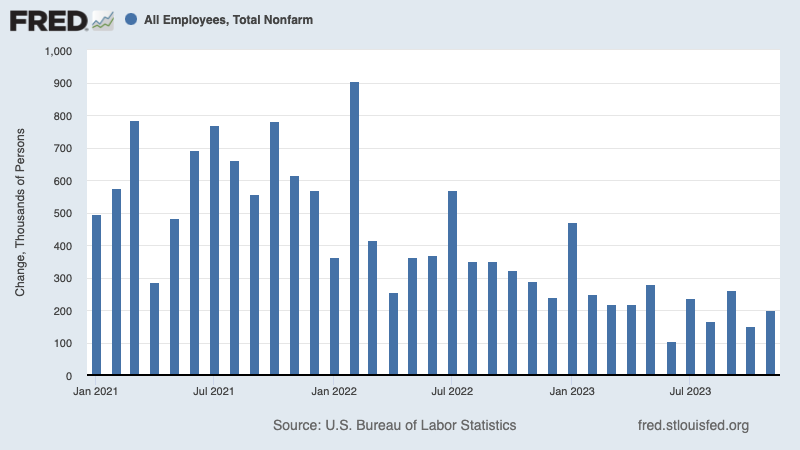

It’s great news that U.S. economy continues to create a lot of jobs every month. Just on Friday, we learned employers added a healthy 199,000 jobs in November.

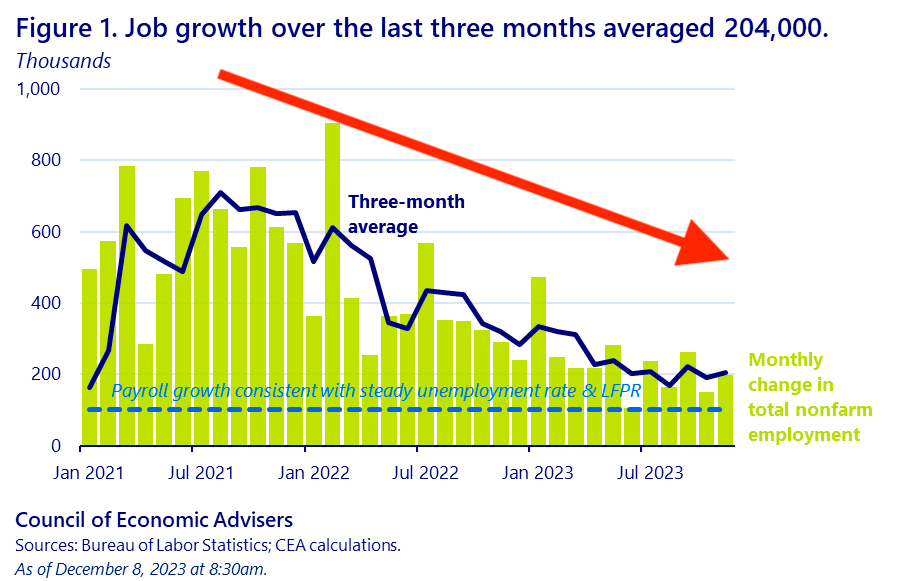

Still, it’s worth having a frank discussion about how the economy is cooling. As you can see in the chart above, the pace of job gains has come down significantly from summer 2021 levels.

To be clear, this is not to suggest that we’re doomed for a recession. Rather, it’s an acknowledgement that some of the unusual massive forces that have been juicing growth over the past few years have been easing. And the data seems to confirm economic conditions have gone from very hot to something that’s a bit more normal.

A quick look back

A year ago, many economists were warning the U.S. was barreling toward a recession.

At the time, it was a bit challenging to make sense of these bearish predictions considering the persistent massive economic tailwinds signaling future growth and the many other reasons for optimism.

Importantly, inflation at the time had already been cooling for months despite persistent economic growth — evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession. (This is a narrative we’ve been repeating every week in TKer’s weekly review of the macro crosscurrents).

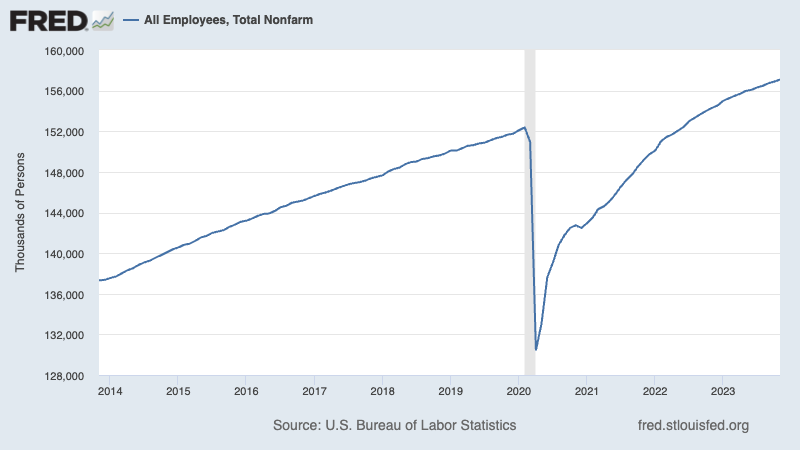

With the benefit of hindsight, we now know the economy created jobs every month year to date, consumer spending climbed to new record highs, and GDP growth remained positive and even accelerated in Q3.

We’re going from great times to good times

One of the most clicked and shared TKer newsletters ever is the March 4, 2022 issue: Three massive economic tailwinds I can't stop thinking about

Those three tailwinds: The unprecedented trillions of dollars worth of excess savings accumulated by consumers, the eye-poppingly high number of job openings, and the record-high levels of core capex orders.

These metrics are notable because they’re leading indicators: Excess savings represent extra money that has yet to be spent; elevated job openings represent hiring that has yet to happen, which also means incremental consumer spending power that has yet to be realized; and core capex orders represent capital goods businesses have yet to put in place, which means there’s still work to be done by manufacturers and that there’s more capacity coming for the businesses that ordered this stuff.

In recent months, these forces have trended toward more normal levels.

Excess savings have faded from peak levels, and most economists agree these balances will soon be depleted.

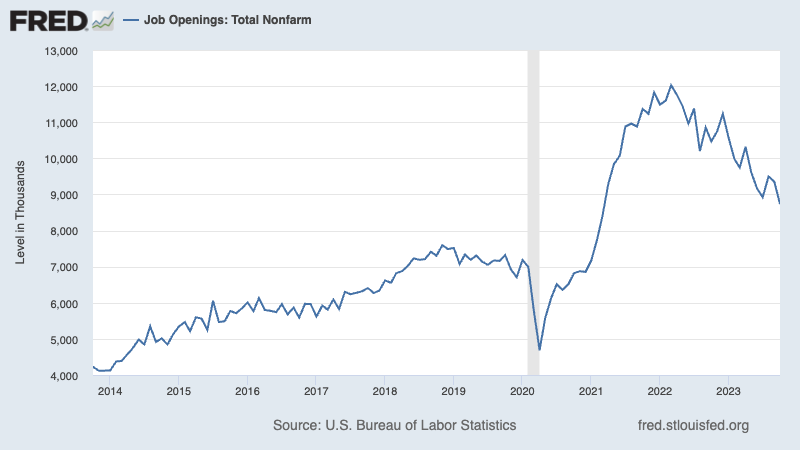

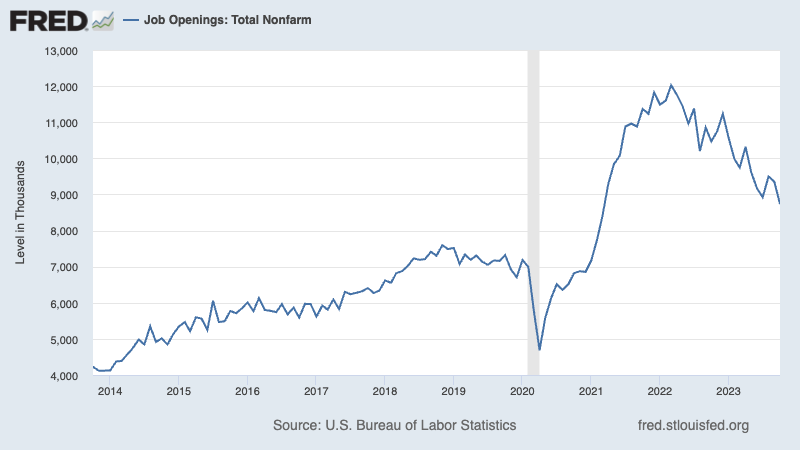

Job openings have come down significantly. According to the BLS’s Job Openings and Labor Turnover Survey, employers had 8.73 million job openings in October. This was the lowest print since March 2021, and it’s down significantly from the March 2022 high of 12.03 million.

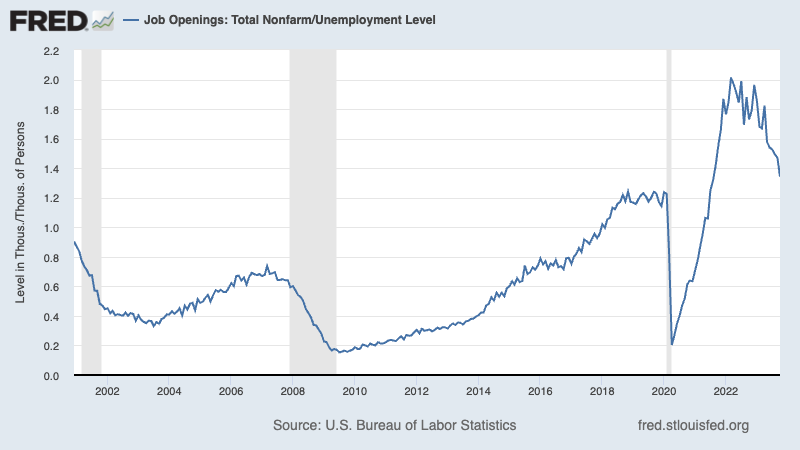

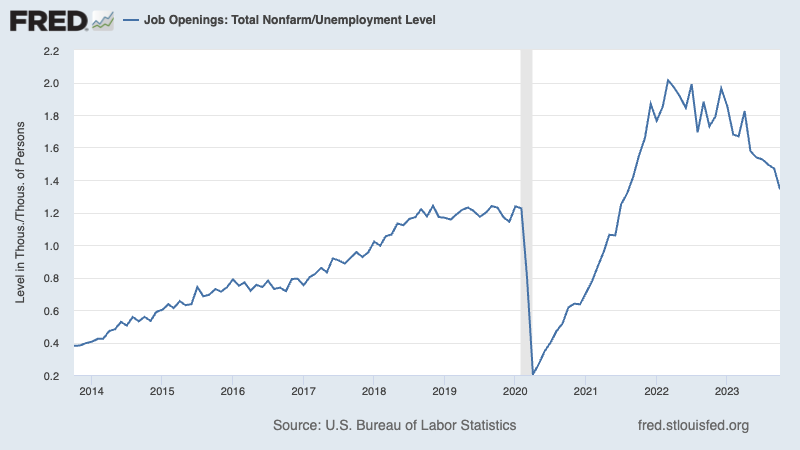

During the period, there were 6.50 million unemployed people — meaning there were 1.3 job openings per unemployed person. This metric — one of the most obvious signs of excess demand for labor — is close to prepandemic levels.

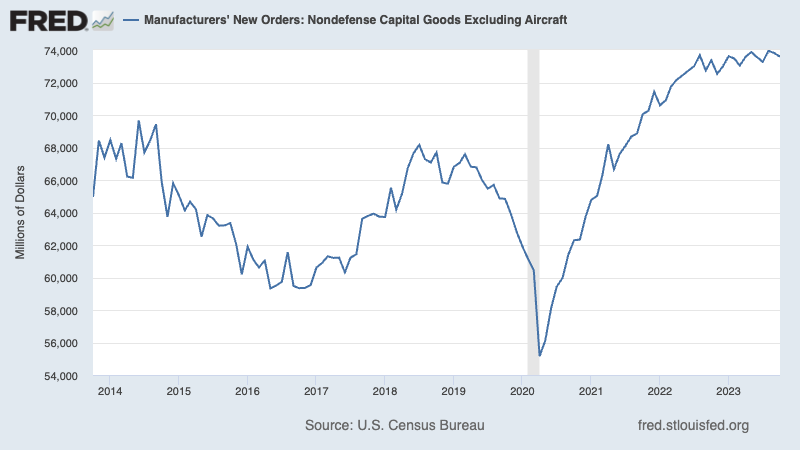

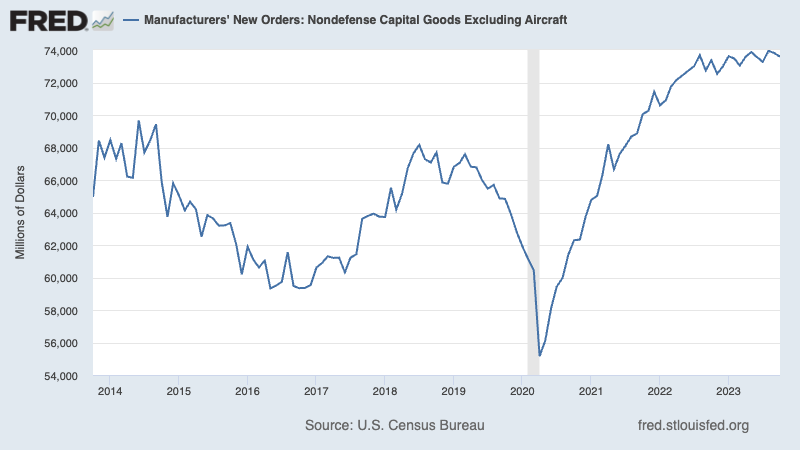

Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — fell 0.3% to $73.59 billion in October. While this figure continues to trend near record levels, growth seems to be stalling.

Let’s not panic

Just because excess savings are down doesn’t mean people are out of money. People most definitely have money. People are sitting on a lot of wealth. It’s just that the extra cash sitting on top of all that money and wealth has largely been spent.

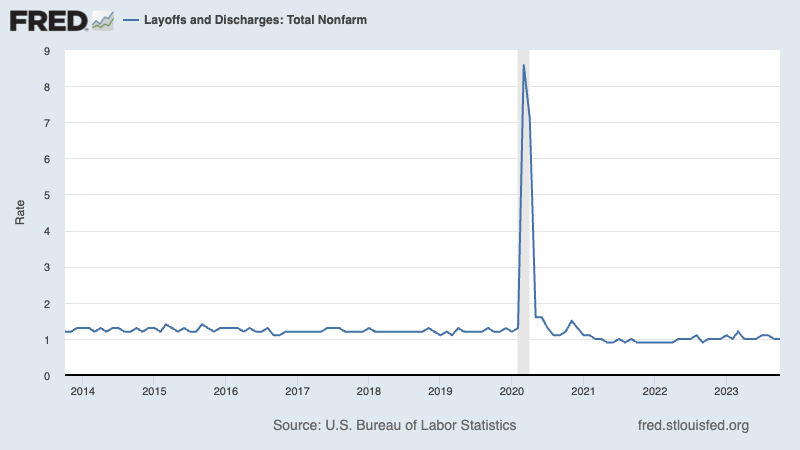

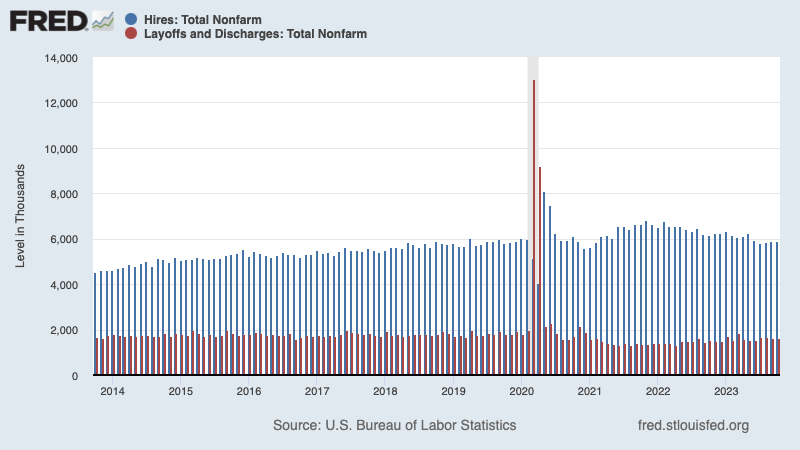

And just because job openings are down doesn’t mean the labor market is toast. There are still a lot of job openings. Furthermore, layoff activity remains low, hiring activity remains elevated, and claims for unemployment insurance remain depressed. It’s just that employers aren’t quite as desperate to fill open positions as they have been over the past two years.

And just because capex orders have gone sideways doesn’t mean business activity is going sideways. A lot of this equipment has yet to be delivered. Once in place, businesses are likely to be more productive than they once were.

Keep in mind that these cooling metrics are the intended effect of the Federal Reserve’s efforts to bring down inflation. (More here and here.) And in particularly good news, inflation rates have come down significantly from crisis levels.

Indeed, we seem to be realizing that bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession. (Again, a narrative we’ve been repeating every week in TKer’s weekly review of the macro crosscurrents).

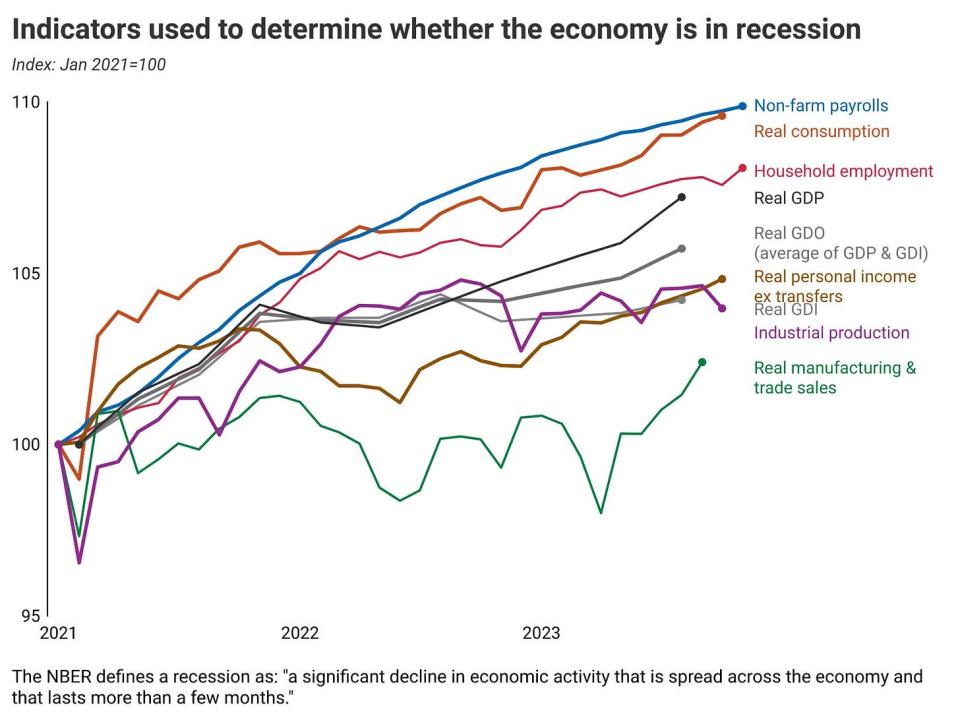

Here’s a great chart from economist Justin Wolfers tracking the trajectory of key measures of economic activity.

As you can see, while the rate of growth may be decelerating for some key measures, they are nevertheless still growing.

"If I had asked you a year ago to sketch what you thought a soft landing might look like," Wolfers tweeted after Friday’s jobs report, "it's likely you would have pretty much drawn the current economic data."

But let’s also not get complacent

I think it’s fair to say when growth rates cool and the forces juicing excess demand fade, you may be at greater risk of going into recession in the near future.

And let’s be realistic: Recessions happen.

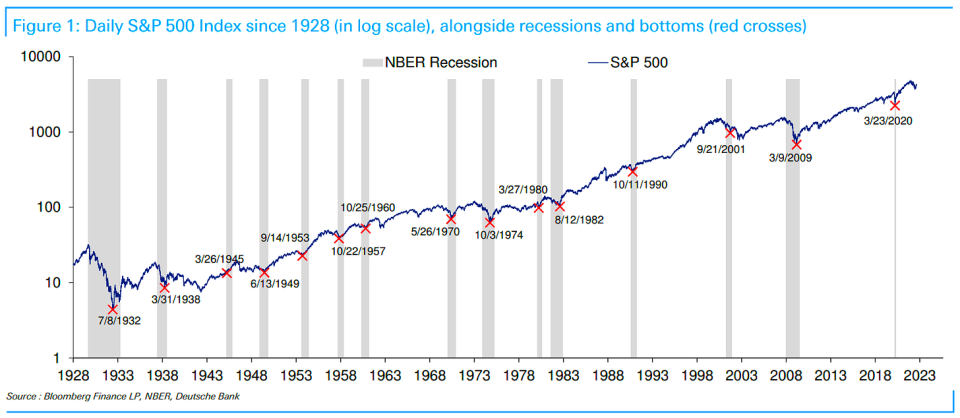

Recessions and the market volatility associated with economic downturns are unfortunate hurdles on the long-run path to building wealth in risk assets.

Consequently, I don’t think it’s totally unreasonable that some economists are forecasting a recession in 2024.

At the same time, not all recessions are the same. It’s certainly possible that the next recession is a short and shallow one. And keep in mind that a recession at this point would begin as the economy is in an unusually and historically strong position — meaning that a recession may knock the economy from being very strong to just strong.

To reiterate, a recession in the near-term is no sure thing. But as the data continues to come in, we’ll have to be vigilant as we watch for signs that the economic narratives may be shifting.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

The labor market continues to add jobs. According to the BLS’s Employment Situation report released Friday, U.S. employers added 199,000 jobs in November. While the pace of job growth has generally been cooler, a 35th straight month of gains reaffirms an economy with robust demand for labor.

Employers have now added a whopping 2.6 million jobs since the beginning of the year. Total payroll employment is at a record 157.1 million jobs.

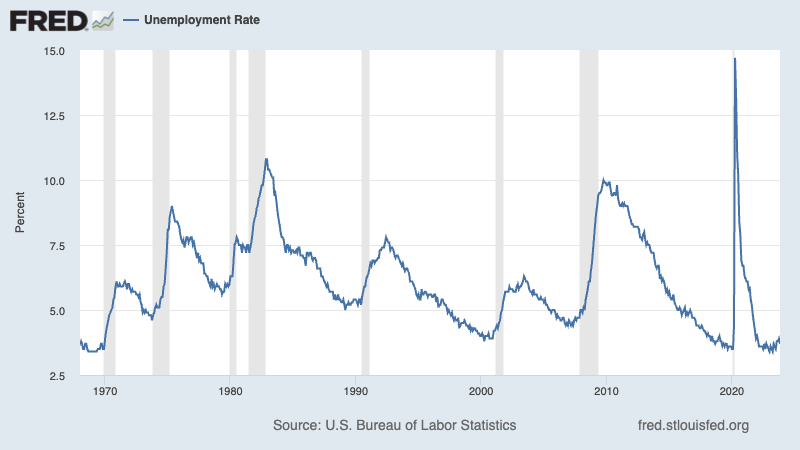

The unemployment rate — that is, the number of workers who identify as unemployed as a percentage of the civilian labor force — fell to 3.7% during the month. While it’s above its cycle low of 3.4%, it continues to hover near 50-year lows.

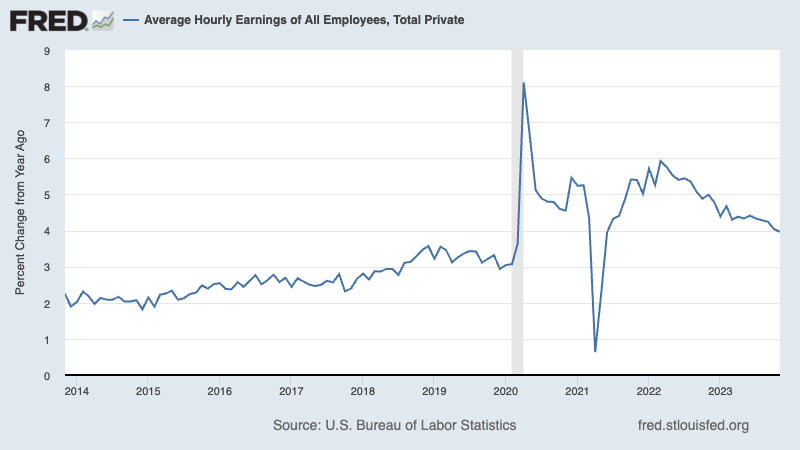

Wage growth is cooling. Average hourly earnings rose by 0.3% month-over-month in November, up slightly from the 0.4% pace in October. On a year-over-year basis, this metric is up 4.0%, a rate that’s been cooling but remains elevated.

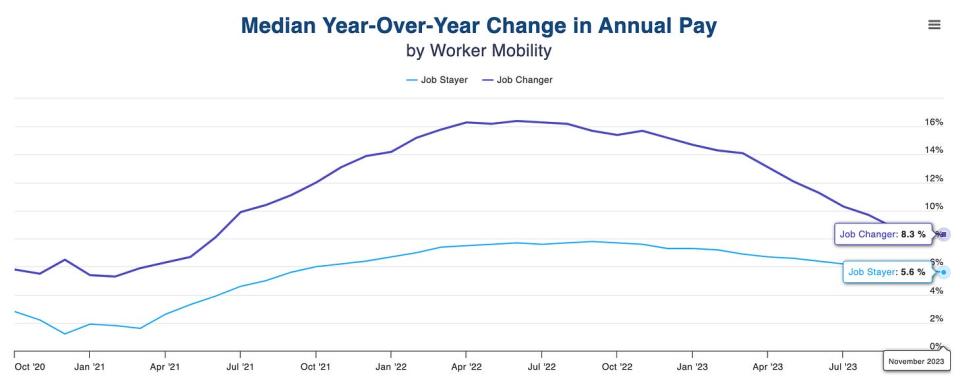

📈 Job switchers get better pay. According to ADP, which tracks private payrolls and employs a different methodology than the BLS, annual pay growth in November for people who changed jobs was up 8.3% from a year ago. For those who stayed at their job, pay growth was 5.6%.

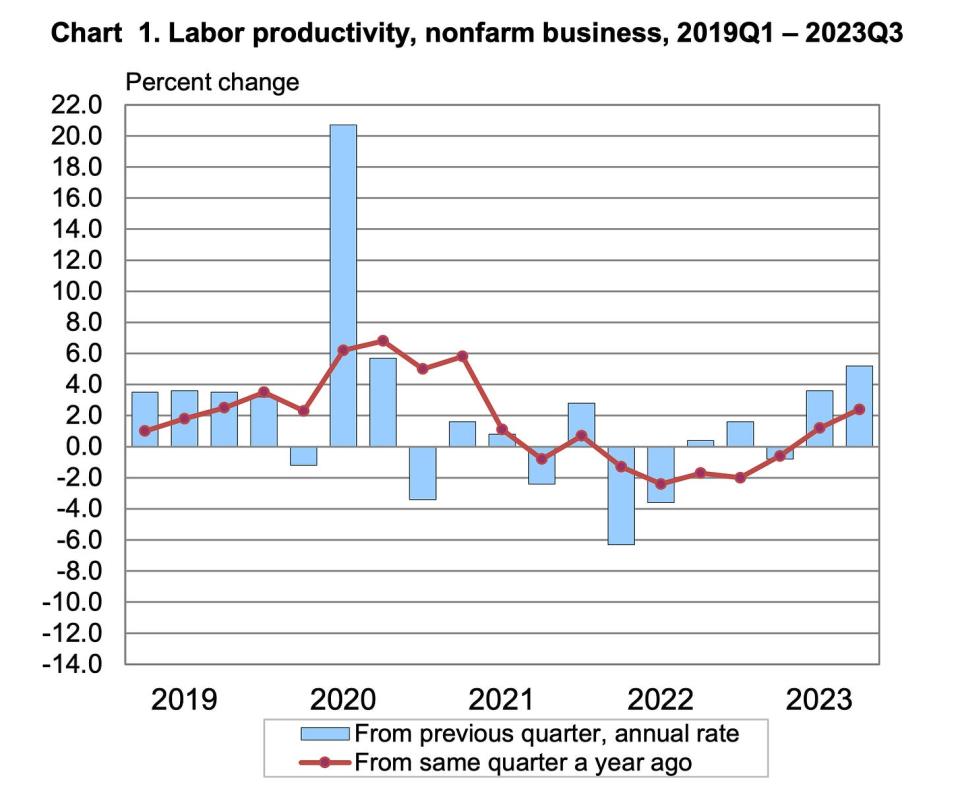

Labor productivity is up. From the BLS: "Nonfarm business sector labor productivity increased 5.2% in the third quarter of 2023… as output increased 6.1% and hours worked increased 0.9%. The increase in labor productivity is the highest rate since the third quarter of 2020, in which productivity increased 5.7%."

Job openings fall. According to the BLS’s Job Openings and Labor Turnover Survey, employers had 8.73 million job openings in October. This was the lowest print since March 2021. While this remains elevated above prepandemic levels, it’s down from the March 2022 high of 12.03 million.

During the period, there were 6.50 million unemployed people — meaning there were 1.3 job openings per unemployed person. While down from its peak, this continues to be one of the most obvious signs of excess demand for labor.

Layoffs remain depressed, hiring remains firm. Employers laid off 1.64 million people in October. While challenging for all those affected, this figure represents just 1.0% of total employment. This metric continues to trend below pre-pandemic levels.

Hiring activity continues to be much higher than layoff activity. During the month, employers hired 5.89 million people.

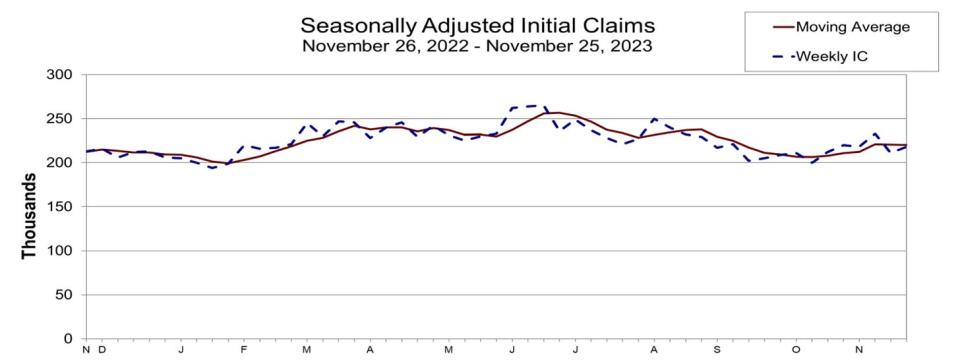

Unemployment claims tick higher. Initial claims for unemployment benefits increased to 220,000 during the week ending December 2, up from 219,000 the week prior. While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

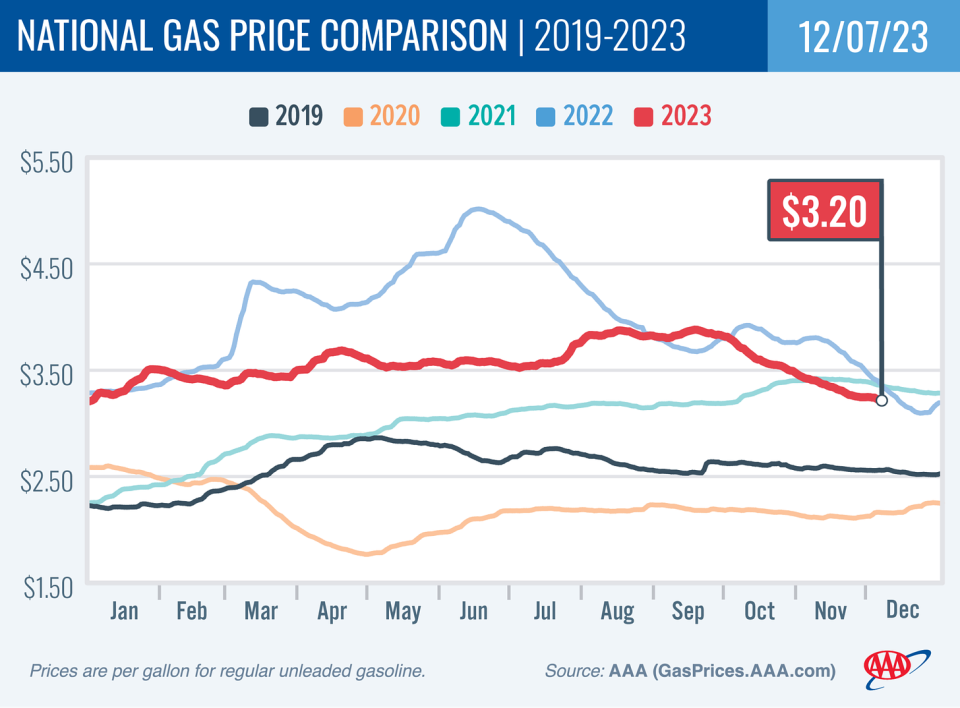

Gas prices continue to fall. From AAA: "After a one-day dalliance with a rising price, the national average for a gallon of gas resumed its steady retreat, shedding four cents since last week to $3.20. The main reason is a weaker cost for oil, which is struggling to stay above $70 per barrel. The falling price comes just a week after OPEC+ announced voluntary production cuts of about 2 million barrels daily. But instead of viewing it as coal in the stocking, the oil market response has thus far been a resounding ‘meh.’"

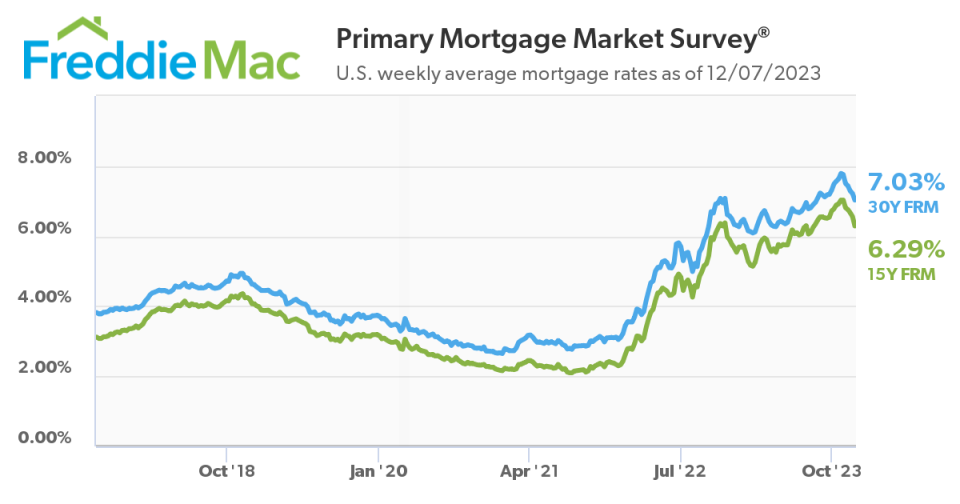

Mortgage rates continue to decline. According to Freddie Mac, the average 30-year fixed-rate mortgage fell to 7.03%. From Freddie Mac: "The 30-year fixed-rate mortgage averaged near 7% this week, down from nearly 7.80% just six weeks ago. When rates began to rapidly drop, purchase applications rebounded initially, but this improvement in demand diminished in the last week. Although these lower rates remain a welcome relief, it is clear they will have to further drop to more consistently reinvigorate demand."

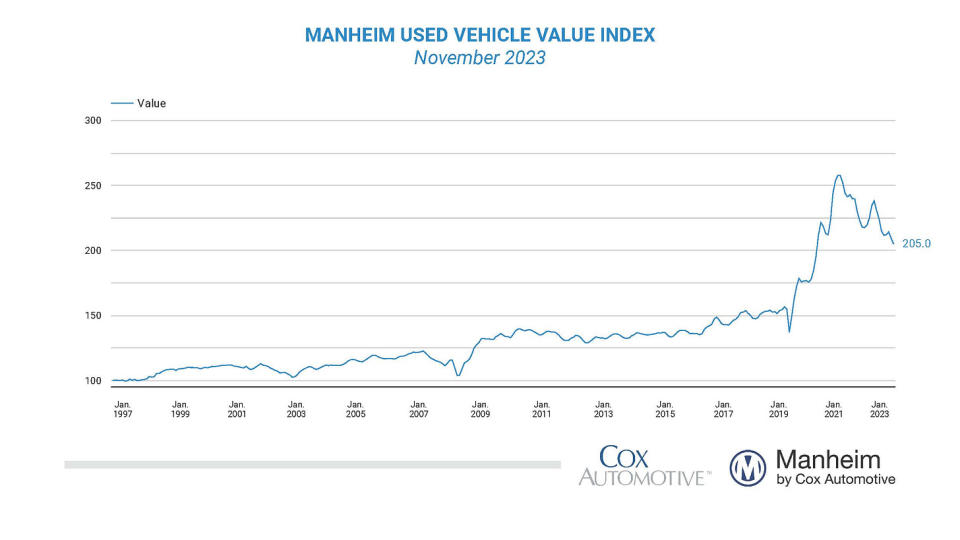

Used car prices continue to come down. From Manheim: "Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.1% in November from October. The Manheim Used Vehicle Value Index (MUVVI) dropped to 205.0, down 5.8% from a year ago."

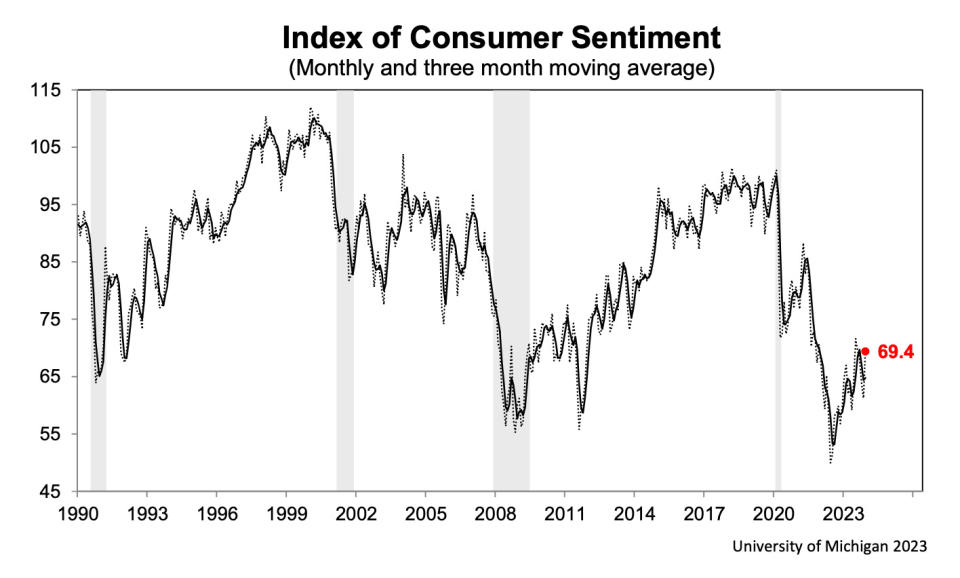

Consumer sentiment improved. The University of Michigan’s consumer sentiment index jumped in December. From the survey: "Consumer sentiment soared 13% in December, erasing all declines from the previous four months, primarily on the basis of improvements in the expected trajectory of inflation. … There was a broad consensus of improved sentiment across age, income, education, geography, and political identification. A growing share of consumers—about 14%—spontaneously mentioned the potential impact of next year’s elections. Sentiment for these consumers appears to incorporate expectations that the elections will likely yield results favorable to the economy."

On inflation expectations: "Year-ahead inflation expectations plunged from 4.5% last month to 3.1% this month. The current reading is the lowest since March 2021 and sits just above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations fell from 3.2% last month to 2.8% this month, matching the second lowest reading seen since July 2021."

This chart from Bloomberg’s Michael McDonough shows how sentiment has improved across political persuasions.

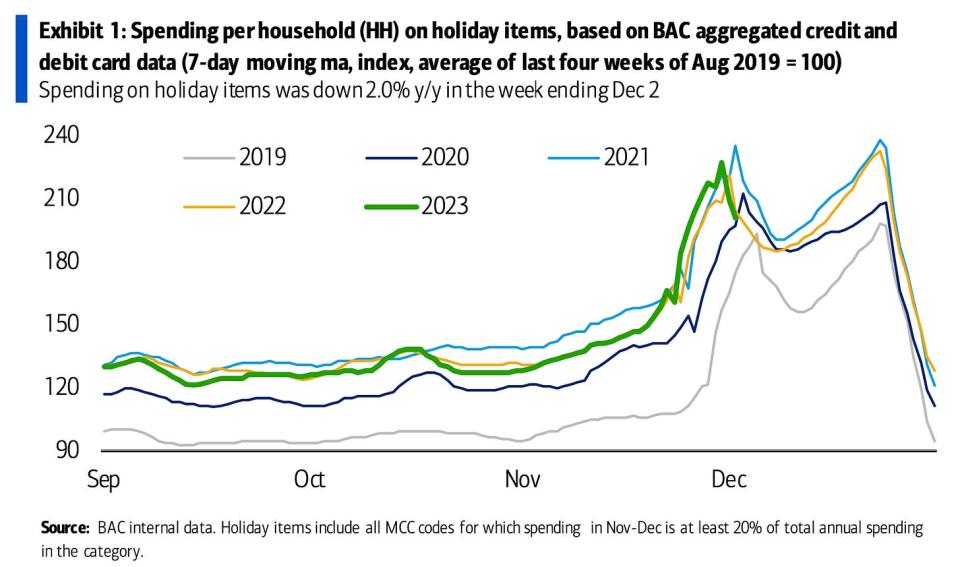

Card data suggest consumer spending is holding up. From BofA: "Total card spending per HH was up 1.8% y/y in the week ending Dec 2, according to BAC aggregated credit and debit card data. Y/y and 4-year spending growth for the week were still impacted in some categories by shifts in the timing of Thanksgiving. Stepping back, however, holiday season spending is off to a solid start."

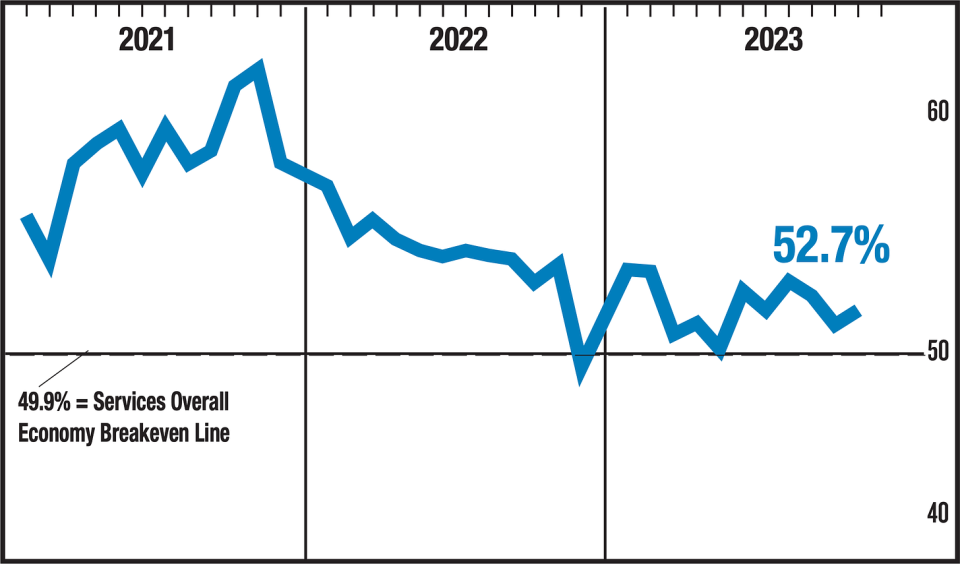

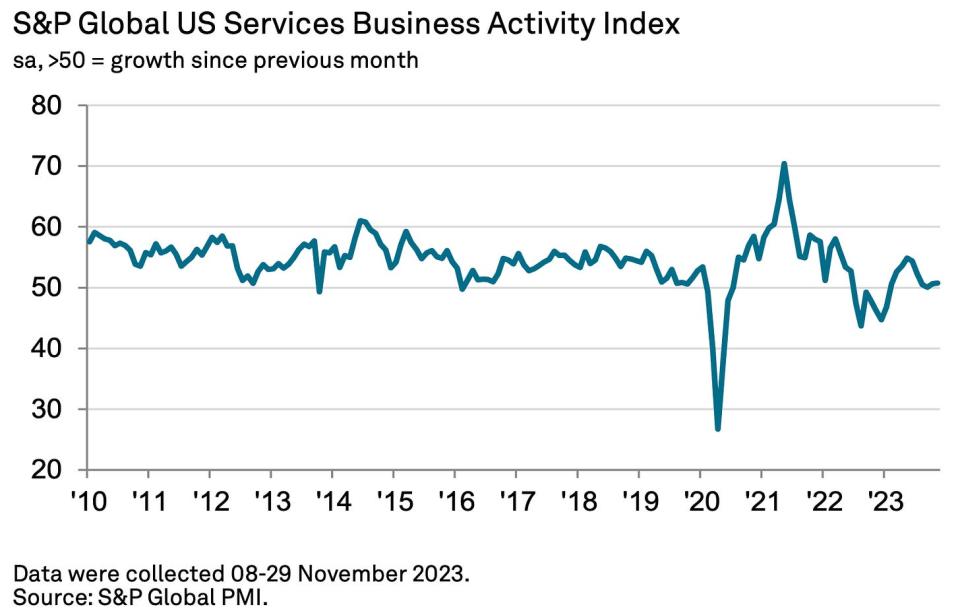

Services surveys signal growth. The ISM’s November Services PMI reflected growth in the sector at an accelerating pace.

From S&P Global’s November Services PMI report: "While service sector businesses continued to report further output gains in November, growth remains considerably weaker than seen earlier in the year, and forward-looking indicators point to growth slowing in the months ahead. Firms providing both goods and services have become increasingly concerned about excessive staffing levels in the face of weakened demand, resulting in the smallest overall jobs gain recorded by the survey since the early pandemic lockdowns of 2020."

Business investment is cooling. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — fell 0.3% to $73.59 billion in October. While this figure continues to trend near record levels, growth seems to have stalled.

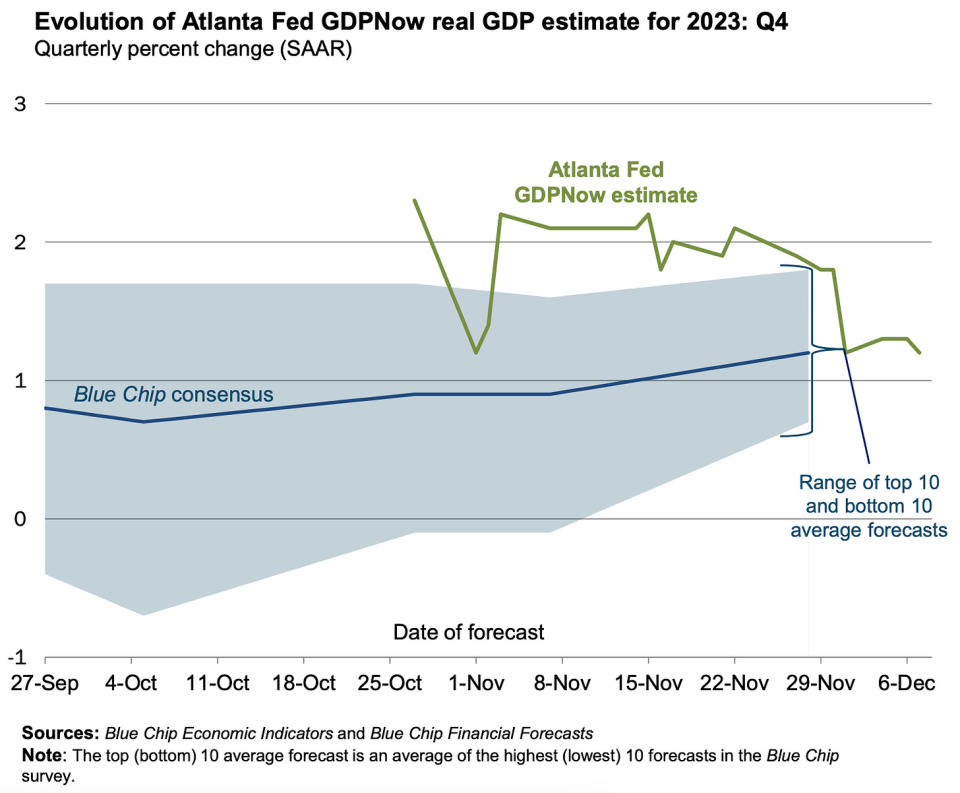

Near-term GDP growth estimates are cooling. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 1.2% rate in Q4.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

A version of this article was published on TKer.co.

Yahoo Finance

Yahoo Finance