The shifting views on the economy in 2023

Note: A version of this article was published on Tker.co.

Stocks rallied last week, with the S&P 500 rising 2.5% to close at 4,719.19. The index is now up 22.9% year to date, up 31.9% from its October 12, 2022 closing low of 3,577.03, and down 1.6% from its January 3, 2022 record closing high of 4,796.56.

Inflation continues to dominate conversations about the markets and the economy.

But the nature of those conversations have shifted significantly over the past year. This evolution can be seen in how the Federal Reserve’s language has changed from meeting to meeting.

At the Fed’s December 2022 policy meeting, Chair Jerome Powell warned: "Inflation remains well above our longer-run goal of 2%. … It will take substantially more evidence to give confidence that inflation is on a sustained downward path."

At the time, inflation rates had begun to come down from their mid-2022 highs — but confidence wasn’t particularly high that they would come down to comfortable levels in the near term. Everyone agreed interest rates would be hiked further in 2023. And many economists were convinced that the cost of defeating inflation was a recession.

Fast forward to present day after four more interest rate hikes. At their December 2023 meeting this past week, Powell acknowledged, "We're seeing inflation making real progress."

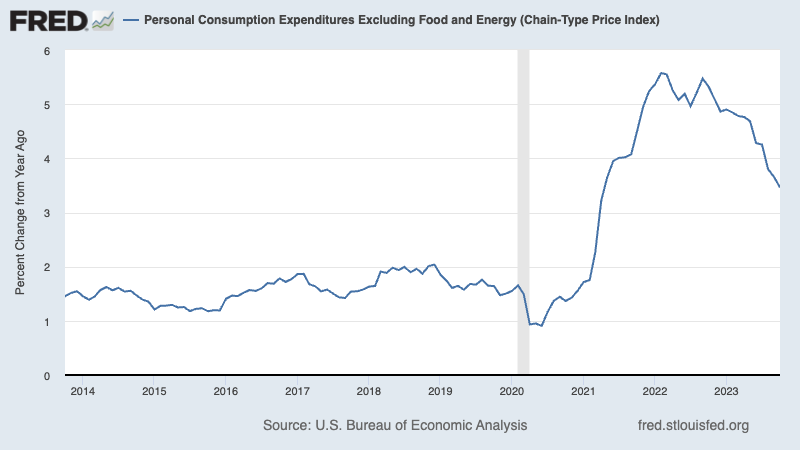

Indeed, inflation rates have come down significantly. The core PCE price index — the Fed’s preferred measure of inflation — has cooled to 2.4% on an annualized rolling three-month basis. TKer would go as far as to argue inflation is no longer a crisis.

Impressively, the economy absorbed higher interest rates and realized lower inflation without having to go into recession. To get a sense of how surprising this was, check out: TKer's 2023 chart of the year

Today, we are no longer talking about more rate hikes. Rather, we are now talking about expectations for rate cuts in 2024.

Normalization has come with fading tailwinds

Disruptions caused by the COVID-19 pandemic led to bottlenecks across the global supply chain. With supply lagging demand, inflation picked up in 2021 and into 2022.

As more and more people were able to go back to work, supply chains eased and supply gradually caught up with demand. This helped ease inflation, even as economic growth persisted — suggesting the goldilocks soft landing scenario that TKer described in January.

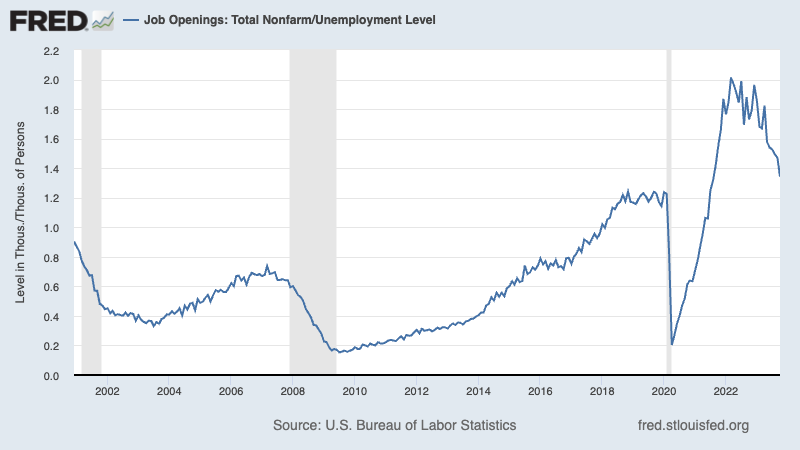

More recently, the massive tailwinds that have defined excess demand have faded significantly. Specifically, excess savings are nearing depletion, job openings are coming into balance with unemployment, and business investment orders have leveled off.

And while economic normalization has been good news for inflation, it also means demand is not as hot as it used to be.

Normalization also means debt delinquencies are coming up from unusually low levels and could eventually mean metrics like the unemployment rate and layoff rate also come off from unusually low levels.

Zooming out

The pandemic era economy has been an unusual one. The initial disruptions were unprecedented. With the unusually strong positive developments over time came unusually problematic challenges like inflation rates surging to levels the world hasn’t seen in 40 years.

And the pace and nature of the economic recovery has been almost unimaginable.

"I have always felt," Fed Chair Jerome Powell said on December 13, "since the beginning, that there was a possibility, because of the unusual situation, that the economy could cool off in a way that enabled inflation to come down without the kind of large job losses that have often been associated with high inflation and tightening cycles. So far, that's what we're seeing."

As things normalize, we can expect areas of strength to fade, which could present new challenges. But we should also expect new positives to emerge as unusual headwinds like high inflation dissipate.

For TKer’s early discussions on these big shifts, read: Attitudes are on the cusp of shifting in 3 major ways and Attitudes have shifted in 3 major ways

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

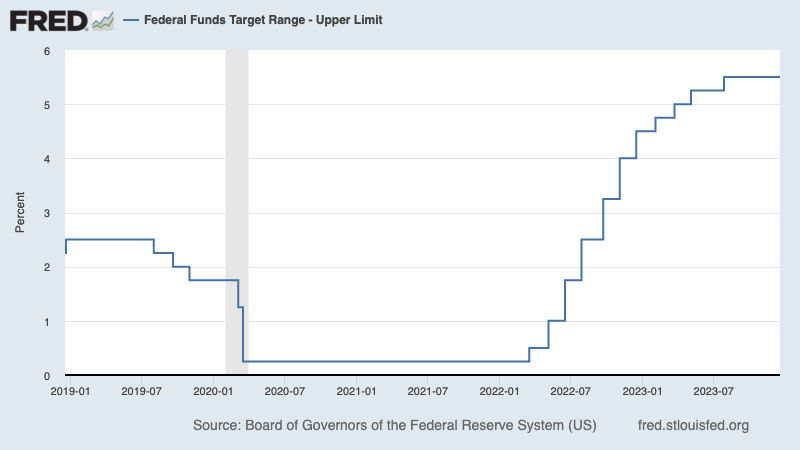

The Fed keeps rates unchanged, signals rate cuts. On Wednesday, the Federal Reserve kept monetary policy tight, leaving its target for the federal funds rate unchanged at a range of 5.25% to 5.5%.

From the Fed’s policy statement: "Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated."

However, the Fed’s economic projections suggested that the central bank could cut rates three times in 2024.

That said, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability. So even though there may not be more rate hikes and rate cuts may be around the corner, rates are likely to be kept high for a while.

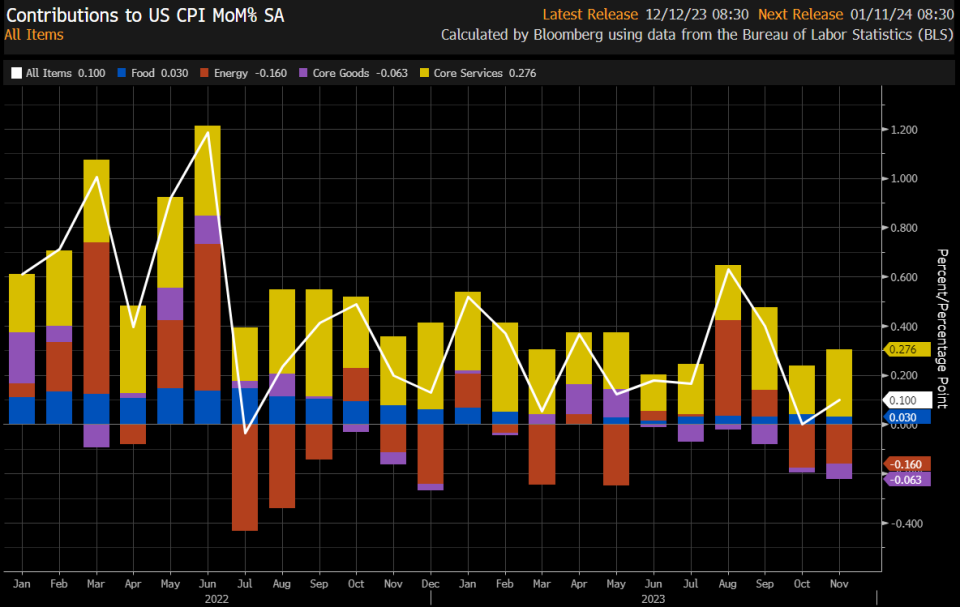

Inflation cools. According to BLS data released Tuesday, the Consumer Price Index (CPI) in November was up 3.1% from a year ago. This was down from the 3.2% rate in October. Adjusted for food and energy prices, core CPI was up 4.0%, the lowest since September 2021.

On a month-over-month basis, CPI was up just 0.1% as energy prices fell 2.3%. Core CPI was up a modest 0.3% as good prices fell and services prices rose.

If you annualize the three-month trend in the monthly figures, CPI was rising at a 2.2% rate and core CPI was climbing at a 3.4% rate.

While many broad measures of inflation continue to hover above the Fed’s target rate of 2%, they are way down from peak levels in the summer of 2022. And the trend suggests they could continue to move lower.

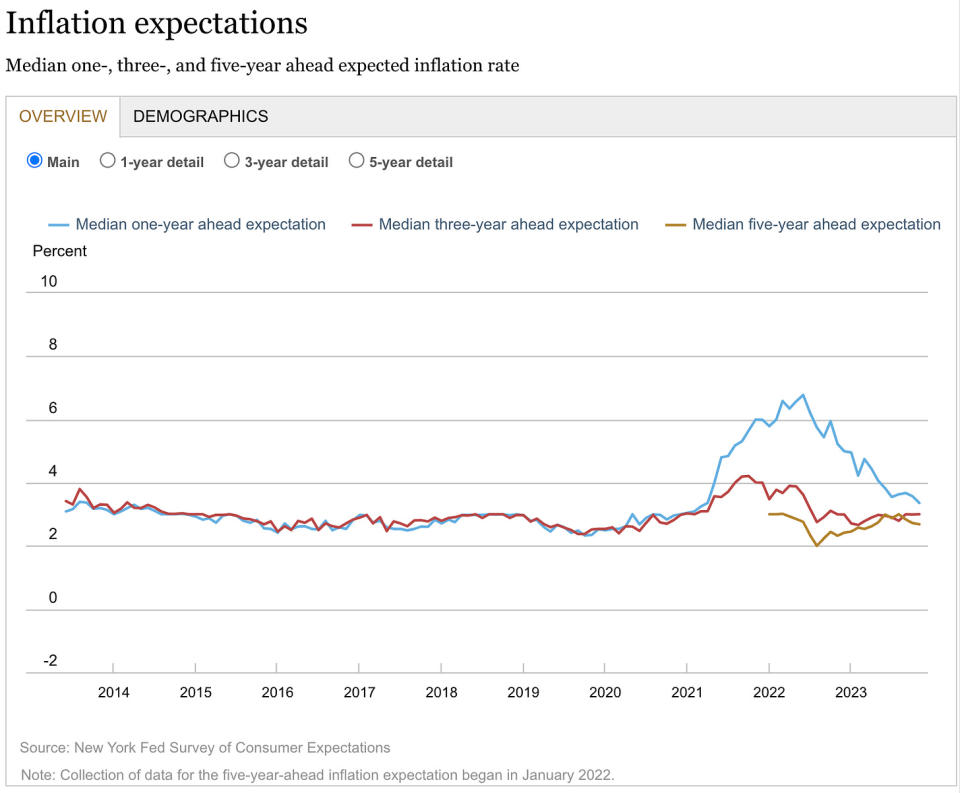

Inflation expectations improve. From the New York Fed’s November Survey of Consumer Expectations: "Median one-year ahead inflation expectations declined by 0.2 percentage point in November to 3.4%. This is the lowest reading since April 2021. Median inflation expectations at the three- and five-year ahead horizons remained unchanged at 3.0% and 2.7%, respectively."

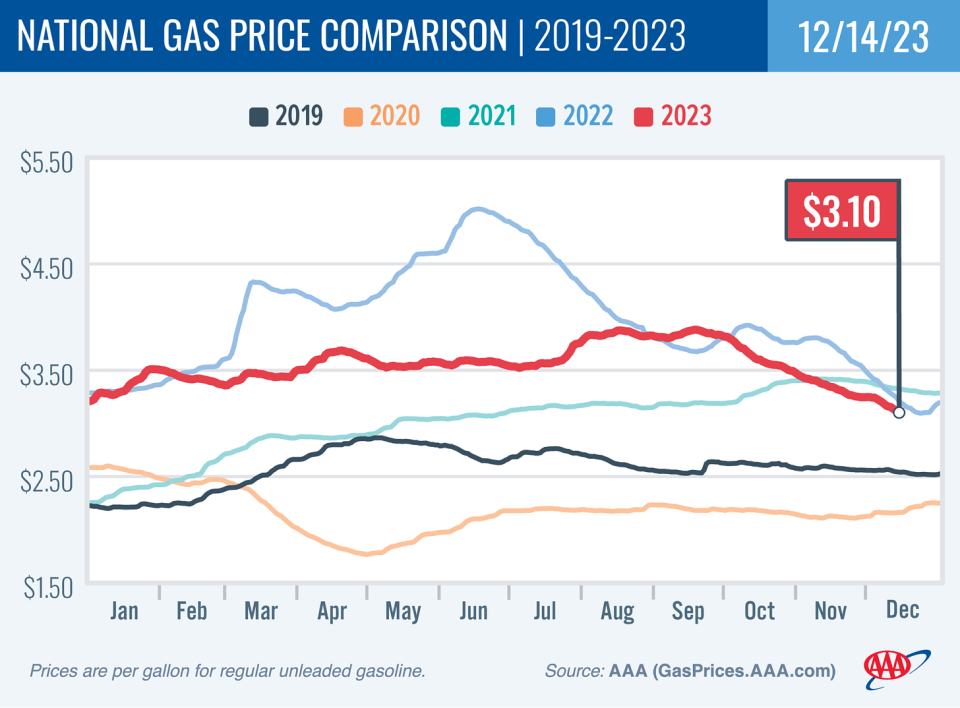

Gas prices continue to fall. From AAA: "According to new data from the Energy Information Administration (EIA), gas demand increased from 8.47 to 8.86 million b/d last week. Meanwhile, total domestic gasoline stocks increased slightly to 224 million bbl. Typically, higher demand would push pump prices higher, but lower oil prices have pushed prices lower. If oil prices remain low, drivers can expect pump prices to do the same during the holiday season. Today’s national average of $3.10 is 25 cents less than a month ago and 11 cents less than a year ago."

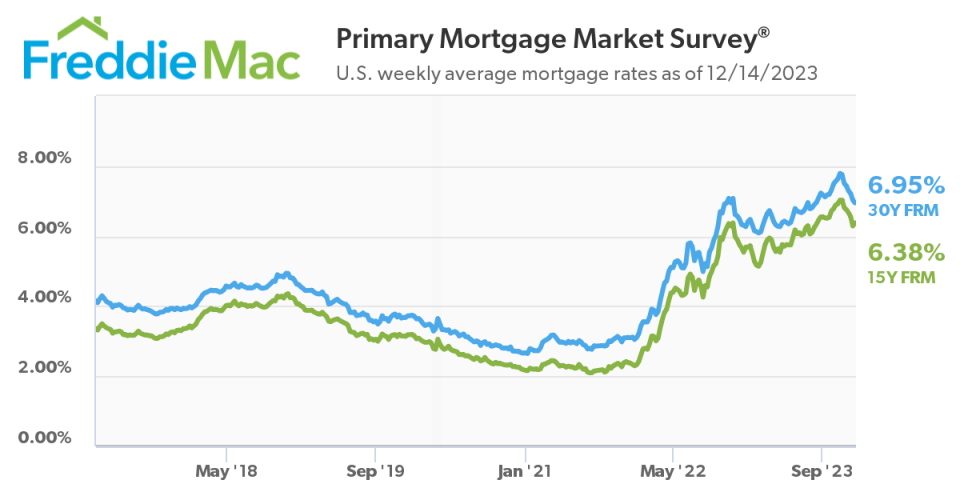

Mortgage rates continue to decline. According to Freddie Mac, the average 30-year fixed-rate mortgage fell to 6.95%. From Freddie Mac: "Potential homebuyers received welcome news this week as mortgage rates dropped below seven percent for the first time since August. Given inflation continues to decelerate and the Federal Reserve Board’s current expectations that they will lower the federal funds target rate next year, there will likely be a gradual thawing of the housing market in the new year."

Rent is coming down. From Redfin: "The median U.S. asking rent declined 2.1% year over year in November to $1,967 — the biggest annual drop since February 2020 — and fell 0.6% from October."

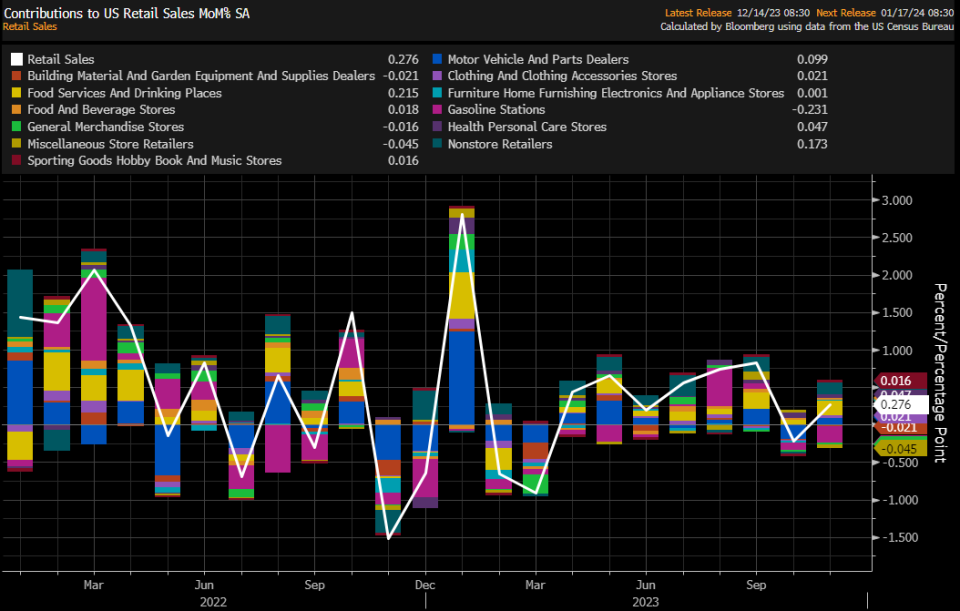

Consumers are spending. Retail sales increased 0.3% in November to a record $705.7 billion.

Categories leading growth included restaurants and bars, sporting and hobby, online, and furniture. Gas stations, department stores, and electronics saw declines.

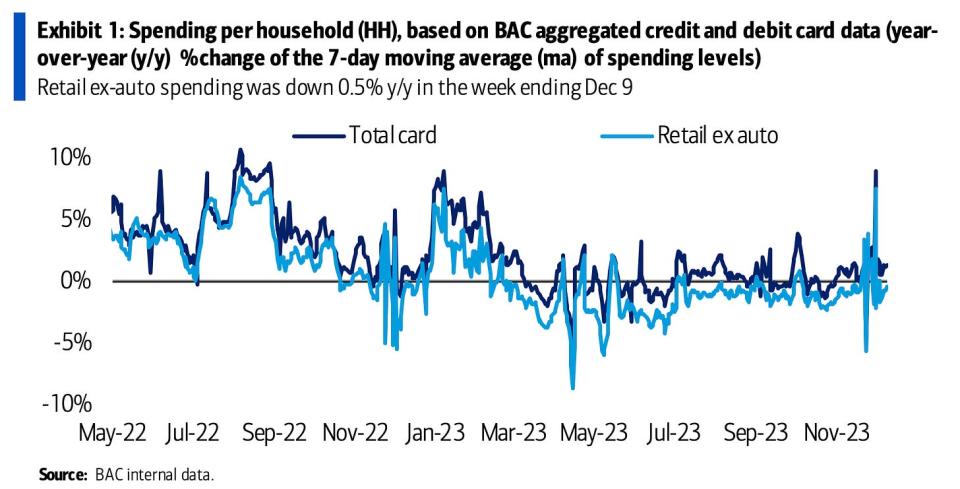

Card data suggest consumer spending is holding up in December. From BofA: "Total card spending per HH was up 1.3% y/y in the week ending Dec 9, according to BAC aggregated credit and debit card data. Spending on holiday items fell 1.5% y/y in the week ending Dec 9. … However, in the 16 days since Thanksgiving, spending on holiday items was up 0.8% compared to the same period last year."

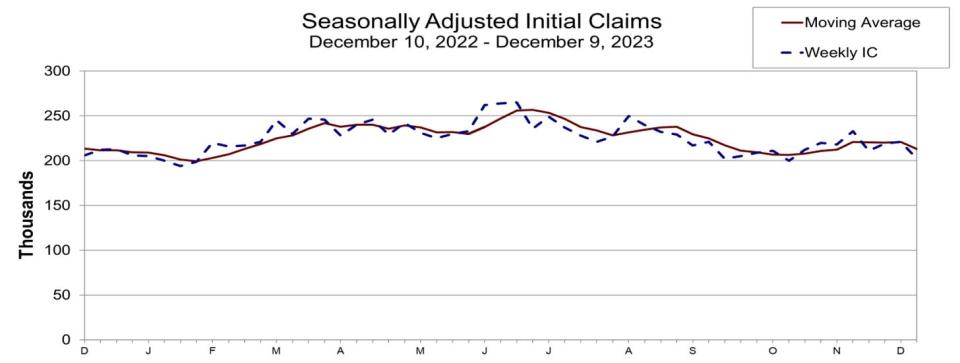

Unemployment claims fall. Initial claims for unemployment benefits fell to 202,000 during the week ending December 9, down from 220,000 the week prior. While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

Small business optimism ticks lower. The NFIB’s Small Business Optimism Index declined in November.

Importantly, the more tangible "hard" components of the index continue to hold up much better than the more sentiment-oriented "soft" components.

Keep in mind that during times of stress, soft data tends to be more exaggerated than actual hard data

Industrial activity picks up. Industrial production activity in November rose 0.2% from October levels, with manufacturing output climbing 0.3%.

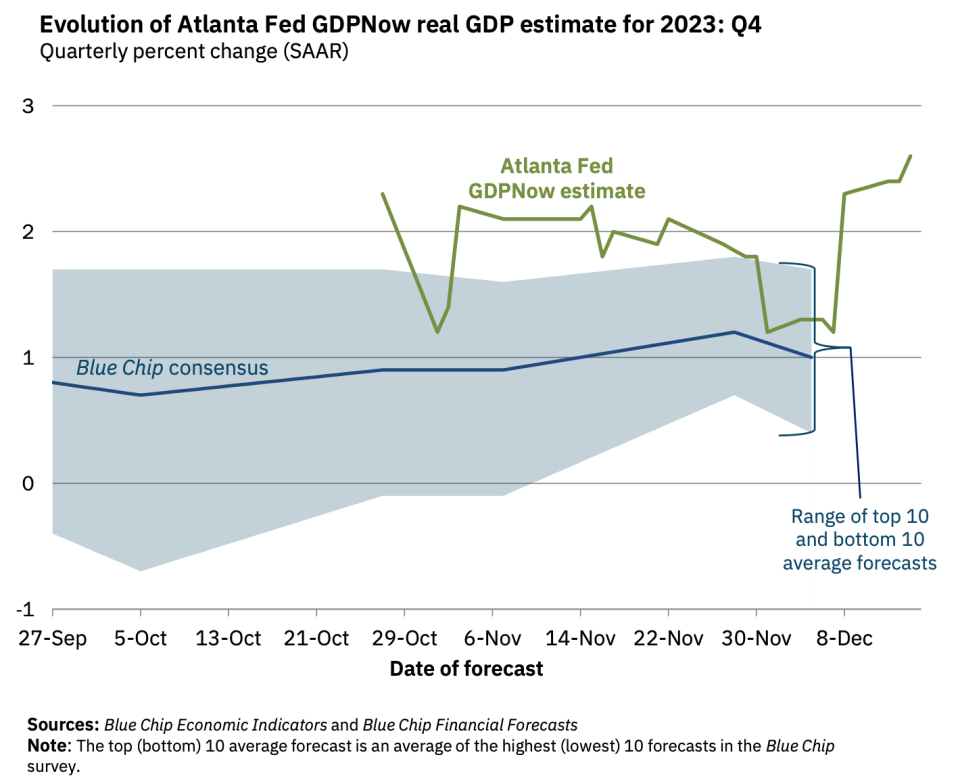

Near-term GDP growth estimates are cooling. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.6% rate in Q4.

Putting it all together

We continue to get evidence that we are experiencing a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this article was published on Tker.co.

Yahoo Finance

Yahoo Finance