The final full week — What you need to know in markets this week

The final full trading week of 2016 is here.

And along with this final push towards the end of what’s been an eventful 2016, the economic and corporate calendar is also slowing down.

Last week, stocks finished the week little-changed after some early-week excitement around the potential for the Dow to crack 20,000 for the first time. Ultimately, the blue-chip index closed the week about 160 points away from the milestone.

The highlight this week won’t come until Thursday, when the third estimate of third quarter GDP crosses the tape at 8:30 a.m. ET. Expectations are for growth to be revised up for the second time to an annualized rate of 3.3%.

Economic calendar

Monday:

No major economic reports.

Tuesday:

No major economic reports.

Wednesday:

Existing home sales, November (5.54 million expected; 5.6 million previously)

Thursday:

Initial jobless claims (255,000 expected; 254,000 previously)

Third quarter GDP, third estimate (+3.3% expected; +3.2% previously)

Personal income (+0.3% expected; +0.6% previously)

Personal spending (+0.5% expected; +0.3% previously)

Friday:

University of Michigan consumer confidence, December (98.0 expected; 98.0 previously)

New home sales, November (575,000 expected; 563,000 previously)

A new bull market?

It’s odd to ask if we’re at the beginning of a new bull market considering the S&P 500 has more than tripled since the post-financial crisis bottom. But a rise in the price of certain assets, of course, does not preclude those assets from further rising in price.

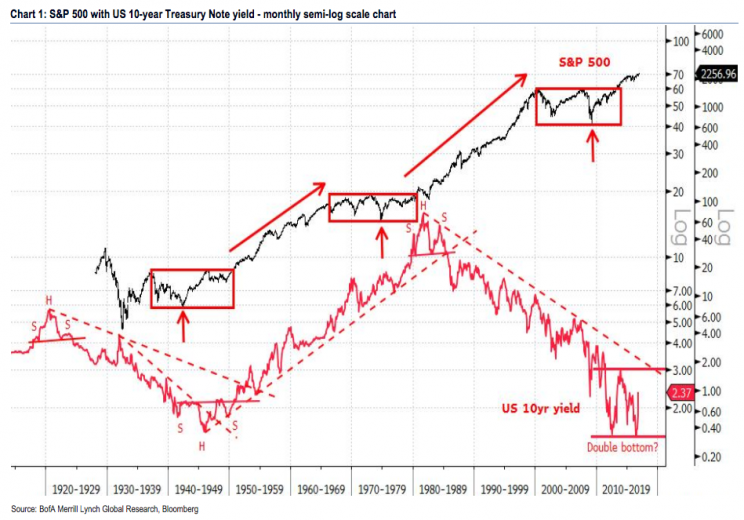

In recent days the view on markets from technical analysts has turned decidedly more bullish. And this perspective now is now asking market participants if we’re only now at the beginning of a secular bull market. And under this framework, the post-crisis surge back to levels seen in 2000, and then again in 2007, was merely the prologue for the next leg of higher stock prices.

“Given the post-Brexit capitulation on ‘rates lower for longer’ and the seismic shift to ‘a rising rate environment,’ the current secular bulltrend best fits the 1950-1966 secular bull market,” Stephen Suttmeier, a technical research analyst at Bank of America Merrill Lynch, wrote in a note to clients this week.

“The 1950s was a period of higher stock prices and higher US interest rates. The US 10-year yield bottomed near 1.5% in late 1945 and the S&P 500 remained firmly within its secular bull market until yields moved to 5-6% in the mid 1960s. The S&P 500 rallied 460% over this period.” (Emphasis added.)

And this technical outlook from BAML echoes the sentiment expressed by long-time market pro Jeff Saut in an appearance on Yahoo Finance last week.

Saut said we’re in a secular bull market, which in his view could last 14 or 15 years. And while this period will see its ups and downs, the trend is up.

Do some quick math in your head and you’ll quickly realize that a doubling or tripling of the S&P 500 from here will yield some gaudy numbers on the index’s level. All of a sudden we’re not talking about the S&P 500 hitting 2,300 next year, but 3,000 or 4,000 or even 6,000.

Big numbers!

But remember that if markets are going up by a mid- or high-single digit percentage from a higher base, we’ll see a larger number for the index’s overall level. Compounding interest and all that.

The S&P 500 entering or maturing into a period where we see another doubling in the index may seem, conceptually, like a reach. But it has happened before. It will happen again. The main question is if that time is now.

And so in the same way that the Dow hitting 20,000 is mostly a psychological milestone, the S&P 500 maybe hitting levels like 4,000 is as much a function of improving business fortunes as investors believing was perhaps once seemed unbelievable.

All about the dollar

The hot new worry in financial markets is the US dollar.

Specifically, that the rising level of the US dollar will negatively impact global financial markets and cut off any US-led global recovery in economic activity.

“The function of a reserve currency is to provide sufficient global funding conditions to keep economies going,” Morgan Stanley strategists wrote in a note highlighted by Business Insider.

“Rising [US dollar] funding costs, especially when combined with a ‘USD shortage’, will ultimately undermine economic prosperity globally.”

In short, the worry here jumps off a point made by Hyun Song Shin of the Bank for International Settlements in a speech last month, which is that the rising value of the US dollar doesn’t represent the strength of the US economy so much as it reflects stresses in the global banking system.

And if the dollar moves not just in response to macroeconomic states of play but also reflects financial market stresses, then the knock-on effects of dollar strength — a preference for dollar-denominated assets, trouble paying off dollar-denominated debts in depreciating foreign currency, negative revenue impacts for US-based companies — could crop even when market conditions would otherwise appear tranquil.

This is all also coming on the backdrop of the Federal Reserve raising interest rates, perhaps up to three times next year. And so not only does the US dollar rally reflect the tightening conditions as determined by the market, but with policymakers that determine the benchmark price for dollar lending raising rates the liquidity squeeze from a dollar shortage could be considerable.

“The dollar as the barometer of leverage and risk-taking capacity has implications both for financial stability and the real economy,” Shin said.

“If banks put such a high price on balance sheet capacity when the financial environment is largely tranquil, what will happen when volatility picks up? If banks react to resurgent volatility by reducing their intermediation activity, as happened during the 2007–09 crisis, the banking sector may become an amplifier of shocks rather than an absorber of shocks.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance