The daily fantasy sports market has a demographic problem

In 2015, daily fantasy sports, a newer subset of traditional “season-long” fantasy sports, exploded in popularity. The two leading companies that offer the product, private tech startups DraftKings and FanDuel, spent hundreds of millions in advertising, raising awareness of the business. But 2016 was a very different year for the burgeoning industry, characterized by lawsuits, outrage, and negative headlines.

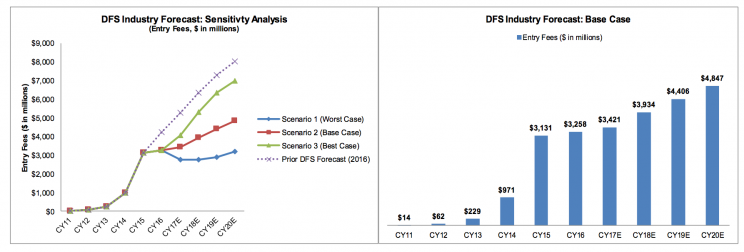

Nevertheless, a new report from Eilers & Krejcik Gaming determines that the daily fantasy market (DFS) grew in 2016, just slightly, by about 4% to reach $3.26 billion in total entry fees. (That’s strictly “handle” as in how much the companies handled in entry fees, not revenue, because it doesn’t take into account what they paid out in prizes; DraftKings and FanDuel are not yet profitable.) Based on the meager growth, Eilers has severely reduced its projections for the future size of the DFS market.

Slight growth, of course, is better than no growth. And the firm’s own Adam Krejcik says that 4% is a sunnier figure than he expected. “My personal thesis heading in was that the industry is going to be down for the year,” Krejcik says. “So I was a little surprised when we had the final numbers. I thought I’d be writing something a little more negative. So I think that speaks to the public perception; there have been quite a few articles about the death or demise of DFS, and I don’t think that’s the case. But you could certainly say the growth has slowed dramatically.”

Apart from total entry fees growing, the industry news is a mixed bag, with more bad than good. And the most interesting finding of the Eilers report is about the DFS user demographic: it isn’t evolving, and that’s a problem.

The DFS demographic hasn’t changed

An estimated 57 million people play season-long fantasy sports, while fewer than 10 million are registered DFS users—and the number of active users is likely much lower than that.

The thinking about DFS, over a year ago when DraftKings and FanDuel were flying high and raising big venture money, was that it had the potential to get as big as season-long fantasy, since it offers a faster, more exciting game. (Quick crash course: In traditional fantasy football, you draft a team before the NFL season starts, and that’s your team for the whole year; DFS allows you to keep entering new contests each week, or each day, with a new team.)

Two years ago, many were projecting that DFS could eventually rival season-long fantasy. Now Eilers & Krejcik is throwing cold water on that idea.

The problem? The DFS user base today looks “markedly similar,” the report says, to that of a few years ago: 95% male, white, age 25-35, and “typically analytical and/or a sports fanatic.” While season-long fantasy football has grown its appeal to a diverse audience (some estimates suggest nearly 30% of season-long fantasy sports players are women), DFS “just hasn’t gotten more diverse,” Krejcik says. “If you bought into the argument that this was going to meaningfully penetrate and cross-market into season-long, you would see that shift by now.”

These days, 45% of NFL fans are women. Season-long fantasy football has catered to that audience. But DFS is still white and male.

As a result, the Eilers report concludes it’s “increasingly unlikely that DFS will reach some of the more bullish forecasts we laid out a few years ago—at least not in its current form.” Even in Eilers & Krejcik’s best-case scenario, the industry does not touch last year’s forecast.

Smaller DFS operators are disappearing

Notice that “in its current form” comment—that could be encouraging for smaller players that seek to offer something unique from DraftKings and FanDuel, such as Draft, which focuses on the fun of the draft experience by offering head-to-head snake drafts. Draft recently raised new funding and brought on a new co-CEO. “I think there’s a huge future for daily fantasy, just maybe not in the same exact incarnation it was before,” says founder Jeremy Levine.

On the other hand, many smaller DFS companies vanished in 2016, and the roll-up is expected to continue. Eilers lists more than five DFS companies that in 2016 either sold their assets, closed completely, or closed operations in North America, including DraftDay (“attempting pivot to non-US markets”), DraftOps (shut down, filed for bankruptcy) and FantasyFeud (closed and sold its user accounts to Fantasy Aces). “In retrospect, there were just too many people attempting to come in,” says Krejcik.

Consolidation will only get worse, Eilers predicts: “That trend will continue—and arguably accelerate—in 2017, as many of the second-tier DFS sites that survived 2016 run out of funding options and are forced to sell or shutter.”

Could DraftKings or FanDuel be a buyer? That depends on whether their planned merger gets approved by regulators.

DraftKings and FanDuel merger won’t change things for others

The elephant in the daily fantasy sports room right now is the planned tie-up of DraftKings and FanDuel. The two competitors announced in November their plan to merge into one company, though they do not expect it to go through until the second half of 2017. For the time being, they are still operating as separate companies.

Krejcik expects the merger to go through, though some legal experts have their doubts. The issue will hinge on whether a combined company (which would boast 95% market share of daily fantasy sports) would be considered an unfair monopoly, or if regulators buy the argument that DraftKings and FanDuel are part of the much larger, broad fantasy sports market, which would make them less of a power, even combined, when compared to giants like ESPN and Yahoo.

But the more important question for the future of the industry is what a combination of the No. 1 and No. 2 players will mean for everyone else.

Krejcik thinks it won’t mean much. DraftKings and FanDuel merging may not really help or hurt the chances that other players can grow. “The smaller parties are going out of business with them separated, so I don’t think them combining necessarily speeds up that process,” he says.

What it will do is save costs for DraftKings and FanDuel, and help the combined company achieve profitability. Eilers forecasts savings of more than $10 million per year. But that will come at a price: expect layoffs (to remove redundant positions) and a “power struggle,” the report expects, between the cultures of the two companies and between their two lead executives, Jason Robins and Nigel Eccles. Those two say otherwise and, since announcing their intent to merge, have conducted interviews together.

(The Eilers & Krejcik report, by the way, reveals that DraftKings surpassed FanDuel in 2016 in terms of entry fees, which is an impressive victory for the company, which came along four years after FanDuel, and for its CEO Robins, but one that doesn’t much matter if the companies are about to combine.)

Another silver lining for all DFS operators: the most devoted players aren’t going anywhere. “These products are sticky for core users, who aren’t going away despite big cuts in marketing,” says Krejcik. “I think the market has a base floor now that is decent.”

To be sure, the report is a net positive simply because of how bad it could have been.

In 2016, DraftKings and FanDuel spent nine months fighting New York Attorney General Eric Schneiderman in court—in the end, the state passed a law expressly protecting daily fantasy sports, but the two companies later had to pay $6 million each in false advertising penalties. ESPN’s Outside the Lines declared that the entire industry had “imploded,” which wasn’t really accurate, but became the de facto narrative among many. DraftKings and FanDuel had to significantly reduce their marketing. FanDuel pulled out of Texas. Both companies had to stop offering college sports contests. The companies had a nightmarish year.

Despite all this, they managed to grow their business. “That’s not bad,” Krejcik offers, “in light of the headwinds.” And Eilers believes the two companies, whether they merge this year or not, will continue to see positive legislative momentum—that is, more states will expressly legalize DFS rather than ban it. “We believe that the worst is over for DraftKings and FanDuel,” Eilers says, “in terms of legal and regulatory challenges at the state level.”

But the bigger story, moving forward, is that in 2017, “the seeds will be planted for the next wave of fantasy contest products,” Eilers reports. If new fantasy products can cater to a larger, diverse audience—not just young white males—they could turn the industry on its head.

—

Disclaimer: Yahoo offers its own daily fantasy sports product.

Daniel Roberts is a writer at Yahoo Finance, covering sports business and technology. Follow him on Twitter at @readDanwrite.

Read more:

IT’S OFFICIAL: DraftKings and FanDuel are merging

DraftKings and FanDuel CEOs: Merger is ‘much bigger than us’

Smaller daily fantasy sports startups look to challenge DraftKings, FanDuel

Here’s where every state stands on daily fantasy sports legality

Yahoo Finance

Yahoo Finance