The bottom 75% of Canadian income earners can't afford an apartment

If you’re hoping to buy a home in one of Canada’s biggest cities, you’re probably out of luck unless you’re making really big bucks.

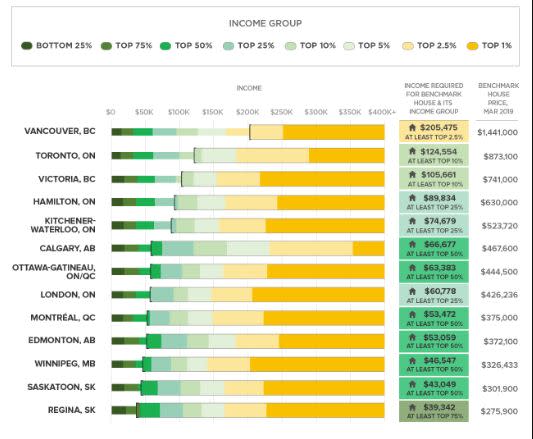

New data from Zoocasa show you need to be among the country’s top 10 per cent of earners to afford Toronto’s $873,100 benchmark price. Only 2.5 per cent can swing Vancouver’s $1,441,000 price tag.

The study looked at the minimum income required to qualify for a 30 year, 3.75 per cent mortgage with a 20 per cent down payment in 13 pockets across the country. The findings were cross-referenced with income tax filings from Statistics Canada.

Even an entry-level home is unattainable for the bottom 75 per cent in the largest markets.

“While it may not come as a surprise that affording a single-family house is limited to the highest-income percentiles in the biggest cities, the numbers show even entry-level housing is out of reach for many in those markets,” said Penelope Graham, managing editor at Zoocasa, in the report.

“Vancouver and Toronto apartment buyers must still have an income within the top 25% in order to swing the benchmark unit price of $656,900 and $522,300, respectively.”

Graham says the prairie markets are your best bet.

“Affording a house is feasible for those within the top 75 per cent income group in Regina, as the benchmark property costs $275,900.

“Saskatoon and Winnipeg are both nearly as affordable, as buyers with incomes in the top 50 per cent can afford houses priced at $301,900 and $326,433, respectively.”

Apartments are within reach in all three markets, with benchmark price of$160,200, $170,800, and 227,538.

After steady declines, a home in Calgary is doable for the top 50 per cent and 75 per cent for an apartment.

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance