This Texas woman’s husband wants to exclude her daughter from family inheritance to keep it in his ‘bloodline’

Family dynamics can be a sensitive and thorny topic to navigate, especially when it comes to divvying up an inheritance.

According to a New York Life Wealth Watch survey, a phenomenon known as the “great wealth transfer” is well underway. It’s projected that 15% of American adults are expected to receive a sizeable inheritance in the next decade from a parent, spouse, or another individual.

Inheritances can be a fantastic financial windfall that can certainly help build generational wealth. However, it doesn’t always come without complications — especially if you already have a complex family situation.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

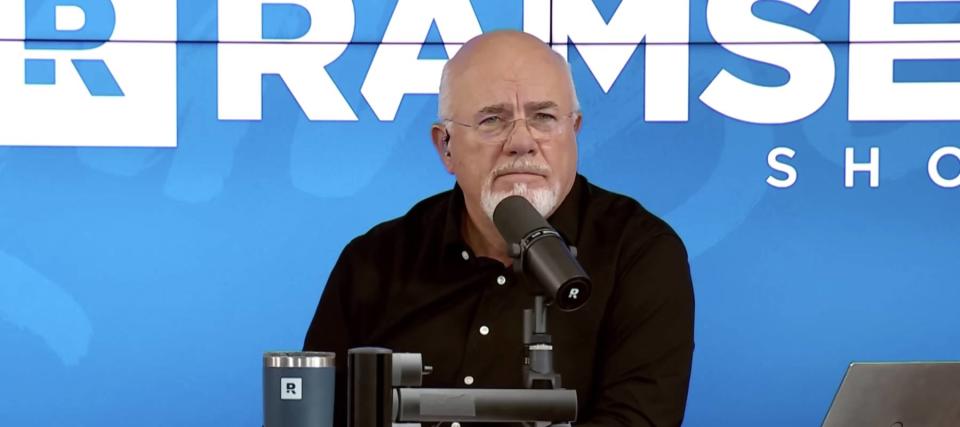

Rochelle, 36, from Houston, Texas, found herself in this exact predicament. She called into an episode of The Ramsey Show for advice.

She told finance guru Dave Ramsey that her husband inherited 33 acres of land after his father passed away. Rochelle and her husband share two-year-old twin sons. They also co-parent Rochelle’s 14-year-old daughter and her husband’s 13-year-old son from previous marriages.

Her husband expressed a desire to keep the land in his “bloodline” — leaving his stepdaughter out of the land inheritance entirely.

Ramsey told Rochelle he thinks family should come before money. “I’m calling BS,” he said, adding, “this kid is more important than a piece of land.”

Family matters

Rochelle explained that her husband wanted the 33 acres of land to be left to his three sons, which would leave his stepdaughter with only one-quarter of whatever was leftover from the couple’s combined assets.

“Cinderella — the step-child — has to go and mop the floors while the three other ones go to the ball,” Ramsey joked.

“Does it occur to him how hurtful it is when he says that?” Ramsey asked. “[What if] you said, ‘that’s hurtful, you’re a butt.’”

The couple plans to sell their current home and use the money to build a new home on the inherited 33 acres. Rochelle told Ramsey that she contributes to nearly half of the family’s income, which makes the situation regarding her daughter even more unfair.

While Rochelle brings in roughly $55,000 from her job annually, her husband brings in slightly more at $65,000. Ramsey pointed out that, since she’s contributing 50% to the house that will be built on the inherited land, then her daughter should have a cut of the money down the road.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these assets instead. Get in now for strong long-term tailwinds

How to avoid inheritance disputes

Ramsey’s final take? “It’s just a stupid piece of dirt,” he said, adding that it would be unfortunate if Rochelle’s daughter assumed that her stepfather had chosen to “value that dirt over relationships.”

Ramsey also suggested that this type of situation might be worth taking up with a marriage counselor.

Approximately 70% of Americans lost a piece of their inherited wealth due to family squabbles over a loved one’s estate, reported the Washington Post. But this doesn’t have to be the case.

Ramsey believes that, in this instance, all four kids should be treated equally given that it's a blended family living under one roof. “He’s her daddy now,” he said.

Some of the most common issues that arise with inheritance disputes involve unequal distributions of wealth, complex family dynamics and general greed.

However, there are ways to avoid a legal battle, including creating a trust and will, clearly communicating your intentions and trying to be as fair as possible when splitting your assets among immediate family members.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

‘Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

The 5 most expensive mistakes in options trading and how to avoid them

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance