Texas Instruments (TXN) Q1 Earnings Beat, Revenues Fall Y/Y

Texas Instruments TXN reported first-quarter 2024 earnings of $1.20 per share, surpassing the Zacks Consensus Estimate by 13.2%. The figure exceeded the guided range of 96 cents-$1.16 per share.

However, the figure declined 35% year over year and 19.5% sequentially.

TXN reported revenues of $3.66 billion, which beat the Zacks Consensus Estimate of $3.61 billion. The figure came within management’s guidance of $3.45-$3.75 billion.

Revenues decreased 16% from the year-ago quarter’s level and 10.2% sequentially.

The year-over-year decline was attributed to weakness across various end markets. The company witnessed sluggishness in its Analog, Embedded Processing and Other segments.

On a sequential basis, Texas Instruments suffered from widespread weakness in the personal electronics, communication equipment, and enterprise systems markets.

A sequential decline by mid-single digits in the automotive market was a major concern.

A sequential upper-single-digit decline in the industrial market was another headwind.

Shares of Texas Instruments have lost 2.1% in the year-to-date period against the industry’s growth of 41.2%.

TXN’s investments in growth avenues and competitive advantages, including manufacturing, technology, product portfolio expansion and consistent returns to shareholders, are likely to instill investors’ optimism in the stock in the days ahead.

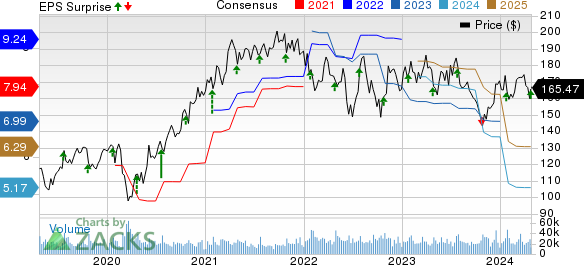

Texas Instruments Incorporated Price, Consensus and EPS Surprise

Texas Instruments Incorporated price-consensus-eps-surprise-chart | Texas Instruments Incorporated Quote

Segments in Detail

Analog: Revenues of $2.84 billion were generated from the segment (77.5% of total revenues), down 14% from the year-ago quarter’s level. The figure came above the Zacks Consensus Estimate of $2.69 billion.

Embedded Processing: Revenues amounted to $652 million (17.8% of total revenues), down 22% year over year. The figure lagged the Zacks Consensus Estimate of $715.28 million.

Other: Revenues totaled $173 million (4.7% of total revenues). The figure was down 33% from the prior-year quarter’s level and missed the consensus mark of $197.13 million.

Operating Details

Texas Instruments’ gross margin of 57% contracted 820 basis points (bps) from the year-ago quarter’s level.

As a percentage of revenues, selling, general and administrative expenses expanded 160 bps year over year to $455 million in the reported quarter.

Research and development expenses of $478 million expanded by 270 bps from the year-ago quarter’s level as a percentage of revenues.

The operating margin was 35.1%, which contracted 910 bps from the prior-year quarter’s number.

Balance Sheet & Cash Flow

As of Mar 31, 2024, the cash and short-term investment balance was $10.4 billion compared with $8.58 billion as of Dec 31, 2023.

At the end of the reported quarter, TXN had a long-term debt of $12.840 billion compared with $10.624 billion in the prior quarter.

The current debt was $1.35 billion, up from $599 million at the end of the fourth quarter of 2023.

Texas Instruments generated $1.02 billion of cash from operations, down from $1.92 billion in the previous quarter.

Capex was $1.25 billion in the reported quarter, and the company reported a free cash outflow of $231 million.

Texas Instruments paid out dividends worth $1.18 billion in the reported quarter. It repurchased shares worth 3 million.

Guidance

For second-quarter 2024, TXN expects revenues between $3.65 billion and $3.95 billion. The Zacks Consensus Estimate for second-quarter 2024 revenues is currently pegged at $3.77 billion, indicating a decline of 16.7% from the year-ago quarter.

The company expects earnings within $1.05-$1.25 per share. The consensus mark for the same is pegged at $1.17 per share, indicating a fall of 37.4% from the year-ago quarter.

The company expects the effective tax rate to be approximately 13%

Zacks Rank and Stocks to Consider

Currently, Texas Instruments carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Dell Technologies DELL and Badger Meter BMI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Arista Networks have gained 9.2% in the year-to-date period. The long-term earnings growth rate for ANET is 17.48%.

Shares of Dell Technologies have gained 61% in the year-to-date period. The long-term earnings growth rate for DELL is currently projected at 12%.

Shares of Badger Meter have gained 21.3% in the year-to-date period. The long-term earnings growth rate for BMI is 15.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance