Texas Instruments to Reward Investors With 17% Dividend Hike

Texas Instruments TXN or TI recently announced a hike in dividend. This time around, the company plans to raise its quarterly dividend by 13 cents to 90 cents per share. This translates to a 17% increase from the prior dividend of 77 cents.

The new dividend will be paid on Nov 18, 2019 to stockholders of record as of Oct 31, 2019, contingent upon a formal declaration by the board of directors at its regular meeting in October.

TI’s Cash position

TI’s strong balance sheet and cash flow provide financial flexibility for dividend hikes, share repurchases and strategic acquisitions.

At the end of second-quarter 2019, its cash and short-term investments totaled $4.2 billion compared with $4.1 billion at the end of the prior quarter. Long-term debt was approximately $4.6 billion, down from $5.1 billion in the first quarter.

The company generated $1.8 billion in cash from operations via spending $284 million on capex, $863 million on share repurchases and $722 million on cash dividends. Free cash flow at the end of the second quarter was $1.51 billion.

Notably, last month, TI announced an offering of senior unsecured notes aggregating $750 million. These notes, which carry an interest rate of 2.250%, should provide financial flexibility and propel long-term growth.

Texas Instruments is one of the few chip-making companies that return a significant amount of cash to its investors.

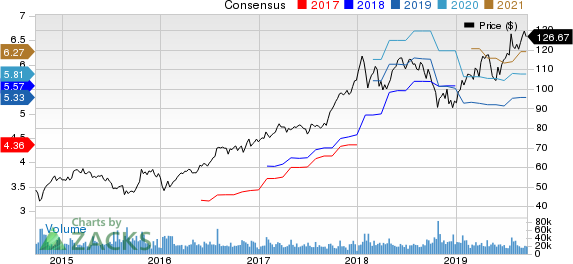

Texas Instruments Incorporated Price and Consensus

Texas Instruments Incorporated price-consensus-chart | Texas Instruments Incorporated Quote

Bottom Line

Texas Instruments is one of the largest suppliers of analog and digital signal processing integrated circuits. The company’s compelling product line-up, increasing differentiation in business and low-cost 300-mm capacity should drive earnings over the long term.

Its margins should continue to expand because of the secular strength in auto and industrial markets, a stronger mix of analog and embedded processing products, benefits of restructuring actions, and more than 300mm capacity coming online. Moreover, the semiconductor giant is poised to gain from the growing market for Internet of Things.

We believe that the increase in dividend and share buyback indicate that the company is confident about steady cash flow generation. However, increasing competition from Analog Devices, NVIDIA Corporation and Applied Materials remains a concern.

Zacks Rank and Other Stocks to Consider

Texas Instruments currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Alphabet Inc. GOOGL, Itron, Inc. ITRI and MACOM Technology Solutions Holdings, Inc. MTSI, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Alphabet, Itron and MACOM Technology is currently projected at 17.5%, 25% and 15%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance