Tesco lowering prices ‘as quickly as possible’ as inflation eases

Tesco is “lowering prices as quickly as possible”, its chief executive said, in the latest sign that Britain’s battle on inflation is nearing its end.

Britain’s biggest supermarket said it had recently reduced prices on thousands of lines across its stores as “cost inflation headwinds ease”, adding: “We continued to work with our supplier partners to lower prices for customers as quickly as possible.”

It said this meant Tesco had consistently been the cheapest of the traditional supermarkets for almost two years.

Ken Murphy, Tesco chief executive, said: “The combination of price, quality and innovation means we are as competitive as we have ever been.”

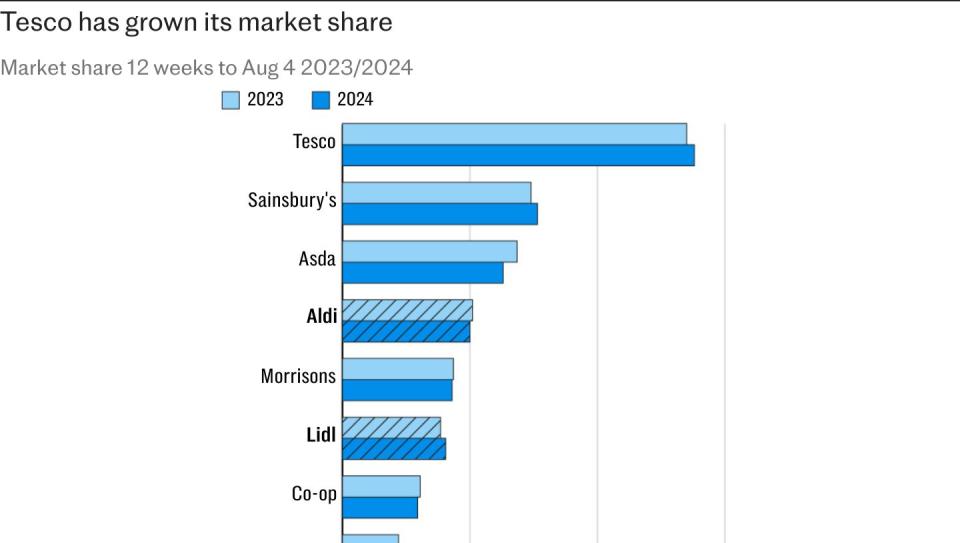

It follows recent industry figures which suggested Tesco has been growing its market share over the past year. According to the latest Kantar figures, Tesco is by far Britain’s largest supermarket, holding around 27.8pc of the grocery market, up from 27pc last October.

Kantar said this marked its strongest position since January 2022.

Mr Murphy said the retailer was “in good shape” going into the Christmas period, shrugging off any concerns that customers were reining in spending amid uncertainty over looming tax rises.

He said: “We track customer sentiment every week, and while they are not doing cartwheels down the hallways, they are in reasonably good shape.

“You’re seeing a stability in customer sentiment from a grocery point of view and a willingness to spend a little bit more to treat themselves.”

It follows a warning from the chief executive of rival Sainsbury’s earlier this week that customers needed more clarity about tax changes in Rachel Reeves’s upcoming Budget before they would start spending again. Recent data from GfK showed there had been a sharp drop in consumer confidence ahead of the Budget.

Companies are also facing uncertainty over proposed employment reforms, with plans being drawn up by Angela Rayner, the Deputy Prime Minister. The changes could include the introduction of day-one rights for workers.

Mr Murphy said he was “looking forward” to the opportunity to work with ministers during a consultation on the changes, saying he was “very keen to make sure that whatever the Government decides to put forward into legislation has the intended consequence of stimulating productivity, stimulating growth and protecting workers at the same time”.

The Tesco chief added: “We need to work together with the Government to make sure that that’s the outcome that they get.”

The comments came as Tesco released its half-year results, in which it raised its profit forecasts for the year. Tesco said it was now expecting to deliver £2.9bn in retail adjusted operating profit – a key measure for supermarkets – for the 12 months to the end of February. This was up from earlier forecasts of at least £2.8bn.

In the first half of the year to August 24, pre-tax profits were up almost a fifth to hit £1.39bn. Total sales, excluding fuel, were up by 4pc to hit £31.5bn.

Mr Murphy said the sales were boosted by stronger demand for its “Finest” range, with more than 20m customers buying from the line in the first half of the year.

Tesco has also been buoyed by growing take-up of its loyalty card scheme. It said more than 23m households had a Clubcard over this period.

Mr Murphy had previously suggested Tesco was considering how it could evolve its loyalty scheme.

He said data from the scheme could start to nudge shoppers when they were buying too many unhealthy items.

Speaking last month, Mr Murphy said: “I can see it nudging you, saying: ‘Look, I’ve noticed over time that in your shopping basket your sodium salt content is 250pc of your daily recommended allowance. I would recommend you substitute this, this and this for lower sodium products to improve your heart health’.”

Yahoo Finance

Yahoo Finance