Teradyne (TER) Q4 Earnings & Revenues Beat Estimates, Down Y/Y

Teradyne TER reported fourth-quarter 2022 earnings of 92 cents per share, which surpassed the Zacks Consensus Estimate by 24.3%. However, the bottom line decreased 32.8% year over year and 20% sequentially.

Revenues of $731.8 million surpassed the Zacks Consensus Estimate of $710.6 million. The figure dipped 11.5% sequentially and 17% on a year-over-year basis.

The year-over-year decline was a result of declining Test and Industrial Automation revenues.

Revenue Details

Revenues from Semiconductor Test platforms, System Test business, Wireless Test business and Industrial Automation were $481 million (65.7% of total revenues), $100 million (13.7%), $40 million (5.6%) and $110 million (15%), respectively.

Revenues of Test and Industrial Automation declined 19.5% and 2.7% from the respective prior-year quarter’s levels.

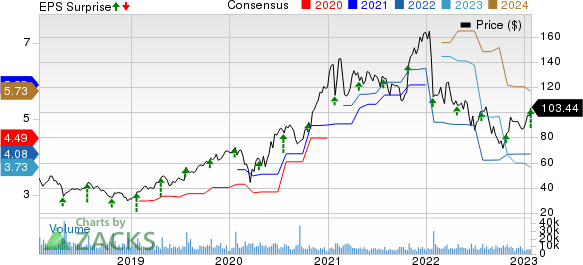

Teradyne, Inc. Price, Consensus and EPS Surprise

Teradyne, Inc. price-consensus-eps-surprise-chart | Teradyne, Inc. Quote

Operating Results

Non-GAAP gross margin was 57.4%, contracting 210 basis points (bps) year over year.

Operating expenses increased 6.2% year over year to $253.9 million. As a percentage of revenues, operating expenses expanded 410 bps year over year to 34.7%.

Non-GAAP operating margin was 23.1%, which contracted 790 bps from the year-ago quarter’s reading.

Balance Sheet & Cash Flow

As of Dec 31, 2022, Teradyne’s cash and cash equivalents (including marketable securities) were $894.4 million, higher than $776.1 million as of Oct 2, 2022.

Net cash provided by operating activities was $183.4 million for the fourth quarter compared with $271.6 million in the prior quarter.

Guidance

For the first quarter of 2023, Teradyne expects revenues between $550 million and $630 million. The Zacks Consensus Estimate for the same is pegged at $641.3 million.

Non-GAAP earnings are expected between 28 cents and 52 cents per share for fourth-quarter 2022. The consensus mark for the stock is pegged at 60 cents per share.

Zacks Rank & Stocks to Consider

Currently, Teradyne carries a Zacks Rank #3 (Buy).

Some better-ranked stocks in the broader Zacks Computer & Technology sector are Agilent Technologies A, Arista Networks ANET and Asure Software ASUR. While Agilent Technologies sports a Zacks Rank #1 (Strong Buy), Arista Networks and Asure Software carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agilent has gained 10.5% in the past year. A’s long-term earnings growth rate is currently projected at 10%.

Arista Networks has lost 5.7% in the past year. The long-term earnings growth rate for ANET is currently projected at 17.5%.

Asure Software has gained 35.8% in the past year. The long-term earnings growth rate for ASUR is currently projected at 23%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Teradyne, Inc. (TER) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance