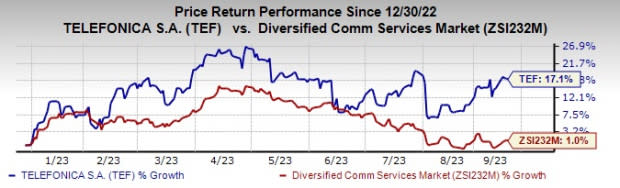

Telefonica (TEF) Gains 17.1% YTD: Will the Trend Continue?

Telefonica TEF witnessed strong momentum this year so far, with shares gaining 17.1% year to date compared with the sub-industry’s rise of 1%.

Telefonica provides mobile and fixed communication services in Europe and Latin America. The company continues to invest heavily in deploying and transforming its network to provide excellent connectivity in all dimensions, capacity, speed, coverage and security.

Image Source: Zacks Investment Research

Catalysts Behind the Price Surge

Let’s delve deeper to unearth the factors working in favor of this Zacks Rank #3 (Hold) stock.

The company’s performance benefits from solid momentum across Telefonica Tech and Telefonica Brazil business segments. In the second quarter, revenues in Telefonica Brazil grew 4.7% to €2,362 million, mainly due to the momentum in mobile revenues and the progressive update on tariffs.

The company’s 5G network provides almost 86% of the population in Spain with advanced mobile Internet services, streamlining the entire communications infrastructure of the country. In Spain, Bluevia plans to increase its fiber coverage to 5 million by 2024. Also, the company announced the launch of a new OTT proposal, Movistar Plus+, which is available to the entire TV market.

Apart from this, the company has reportedly entered into a deal to digitally transform Bodegas Borsao, a Spanish company with more than 2,100 hectares of vineyards and 375 winegrowers, to make the latter’s operational and logistical processes more efficient.

The company pursues strategic collaboration to expand its footprint. In July, Telefonica announced that it is collaborating with the Celo Foundation to decentralize the Celo platform, which will help improve the Celo blockchain’s security.

Going ahead, the company expects 2023 revenues to grow by approximately 4% compared with the previous guidance of low-single-digit growth. OIBDA is expected to grow by approximately 3% compared with the previous guidance of low-single-digit growth.

Despite solid demand, the company is prone to several risks. The company operates in various places throughout the world, which makes it exposed to unfavorable forex dynamics.

Stocks to Consider

Some better-ranked stocks in the broader technology space are Woodward WWD, Aspen Technology AZPN and Badger Meter BMI. Woodward presently sports a Zacks Rank #1 (Strong Buy), whereas Badger Meter and Aspen Technology currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 earnings per share (EPS) has increased 15.9% in the past 60 days to $4.15.

WWD’s long-term earnings growth rate is 13.5%. Shares of WWD have gained 37.6% in the past year.

The Zacks Consensus Estimate for Aspen Technology’s fiscal 2024 EPS has increased 5.8% in the past 60 days to $6.58.

Aspen Technology’s long-term earnings growth rate is 17.1%. Shares of AZPN have declined 12.6% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 6.3% in the past 60 days to $2.86.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 6.7%. Shares of BMI have surged 69.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Telefonica SA (TEF) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance