Teleflex's (TFX) Urolift Drives Market Share, Macro Woes Stay

Teleflex’s TFX innovative product launches across the business units are highly encouraging. Expansion efforts in Asian countries should contribute to its growth. However, macroeconomic concerns weigh on the stock. Teleflex carries a Zacks Rank #3 (Hold) currently.

Teleflex’s prime-line UroLift System has been successfully gaining market share as a minimally invasive technology in treating lower urinary tract symptoms due to benign prostatic hyperplasia (BPH). In 2023, more than 450,000 men were treated with the UroLift System in select markets worldwide (company’s estimated figure).

Teleflex continues to expand the foundation of clinical data that supports the use of UroLift as a safe and effective minimally invasive treatment for BPH. Several studies on Urolift have demonstrated rapid symptom relief and recovery, no new sustained sexual dysfunction and durable results. In the hospital setting, the company is witnessing consistent growth for UroLift. Outside the United States, UroLift’s recent commercialization in Japan has been a significant step to making this therapy more broadly available to men suffering from BPH.

The company is also proceeding with its plans of initial launch activities in China, with a focus on training surgeons and gaining reimbursements. Last year, Teleflex acquired Palette Life Sciences, adding the Non-Animal Stabilized Hyaluronic Acid (NASHA) spacer Barrigel to its Interventional Urology portfolio. The product complements the UroLift system and addresses the top two diseases within urology care — BPH and prostate cancer.

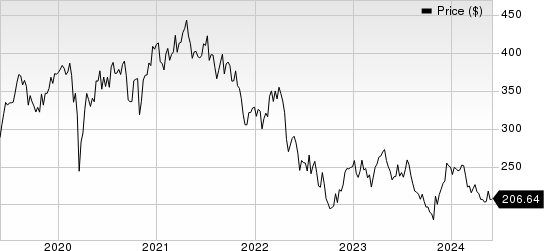

Teleflex Incorporated Price

Teleflex Incorporated price | Teleflex Incorporated Quote

Within the Vascular Access product category, Teleflex remains well positioned for dependable growth over the long term with category leadership in Central Venous Catheters and midlines, anticipated share gains with novel coated Peripherally Inserted Central Catheters (PICCs) portfolio and product introductions.

In the first quarter, revenues increased 2% year over year, led by the underlying growth in PICCs, Central Access and EZ-IO Intraosseous Vascular Access system. Despite the first-quarter performance being affected by the Endurance catheter recall, the company anticipates a clear improvement in the business by the third quarter. Teleflex is poised to capture more market share in peripheral access markets, backed by its new product initiatives.

On the flip side, Teleflex has been grappling with rising expenses for a while. Throughout the last year, the company continued to experience elevated levels of overall cost inflation, specifically within materials and services. In 2024, as well, deteriorating international trade stemming from complex geopolitical environments across the globe resulted in cost inflation. It also witnessed the impacts of higher interest rates and volatile exchange rates driven by monetary policy decisions of central banks.

In the first quarter, Teleflex’s gross margin improvements were partially offset by continued cost inflation. SG&A expenses rose 4.4% from the 2023 comparable figure, mainly due to higher operating expenses incurred by the acquired Palette business, an increase in legal expenses primarily related to higher litigation costs and higher IT-related costs.

According to Teleflex, total inflation is likely to be somewhat higher in 2024 compared to 2023, partly due to the inventory capitalized last year. For 2024, our model estimates a 4.2% year-over-year increase in the company’s cost of goods sold. SG&A expenses are likely to rise 7.2% in the same time frame.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD. While Hims & Hers Health and Medpace sport a Zacks Rank #1 (Strong Buy) each, ResMed carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has surged 127.9% in the past year. Estimates for the company’s earnings have risen from 11 cents to 18 cents for 2024 and from 25 cents to 33 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share have moved up to $11.29 from $11.23 in the past 30 days. Shares of the company have surged 86.3% in the past year compared with the industry’s 4.5% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Estimates for ResMed’s fiscal 2024 earnings per share have moved to $7.64 from $7.59 in the past 30 days. Shares of the company have decreased 0.7% in the past year against the industry’s rise of 2.9%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance