Teleflex (TFX) Earnings and Revenues Beat Estimates in Q4

Teleflex Incorporated’s TFX adjusted earnings per share (EPS) from continuing operations of $3.28 for the fourth quarter of 2019 were up 18.4% year over year. The bottom line also surpassed the Zacks Consensus Estimate by 2.2%.

GAAP EPS for the fourth quarter was $2.28, reflecting a rise of 21.9% from the year-ago period.

Adjusted EPS from continuing operations was $11.15 for the year, reflecting a 12.6% increase from the year-ago period. Moreover, the company surpassed the Zacks Consensus Estimate by 0.6%.

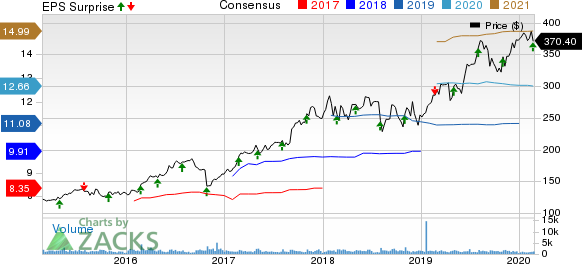

Teleflex Incorporated Price, Consensus and EPS Surprise

Teleflex Incorporated price-consensus-eps-surprise-chart | Teleflex Incorporated Quote

Revenues in Detail

Net revenues in the fourth quarter rose 6.1% year over year to $680.9 million and up 7.1% on a constant exchange rate or CER. The top line surpassed the Zacks Consensus Estimate by 0.3%.

Revenues for the year were $2.59 billion, reflecting a 6% increase from the year-ago period and 8.1% at CER. The metric was in line with the Zacks Consensus Estimate.

Segmental Revenues

In the fourth quarter, the Vascular Access segment reported net revenues of $154.6 million, up 3.7% year over year and 4.6% at CER. The company registered strong growth in PICC (Peripherally Inserted Central Catheters) and EZ-IO.

The Interventional business registered net revenues of $112.7 million, reflecting a 5.2% rise on a year-over-year basis and 6% at CER. The upside was backed by higher sales of complex catheters, biologics, OnControl and MANTA. However, the segment’s revenues were partially offset by the divestiture of the company’s catheter reprocessing product line.

Within the Anesthesia segment, net revenues dipped 2.6% to $85.3 million on a year-over-year basis and 1.3% at CER, primarily driven by the reduction in the buying pattern of US-based distributors.

The Surgical segment recorded net revenues of $95.2 million, reflecting a 2.7% rise on a year-over-year basis and 3.9% at CER on increased sales of ligation clips.

Revenues at the Interventional Urology segment grew 54.3% on a year-over-year basis and 54.4% at CER.

Meanwhile, OEM recorded revenue growth of 3.6% on a year-over-year basis and 4.3% at CER.

The Other product segment (consisting of the company’s respiratory and urology care products) registered net revenues of $89.4 million, a dip of 5.6% year over year and 4.2% at CER. Despite a strong flu season, the decline was primarily caused by the shutdown of a facility of one of the company’s third-party sterilization providers during the quarter.

Margin

In the reported quarter, gross profit totaled $398.3 million. Gross margin expanded 147 basis points (bps) to 58.5% on an 8.9% rise in gross profit.

Selling, general and administrative expenses expanded 10.1% to $240.6 million in the quarter under review, while research and development expenses rose 11.9% to $31.1 million.

Overall adjusted operating profit was $126.5 million, up 5.9% year over year. However, adjusted operating margin saw a 4-bps contraction year over year to 18.6%.

Liquidity Position

Teleflex exited the year with cash and cash equivalents of $301.1 million, down from $357.2 million at the end of 2018.

Cumulative cash flow from operating activities from continuing operations was $437.1 million at the end of 2019 compared with $435.1 million at the end of 2018.

2020 Outlook

On a GAAP basis, the company projects revenue growth of 6.5-7.5%. At CER, revenue growth is estimated between 7.2% and 8.2%. The Zacks Consensus Estimate for revenues is pegged at $2.78 billion.

The company anticipates 2020 adjusted EPS from continuing operations of $12.50-$12.70. The Zacks Consensus Estimate for the same is pegged at $12.67.

Our Take

Teleflex exited 2019 with better-than-expected quarterly results. We are encouraged by the company’s robust improvement in revenues on balanced growth across the majority of segments and geographies. The continued UroLift momentum in the fourth quarter is impressive. The expansion of gross margin also buoys optimism.

However, the contraction in the adjusted operating margin, and a decline in revenues in two business segments and the EMEA region are creating headwinds. The shutdown of one of the company’s third-party sterilization providers during the quarter is also concerning.

Zacks Rank and Key Picks

Teleflex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks, which reported solid results this earnings season, are Stryker Corporation SYK, STERIS plc STE and ResMed Inc. RMD.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Its fourth-quarter revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

STERIS reported third-quarter fiscal 2020 adjusted EPS of $1.45, outpacing the Zacks Consensus Estimate by 1.4%. Net revenues of $774.3 million outpaced the consensus estimate by 3.3%. The company carries a Zacks Rank #2 at present.

ResMed currently carries a Zacks Rank #2. It reported second-quarter fiscal 2020 adjusted EPS of $1.21, surpassing the Zacks Consensus Estimate by 19.8%. Its revenues of $736.2 million outpaced the consensus mark by 1.5%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance