Teck shareholder urges board to engage with Glencore

A long-term investor in Teck Resources Ltd. who has previously clashed with management called on the Vancouver-based miner to give more consideration to Glencore PLC’s takeover proposal.

“How can the board of Teck receive a credible bid at decent premium and not at least engage with the company AND delay the current shareholder vote on the split up?????” Ben Cleary, a portfolio manager at Sydney-based Tribeca Global Natural Resources Ltd., said in an email on April 11.

Cleary’s email landed at about the same time Glencore added a sweetener to the takeover proposal it made on April 3 by including a cash component in addition to shares in the combined entity.

The Glencore proposal arrived amid Teck’s preparations for a shareholder vote on April 26 that will determine whether one of Canada’s biggest miners will split off its metallurgical coal assets into a separate company from its copper and other metal assets, and whether to phase out its dual class structure.

Cleary called on Teck’s management to delay the vote and consider Glencore’s offer, which the board unanimously rejected. Cleary added that he met this week with Glencore chief executive Gary Nagle, before the Swiss commodities giant sweetened its offer for Teck.

“If (Glencore) comes back with a higher offer SURELY the board must delay the vote and engage or they are simply not acting in the interests of shareholders,” Cleary wrote, though he did not comment on the new offer.

SURELY the board must delay the vote and engage or they are simply not acting in the interests of shareholders

Ben Cleary

Glencore has also called on Teck to delay its shareholder vote and reconsider its offer.

Initially, Glencore proposed an all-share merger under which Teck shareholders would control 24 per cent of the equity in the combined assets — which it said valued Teck shares at a 20 per cent premium. It also said it would commit to splitting off Teck’s metallurgical coal assets into a new company with Glencore’s thermal coal and oil trading businesses, and would put the combined metal assets in a separate company.

On Tuesday, Glencore said it would pay up to US$8.2 billion in cash to Teck’s shareholders who did not want exposure to its thermal coal business. Its press release announcing the new offer did not say how much cash this equated to on a per share basis, but said Teck shareholders could also opt for equity in the fossil fuels company.

Teck said it received the offer and would review it, but suggested it was unlikely to change its position.

“Glencore’s revised proposal appears to be largely unchanged, with the exception of a cash consideration alternative in lieu of shares in the proposed combined coal entity,” the company said in a statement. “The revised proposal does not provide an increase in the overall value to be received by Teck shareholders or appear to address material risks previously raised by Teck.

Teck’s board of directors rejected the Glencore proposal on April 3, and on Monday, at 5 a.m. Vancouver time, chief executive Jonathan Price hosted a hastily scheduled conference call for analysts, investors and journalists to reiterate the board’s position that Glencore’s proposal was a “non-starter.”

“Glencore’s rejected proposal was highly uncertain, dilutive and value destructive to Teck shareholders,” Price said on the call.

Price contended that Glencore’s plan to split off its fossil fuels and metals businesses was too vague to be taken seriously, and that its thermal coal and oil trading businesses would act as “inherent anchors on valuation.” Price urged Teck shareholders to approve the April 26 plan to split off its metallurgical coal assets from its metals business. Under that plan, the coal company would be obligated to funnel approximately 90 per cent of its cash flows to Teck’s metals business for six years.

By creating a pure-play copper business, Price said Teck shareholders could gain equity in a company that would trade at a higher multiple whereas Glencore’s proposal would thwart that.

“The shift in mix to less desirable assets would undermine the rerating efforts, as it’s clear that exposure to these commodities have had real consequences on Glencore’s valuation,” Price said. “The Teck board believes that contaminating and diluting Teck’s strong pure-play businesses commonly destroys value for our shareholders.”

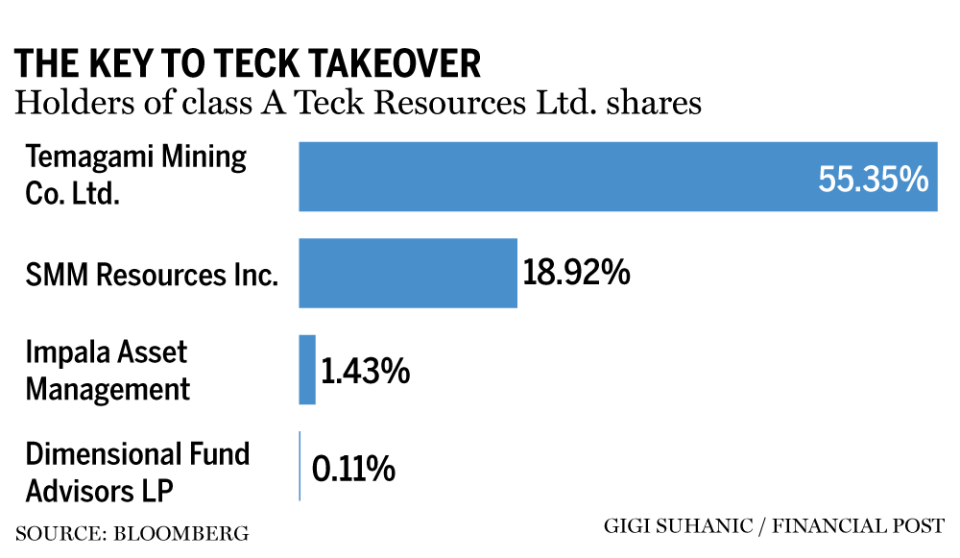

Teck shareholders will also vote on April 26 on whether to phase out the company’s dual class structure, which endows class A shares with 100 votes apiece and class B shares with one vote, over the next six years. Although class A shares represent approximately one per cent of the outstanding Teck shares, the dual structure has given a few key class A shareholders an outsized voice in Teck’s governance.

The Teck board believes that contaminating and diluting Teck's strong pure-play businesses commonly destroys value for our shareholders

Jonathan Price, chief executive, Teck

Indeed, Price created a presentation for his call on Monday that noted class A shareholders are “opposed” to Glencore’s offer, as part of the rationale for rejecting the offer.

According to Teck’s filings, Teck chairman emeritus Norman Keevil’s family’s Keevil Holding Corp., and a subsidiary of Japan’s Sumitomo Corp. control 74.3 per cent of the class A shares.

Bob Bishop, of New York-based Impala Asset Management LLC, said he controls approximately 120,000 class A shares, which trade at low volumes. He said the Glencore offer, prior to the cash sweetener, did not represent enough of a premium to be attractive to him, and said the April 26 vote to sunset the class A shares would make a huge difference and the split off of the metals business from the metallurgical coal business made sense to him.

In 2021, both Bishop and Cleary had been outspoken critics of Teck’s previous chief executive Don Lindsay, saying his strategy to invest in oilsands had been a costly divergence. In addition to calling for Lindsay to be replaced, they urged Teck to divest from the oilsands, phase out its dual class structure and focus on base metals.

In October, the company sold its oilsands assets for $1 billion; and this January, it replaced Lindsay with Price, who has said that the energy transition has created sharply divergent demand outlooks for metallurgical steel and copper.

In an April 9 interview, Price said metallurgical coal is still necessary for steel production but the demand outlook is about “maintaining production,” whereas he said he expected robust growth for copper, because it is a key metal needed for electrification.

“So ultimately, we have two different commodity outlooks,” Price said. “We have different business strategies, and we have different shareholder return profiles and therefore we are providing our investors with choice as to which of those shareholder return profiles they prefer for their portfolios.”

In addition, Price said in the interview that phasing out the dual class structure “will be consistent with good governance and something we think will unlock value in Teck shares over time.”

Up until Monday, Cleary said he “was a much happier shareholder” as a result of those changes. Still, he wants Teck to delay the April 26 vote so it can engage with Glencore on merger talks.

Teck needs at least two-thirds of both class A and class B shareholders’ approval to move forward with either separating its coal and metals businesses or phasing out its dual class structure.

“I think the important thing to note, though, is neither of those votes has any relevance whatsoever to Glencore’s proposal, which is entirely independent of that,” Price said in the interview. “And as I said, it’s been rigorously reviewed by our board of directors and has been rejected out of hand, given we consider it to be very destructive and high risk of execution.”

• Email: gfriedman@postmedia.com | Twitter: GabeFriedz

Yahoo Finance

Yahoo Finance