Teck Resources (TECK) Q1 Earnings Lag Estimates, Decline Y/Y

Teck Resources TECK reported first-quarter 2023 adjusted earnings per share (EPS) of 56 cents, missing the Zacks Consensus Estimate of 87 cents. The bottom line marked a 58% plunge from earnings of $1.32 per share reported in the year-ago quarter. Gains from increased prices for steelmaking coal and higher copper sales volumes were offset by lower zinc and copper prices and lower steelmaking coal sales volumes. Earnings were also impacted by increased unit costs at the steelmaking and Quebrada Blanca (QB) operations.

Including one-time items, EPS from continuing operations was 48 cents in the first quarter of 2024 compared with $1.65 in the year-ago quarter. This reflected the reduced ownership of Elk Valley Resources (“EVR”), lower copper and zinc prices, and higher unit costs at steelmaking coal and QB operations. Also, finance expenses and depreciation and amortization expenses were higher year over year as the depreciation of a majority of the QB assets has started and interest capitalization ceased.

Net sales amounted to around $2.96 billion compared with $2.8 billion in the year-ago quarter. The top line, however, missed the Zacks Consensus Estimate of $2.99 billion.

The gross profit was CAD$1.29 billion ($0.95 billion), marking a 22.6% plunge from the year-ago quarter. The gross margin was 32.3% compared with the year-ago quarter’s 44%.

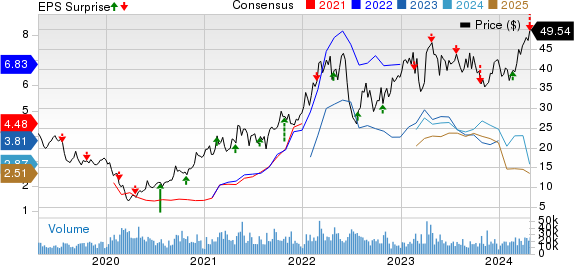

Teck Resources Ltd Price, Consensus and EPS Surprise

Teck Resources Ltd price-consensus-eps-surprise-chart | Teck Resources Ltd Quote

The adjusted EBITDA was CAD$1.69 billion ($1.25 billion), which marked a 14% decline from the year-earlier period. The EBITDA margin was 42.5% in the quarter under review compared with the year-ago quarter’s 52.1%.

Segment Performances

The Steelmaking Coal segment reported sales of CAD$2.37 billion ($1.75 billion), reflecting a year-over-year increase of 1.5%. First-quarter sales volumes were reported at 5.9 million tons, down 5% due to extreme cold weather in January as well as rail impacts in the first two months of the year. This was somewhat offset by higher steelmaking prices.

The segment reported a gross profit of CAD$1.12 billion ($0.8 billion), which was down 12% from the first quarter of 2023 due to higher unit operating costs and lower sales volumes, partially offset by higher realized steelmaking coal prices.

The Copper segment’s net sales surged 41% year over year to CAD$1.08 billion ($0.8 billion) in the reported quarter, attributed to higher production offset by lower copper prices.

Copper production for the first quarter was reported at 99,000 tons, 74% higher than the first quarter of 2023. Copper in concentrate production from QB was at 43,300 tons, reflecting the ongoing ramp-up. Improved performances at Antamina and Highland Valley Copper were offset by lower output at Carmen de Andacollo due to the extreme drought conditions.

The segment’s gross profit was CAD$106 million ($79 million) in the reported quarter, which marked a 59% plunge from the year-ago quarter. This was attributed to lower copper prices and the loss incurred at QB, as it is progressing ramp-up of production and the company has commenced depreciation of the operating assets.

The Zinc segment’s net sales were down 12% year over year to CAD$541 million ($401 million) in the reported quarter as higher production levels were offset by owing to lower zinc prices. The segment’s gross profit marked a significant year-over-year drop of 51% to CAD$63 million ($47 million).

Cash Flow & Balance Sheet

Teck Resources generated a cash flow of CAD$0.04 billion ($0.03 billion), which was substantially down compared with $1.09 billion ($0.8 billion) of cash flow in the first quarter of 2023. The company had cash and cash equivalents of CAD$1.3 billion ($0.9 billion) at the end of the first quarter of 2024 compared with CAD$0.7 billion ($0.5 billion) at the end of 2023. The company’s debt was CAD$6.17 billion ($4.52 billion) at the end of the first quarter of 2024.

TECK returned around CAD$145 million ($107 million) to shareholders in the first quarter through the purchase of CAD$80 million ($59 million) of Class B subordinate voting shares under its normal course issuer bid, and CAD$65 million ($58 million) as dividends.

Guidance

Teck Resources expects steelmaking coal production to be between 24 million tons and 26 million tons in 2024. Copper production is anticipated to be 465,000-540,000 tons. Zinc production is projected between 565,000 tons and 630,000 tons. Refined zinc output is estimated between 275,000 tons and 290,000 tons.

For second-quarter 2024, the company expects sales of zinc in concentrate of 50,000-60,000 tons at Red Dog. Steelmaking coal sales are projected to be 6.0-6.4 million tons for the quarter.

Update on Sale of Steelmaking Coal Unit

On Nov 13, 2023, Teck Resources announced that it has agreed to sell its entire stake in its steelmaking coal business, EVR, for an implied enterprise value of $9 billion. The majority of the sale (77%) will be made to Glencore plc GLNCY, 20% to Nippon Steel Corporation and 3% to POSCO PKX.

Nippon Steel Corporation completed the acquisition of the 20% interest in EVR on Jan 3, 2024, with a payment of $1.3 billion in cash to Teck. On Jan 3, 2024, POSCO exchanged its 2.5% interest in Elkview Operations and 20% stake in the Greenhills joint venture for a 3% interest in EVR. The sale to Glencore is expected to close by the third quarter of 2024. Until the deal is closed, Teck will continue to operate the steelmaking coal business and will retain all cash flows.

Proceeds will be used to strengthen TECK’s balance sheet while returning cash to shareholders. It will help the company focus on growing its extensive copper portfolio and thereby capitalize on the energy transition trend.

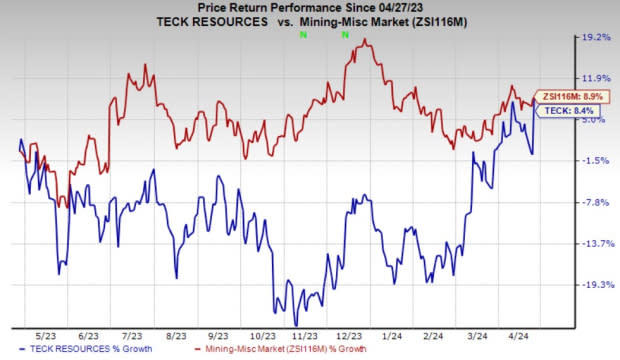

Price Performance

The company’s shares have gained 8.4% in the past year compared with the industry’s 8.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Teck Resources currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the basic materials space is Avient AVNT, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Avient’s current fiscal year earnings is pegged at $2.55 per share, indicating year-over-year growth of 8%. AVNT beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, the average earnings surprise being 7.1%. The company’s shares have gained around 15% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

POSCO (PKX) : Free Stock Analysis Report

Glencore PLC (GLNCY) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance