Technical Update For AUD/USD, EUR/AUD, AUD/JPY & AUD/CHF: 01.11.2018

AUD/USD

Early-month risk-on moves recently helped the AUD to recover some of its latest losses and AUDUSD is no exception to this as it crossed 0.7145-40 region; however, the pair needs to sustain the breakout in order to aim for 0.7200 and the 0.7235-40 resistance-area. Given the quote continue rising past-0.7240, the 0.7260 & 0.7300 are likely following numbers to appear on the Bulls’ radar to target. If at all prices fail to hold their strength and slide beneath 0.7140, the 0.7120 & 0.7100 can come-back on the chart. Assuming the pair’s extended downturn below 0.7100, the 0.7055 and the 0.7040 may be considered as strong supports, breaking which 0.7020 & 0.7000 could gain market attention.

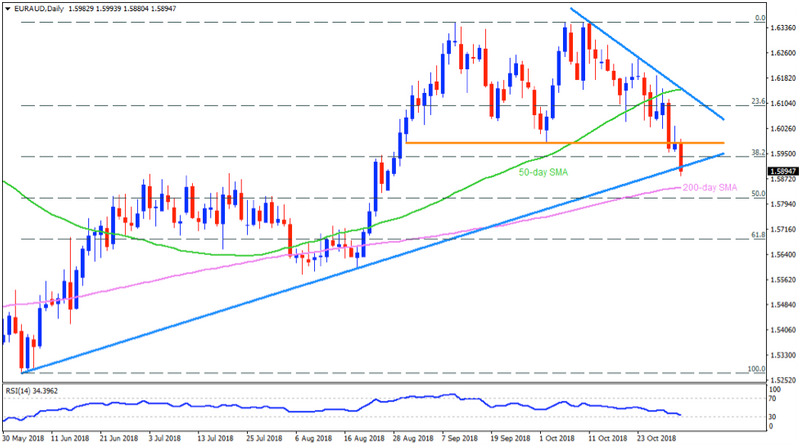

EUR/AUD

Alike AUDUSD, the EURAUD also portrayed the Aussie’s strength by dipping below five-month old ascending trend-line, which if maintained on a daily closing basis, can drag the pair to 200-day SMA level of 1.5845. Should the pair refrains to respect the 1.5845 rest-point, the 1.5800 and the 1.5720 might try threatening sellers, failing to do so could open the gate for 1.5650 and 1.5600 levels. Meanwhile, the 1.5950 and the 1.5975-85 seem restricting the pair’s near-term advances ahead of highlighting the 1.6000 and the 1.6030 resistances. During the pair’s successful rise beyond 1.6030, the 1.6120 and the 1.6145-50 confluence, including 50-day SMA & immediate descending TL, might trouble the Bulls.

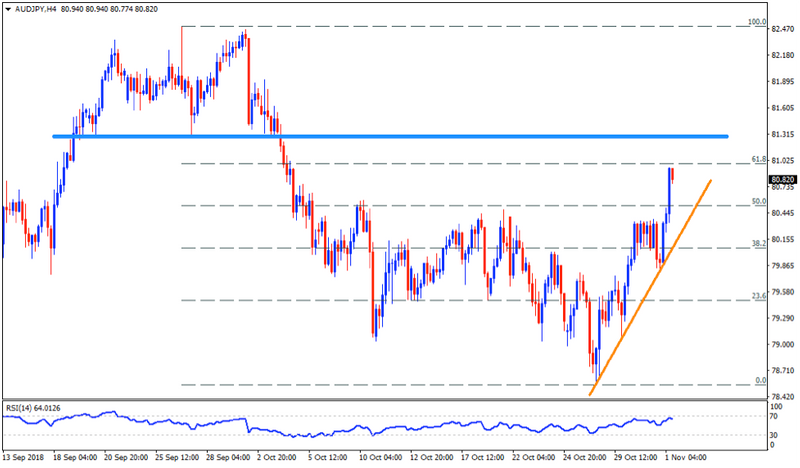

AUD/JPY

AUDJPY’s clearance of 80.60 pushes the pair towards 81.00 round-figure but the 81.25-30 may disappoint buyers afterwards, if not then 81.65 & 82.00 could be their next bets. In case the quote rules above 82.00 landmark, the 82.25 & 82.50 are expected levels to watch. Alternatively, 80.60 & 80.40-35 may offer nearby supports to the pair during its pullback whereas an upward slanting TL, at 80.00, can confine further declines. Though, the support-line’s inability to tackle Bears may flash 79.00 & 78.50 on their radars to target.

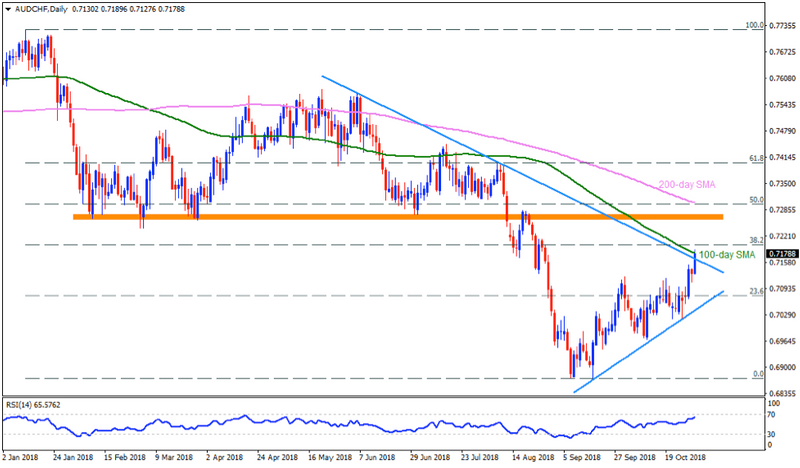

AUD/CHF

Not only a D1 close beyond descending resistance-line stretched since June, but an apt closing above 100-day SMA level is also required for the AUDCHF to go ahead with its recent recovery otherwise its drop to 0.7140 & 0.7120 can’t be denied. Given the pair’s continued downside beneath 0.7120, the 0.7100 and an ascending support-line, at 0.7035, might be of concern as break of them can fetch the pair to 0.6965 & 0.6900 supports. On the upside, a daily close above 0.7165 & 0.7185 respective barriers can escalate the prices to 0.7215 and then to 0.7260-75 resistance-zone. Moreover, pair’s successful trading above 0.7275 enables it to challenge the 200-day SMA level of 0.7305 and the 0.7320 resistance-levels.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance