Tech Turns New Safe Haven Defying Rate Cut Concerns: 5 Picks

The technology sector is firing on all cylinders. Barring some minor fluctuations, Wall Street has been witnessing a strong bull run in the last 18 months, predominantly driven by technology stocks.

During this period, any dip in this sector has proven beneficial to enter the market as technology stocks have rebounded more aggressively. This is likely to continue in the future too, uplifting the technology sector as the new “safe haven.”

Wall Street’s broad-market index — the S&P 500 — registered 30 record-closes this year, solely due to the galloping growth of big-tech stock prices. The tech-heavy Nasdaq Composite posted record highs in the last six trading days. Year to date, the tech-laden index is up 20.9% after soaring 43.4% in 2023.

Of the 11 broad sectors of the S&P 500 Index, the technology sector has jumped 20.1% year to date. Its close resemblance, the communication services sector has climbed 16.3%. None of the remaining sectors have provided double-digit returns this year. The benchmark itself has surged 14.8% year to date.

AI Saga to Continue

The ongoing tech rally since the beginning of 2023 was led by a massive thrust toward artificial intelligence (AI), especially generative AI. The rapid penetration of digital technologies and the Internet worldwide during the lockdown period, ushered in significant adoption of AI. We believe that the AI space is yet to unfold in the United States and international markets.

Despite an improving supply of AI chipsets, demand is likely to outpace supply, resulting in price hikes for chips. The market for AI is expected to show strong growth in the coming decade. Its current size of $200-$300 billion is expected to grow to nearly $2 trillion by 2030, as estimated by several research agencies.

PricewaterhouseCoopers International Ltd. estimated that AI could contribute up to $15.7 trillion to the global economy in 2030. Of this, $6.6 trillion is likely to come from increased productivity and $9.1 trillion is likely to come from consumption-side effects.

Favorable Macro-Economic Scenario

After showing stickiness in the first quarter, various measures of inflation rate are once again showing favorable data in recent months. Peak inflation is far behind us. The labor market remains resilient.

The global supply-chain system has been restoring slowly since last year as U.S. corporate behemoths are rescheduling their supply-chain system’s bypassing of China. The fundamentals of the U.S. economy remain firm despite record-high inflation and interest rate.

On Jun 12, in his post-FOMC meeting statement, Fed Chairman Jerome Powell indicated one rate cut of 25 basis points this year and a full 1% cut in 2025. The performance of high-growth sectors like technology and interest rate are inversely related. Thus, a low interest rate regime will boost this sector.

Our Top Picks

We have narrowed our search to five U.S. technology behemoths that have robust long-term potential. Any dip in these stock prices will be a good buying opportunity. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

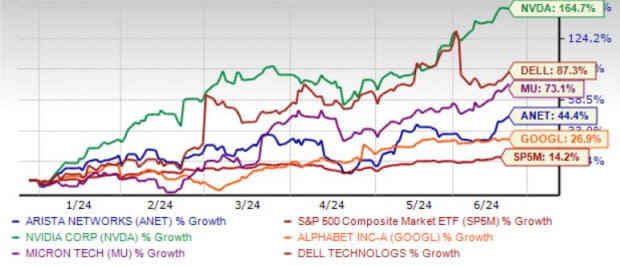

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Alphabet Inc.’s GOOGL robust cloud division is aiding substantial revenue growth. Expanding data centers, cloud regions and availability zones will continue to bolster GOOGL’s presence in the cloud space. Major search updates and the removal of bad ads to enhance search results continue to boost traffic on the company’s search engine.

Growing momentum across GOOGL’s mobile search is contributing further. Strengthening generative AI capabilities should aid business growth in the long term. Deepening focus on the wearables category remains a tailwind for GOOGL. An expanding presence in the autonomous driving space is a plus.

Zacks Rank #1 Alphabet has an expected revenue and earnings growth rate of 15.2% and 31%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last 30 days.

NVIDIA Corp. NVDA reported that blockbuster first-quarter fiscal 2025 revenues of $26.04 billion, soared 262% year over year, marking the third straight quarter of growth in excess of 200%. Adjusted earnings per share were $6.12, compared to $1.09 a year ago. NVDA expects sales of $28 billion in the fiscal second quarter, higher than the current consensus estimate of $26.6 billion.

NVDA expects its next-generation AI chip, called Blackwell, to be its upcoming driver. These chips will be available in data centers in the fourth quarter of fiscal 2025. On Jun 2, NVDA unveiled its new AI chip architecture called “Rubin”.

The Rubin architecture will have new GPUs to launch AI systems, CPUs and networking chips. It will also have new features like a central processor called “Vera”. Rubin is set to be introduced in 2026.

Zacks Rank #1 NVIDIA has an expected revenue and earnings growth rate of 92.6% and more than 100%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days.

Micron Technology Inc. MU produces memory chips used in AI-based chipsets. The enormous growth of AI applications boosted demand for MU’s high bandwidth memory chips. MU is benefiting from improved market conditions, robust sales executions and strong growth across multiple business units.

MU anticipates the pricing of DRAM and NAND chips to increase, thereby improving its revenues. The pricing benefits will primarily be driven by rising AI servers, causing a scarcity in the availability of cutting-edge DRAM and NAND supplies. Also, 5G adoption in IoT devices and wireless infrastructure is likely to spur demand for memory and storage.

Zacks Rank #2 Micron Technology has an expected revenue and earnings growth rate of 50.7% and more than 100%, respectively, for next year (ending August 2025). The Zacks Consensus Estimate for next-year earnings has improved 7% over the last 30 days.

Dell Technologies Inc. DELL is benefiting from strong demand for AI servers driven by ongoing digital transformation and heightened interest in generative AI applications. DELL’s PowerEdge XE9680L AI-optimized server is very much in demand. Strong enterprise demand for AI-optimized servers is aiding DELL.

DELL is witnessing demand from a diversified customer base that includes the likes of higher education institutions, financial services, health care and life services and manufacturing. An expanding partner base that consists of the likes of NVIDIA, Microsoft, Meta Platforms and Imbue has been a major growth driver.

Zacks Rank #2 Dell Technologies has an expected revenue and earnings growth rate of 9.4% and 9.7%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 30 days.

Arista Networks Inc. ANET is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for solid growth in data-driven cloud networking business with proactive platforms and predictive operations. Easing supply chain woes and steady customer additions backed by ANET’s best-in-class portfolio remain the key growth drivers.

Arista Networks is likely to benefit from a software-driven, data-centric approach that helps customers build their cloud architecture and enhance the cloud experience. ANET expects a healthy improvement in gross margin, owing to the optimization of manufacturing output and diligent execution of operational plans.

Zacks Rank #1 Arista Networks has an expected revenue and earnings growth rate of 14.2% and 14.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.7% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance