Tech companies have become historically stingy with their IPOs

Big tech companies have continued to see shares outperform following initial public offerings in 2018 — so much so that the rally after going public has almost come to be expected.

But new data shows that might be impacting companies’s go-public playbook, as newly public companies try to maximize valuations in their first few months of trading on the open market.

According to Dealogic, tech companies have only issued about 17% of total shares in IPOs this year. That percentage would mark the lowest amount offered by tech companies in history.

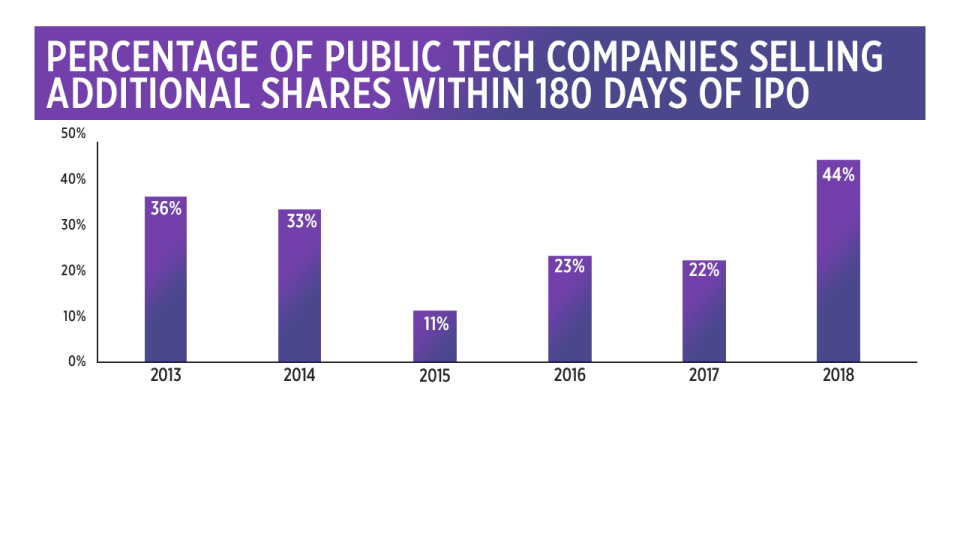

Additionally, companies are selling additional shares following initial public offerings faster than they have in the past. Dealogic said when it comes to follow-on offerings through the first 10 months of 2018, 44% have occurred just 180 days after the IPO. That figure is up 22 percentage points from 2017 and is the second highest since 1995, when the data firm started tracking the number of days companies sell shares after an IPO. In 2012, it was a record 56% of tech companies.

Of course, selling additional shares at a higher price following an IPO would be an easy way for tech companies to capitalize on the buying frenzy that tends to drive up share price in the wake of a public offering. For example, Atlanta-based payments startup Evo Payments (EVOP) initially raised over $220 million by offering 14 million shares in May at an IPO price of $16 per share. The stock popped more than 20% in its first day of trading and rallied over the ensuing months before the company announced a follow-on offering of another 7 million shares at $24.50 per share, roughly 120 days later.

The fact that tech companies have been offering fewer shares than ever before they go public only to offer more shares after potentially seeing the stock pop is not necessarily indicative of a company’s calculated attempt to capitalize on the public’s demand for investing in promising tech companies. There are other factors at play.

Plenty of private money

Mainly, easier access to private capital through the likes of growing venture capital funds, like SoftBank’s $100 billion Vision Fund or other funds following suit, may have reduced the need for public funding. Indeed, the overall number of IPOs annually has failed to come close to 2014’s peak of 275 as venture funding has climbed over the past half-decade, according to Renaissance Capital. At a year-to-date total of 180, 2014’s total will again most likely not be matched. As a consequence, raising capital through the sale of more shares to the public might be increasingly viewed as a secondary benefit as companies eye IPOs, said Adam Augusiak-Boro, a senior associate at EquityZen, a platform for buying and selling shares in private companies.

“Companies have raised so much more money now in the private markets, at least relative to other bull markets like the dot-com era or even back four or five years ago when we hadn’t yet seen the greater prevalence of the mega-fund or the $100 million round that’s much more common now,” he said. “If you have all this private capital, you can get some of the benefits of going public while staying private and then potentially issue fewer shares if and when you actually do go public.”

Looking ahead to 2019’s IPO market, when the likes of ride-sharing giants Uber and Lyft are expected to IPO, the disadvantages of going public may outweigh the benefits, especially with the equity market volatility in October. The tech-heavy Nasdaq tumbled 9% and Amazon (AMZN) fell more than 20% — its worst month since 2008, the depths of the financial crisis.

“In terms of disadvantages, I think there are a few,” Augusiak-Boro said. “You’re subjected to analyst scrutiny… and being at the mercy of market participants, for example, short sellers, is obviously a worrying prospect for some people.”

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Juul surpasses Facebook as fastest startup to reach decacorn status

How Juul became the FDA’s latest target

Where SoftBank’s Vision Fund is deploying its $100 billion

Yahoo Finance

Yahoo Finance