TD Stock’s Dividend Yield Hits 5.4%: Is It Finally Time to Buy?

Written by Kay Ng at The Motley Fool Canada

Many investors park some of their money in guaranteed investment certificates (GICs) to earn fixed income. The benefit of traditional GICs is that they provide income predictability and protection of your principal.

It’s a suitable investment if you want that stability or if you’re saving the money for a big purchase. For example, if you’re planning to buy a car a year later, you could park the money you have saved in a one-year GIC, which now offers an interest rate north of 5%.

As a part of their diversified portfolios, investors could increase or reduce their fixed-income exposure from GICs and bonds according to their risk tolerance and investment goals. What if you want to target higher returns for the longer term? Historically, stocks are the asset class that have delivered the highest returns.

Investors can gain exposure to stocks via exchange-traded funds (ETFs), such as market-wide ETFs like the SPDR S&P 500 ETF Trust for the U.S. market or iShares S&P/TSX 60 Index ETF for the Canadian market.

One stock investing strategy that has worked for many investors is dividend investing, which requires careful selection of individual dividend stocks to ensure a stable and growing income stream. If you’re willing to park money in your bank’s GIC, you might be happy to invest in its stock, too.

One large Canadian bank stock that’s common in dividend portfolios is Toronto-Dominion Bank (TSX:TD). It has actually been out of favour for a while. The stock has seemingly done nothing for investors by trading in a sideways range since early 2022. On the other hand, since fiscal 2021, the blue chip stock has increased its dividend by 29%, which equates to an annual increase of close to 8.9%. This is not bad for investors who only need to sit on the shares and do nothing but watch the dividend income roll in.

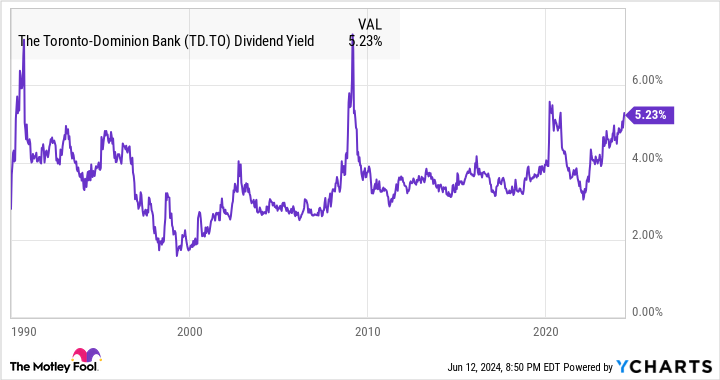

A combination of the stock price traversing sideways and dividend increases has driven TD stock’s dividend yield to a more attractive level of close to 5.4%. And it’s a good time for investors with a long-term investment horizon to buy and lock in a high yield.

TD Dividend Yield data by YCharts

As the sixth-largest North American bank by total assets, TD Bank has staying power. Last quarter, it reported having almost $2 trillion in total assets and $1.2 trillion in total deposits, while its adjusted net income came in at $14.6 billion in the trailing four quarters.

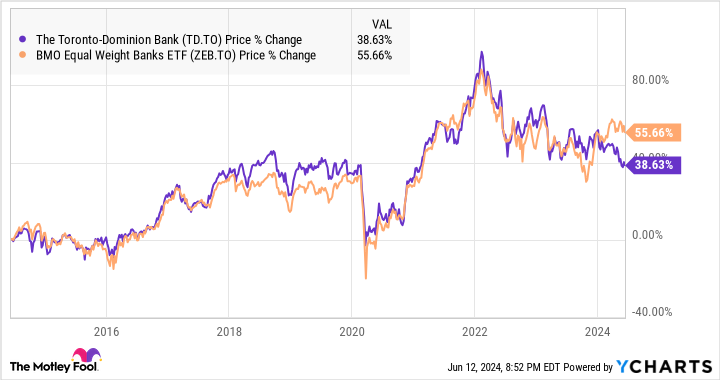

Notably, the stock has been lagging the sector (using the BMO Equal Weight Banks Index ETF as a proxy, as shown in the graph below) and no one has a crystal ball as to when the stock will turn around.

TD data by YCharts

At $75.75 per share at writing, TD stock trades at a blended price-to-earnings ratio of about 9.5, which puts it at a decent discount of approximately 19% from its long-term normal valuation. If its valuation normalizes over the next five years and it grows its earnings by 5% per year, along with its rich dividend, it can deliver annualized returns of north of 14%, which would be a superb return for a blue chip stock. No valuation expansion would lead to a total return of north of 10%, which would still be not bad. So, TD stock appears to be a good buy here.

The post TD Stock’s Dividend Yield Hits 5.4%: Is It Finally Time to Buy? appeared first on The Motley Fool Canada.

Just Released! 5 Stocks Under $50 (FREE REPORT)

Motley Fool Canada's market-beating team has just released a brand-new FREE report revealing 5 "dirt cheap" stocks that you can buy today for under $50 a share.

Our team thinks these 5 stocks are critically undervalued, but more importantly, could potentially make Canadian investors who act quickly a fortune.

Don't miss out! Simply click the link below to grab your free copy and discover all 5 of these stocks now.

Claim your FREE 5-stock report now!

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Toronto-Dominion Bank. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance