TC Energy (TRP) Stock Declines 7% Despite Q2 Earnings Beat

Shares of TC Energy TRP have gone down 7.2% since the company’s second-quarter 2022 earnings announcement on Jul 28. The stock performance came despite TC Energy’s second-quarter earnings marginally beating estimates.

TRP reported second-quarter 2022 adjusted earnings of 78 cents per share, marginally outperforming the Zacks Consensus Estimate of 77 cents. This outperformance could be attributed to the strong results of the Canadian Natural Gas Pipelines, Liquids Pipelines and Power and Storage segments and the U.S. Natural Gas Pipelines unit, partially offset by the weakness of the Mexico Natural Gas Pipelines segment.

TC Energy’s comparable EBITDA of about C$2.37 billion in the reported quarter was up from C$2.25 billion in the prior-year period.

This North America-based energy infrastructure provider’s quarterly revenues of $2.85 billion increased approximately 10% year over year and beat the Zacks Consensus Estimate of $2.62 billion due to solid segmental performances.

TC Energy’s board of directors announced a quarterly dividend of 90 Canadian cents per common share for the quarter ending Sep 30, 2022. The dividend is payable on Oct 31, 2022 to shareholders of record at the close of the business on Sep 30, 2022.

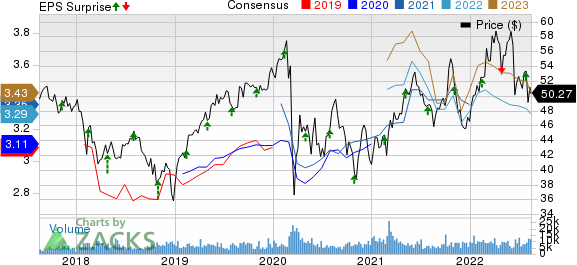

TC Energy Corporation Price, Consensus and EPS Surprise

TC Energy Corporation price-consensus-eps-surprise-chart | TC Energy Corporation Quote

Segmental Information

Canadian Natural Gas Pipelines reported a comparable EBITDA of C$681 million, down about 0.4% from the year-ago quarter’s levels. This marginal decrease was reflective of lower flow-through costs on TRP’s Canadian rate-regulated pipelines, offset by higher rate-base earnings from the NGTL System.

U.S. Natural Gas Pipelines’ comparable EBITDA of C$915 million reflects a 4.1% increase from the prior-year quarter’s level. This upside can be attributed to the stronger U.S. dollar in 2022 with otherwise consistent earnings in the second quarter of 2022 compared to the same period in 2021.

Mexico Natural Gas Pipelines’ comparable EBITDA of C$190 million was up about 15.8% from the year-earlier quarter’s figure of C$164 million. This upside could be due to increased equity earnings from Sur de Texas due to lower interest expenses attributable to the repayment of the peso-denominated loan, with the subsequent issuance of a U.S. dollar-denominated loan on Mar 15, 2022.

Liquids Pipelines unit’s comparable EBITDA of C$341 million in the reported quarter deteriorated from the year-earlier quarter’s level of C$366 million. This downtrend was due to lower contracted volumes in the U.S. Gulf Coast section of the Keystone Pipeline System.

Power and Storage posted a comparable EBITDA of C$252 million, up by 60.5% from the year-earlier quarter’s figure of C$157 million. The uptrend was due to increased Natural Gas Storage and other earnings from actively managing TRP’s natural gas positions in the reported quarter as well as positive contributions from Bruce Power, primarily due to a higher contract price.

Expenditure and Balance Sheet

As of Jun 30, 2022, TC Energy’s capital investments for the reported quarter summed at C$1.26 billion.

TRP had cash and cash equivalents worth C$1504 million and long-term debt of C$39.99 billion, which represented a debt-to-capitalization of 54.9%.

Key Updates

TC Energy announced that Coastal GasLink LP achieved a significant milestone with the execution of revised project agreements with LNG Canada that incorporate a revised cost estimate for the project of $11.2 billion. The revised agreement allows TRP to continue the safe and timely execution of the 670-kilometer project, which is now about 70% complete, with two of the eight sections finished and expected mechanical in-service by the end of 2023.

The company said that in the six months ended Jun 30, 2022, the NGTL System placed approximately $1.5 billion of capacity projects in service.

Zacks Rank & Key Picks

TC Energy currently has a Zacks Rank #3 (Hold). Some better-ranked stocks from the energy space that warrant a look include EnLink Midstream ENLC, Liberty Energy LBRT and Equinor EQNR, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for EnLink’s 2022 earnings stands at 37 cents per share, up 640% from the year-ago earnings of 5 cents.

The Zacks Consensus Estimate for ENLC’s 2022 earnings has been revised upward by about 19.3% over the past 60 days from 31 cents to 37 cents per share.

The Zacks Consensus Estimate for Liberty’s 2022 earnings is pegged at $1.61 per share, up about 257.8% from the year-ago loss of $1.02.

The Zacks Consensus Estimate for LBRT’s 2022 earnings has been revised upward by about 177.5% over the past 60 days from 49 cents to $1.36 per share.

Equinor beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, the average being around 7.3%.

The Zacks Consensus Estimate for EQNR’s 2022 earnings stands at $6.09 per share, up about 97.7% from the year-ago earnings of $3.08.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TC Energy Corporation (TRP) : Free Stock Analysis Report

EnLink Midstream, LLC (ENLC) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance