Tax audits: Where you live could increase chances of an audit

In our Money Mailbag this week, a viewer asks:

“Is it true that you’re more likely to get audited based on where you live?”

In general the IRS audits less than 0.5% of all returns, which in 2016, was 1.1 million audits. The IRS says, when it comes to who gets audited, it shouldn’t matter where you live, or how much you earn, but a new report from ProPublica casts some doubt on that.

Paul Kiel, co-author of the ProPublica report that analyzed audits from 2012 to 2015, calls the findings “really striking.”

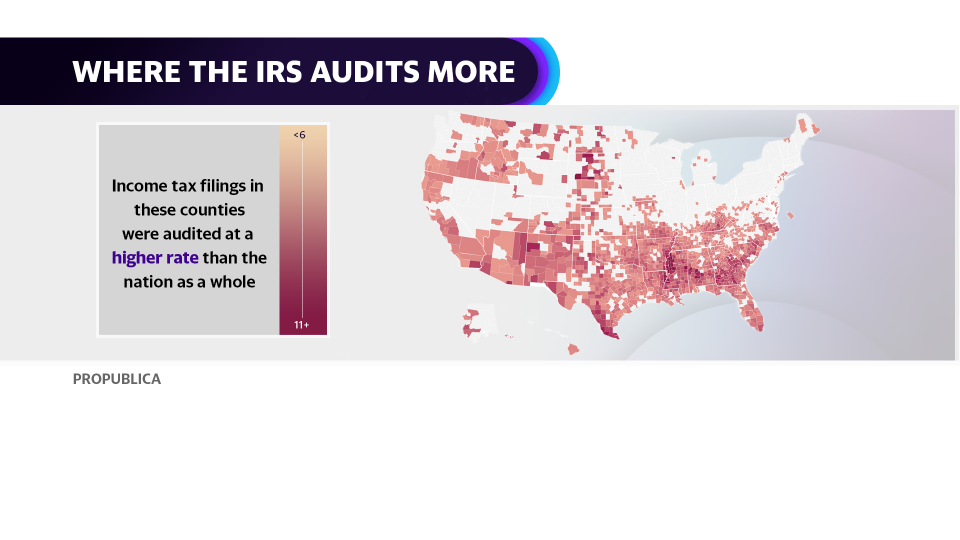

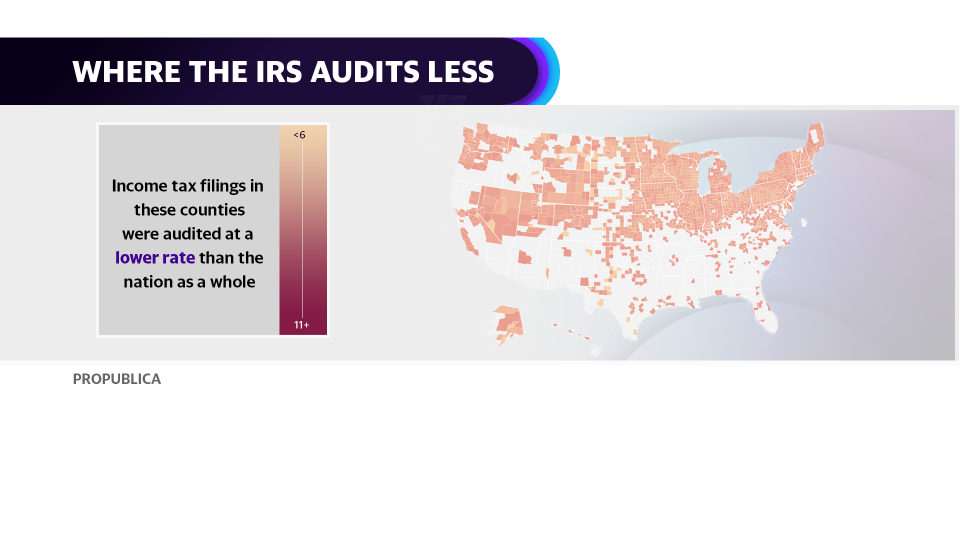

“The below-average map is basically the northern part of the United States, and the above-average is more or less the south,” he says. “You could also see things like counties with a high Latino population, like in the south of Texas, or where the Native American reservations are” had higher audit rates.

Tax audits and your location

The U.S. counties with the highest audit rates – with 40% more than the national average -- were in rural locations like Humphries County in Mississippi. A third of all audits are those who claimed the earned income tax credit (EITC). To be eligible for the EITC refund that ranges from $519 to $6,431, depending on how many children you claim, the adjusted gross income for single filers must be in the range of $15,270 for zero children to $49,194 for three or more children. In 2017, 26 million households claimed this credit.

How tax audits are flagged

“These audits are usually initiated by a computer,” Kiel says. “They go after these people that get this credit because they want to make sure that your kids are your kids.”

Of the top 10 most audited counties in the country, ProPublica found most were in the south, mainly in Mississippi:

Humphreys County, Mississippi

Tunica County, Mississippi

East Carroll Parish, Louisiana

Noxubee County, Mississippi

Sharkey County, Mississippi

Shannon County, South Dakota

Holmes County, Mississippi

Quitman County, Mississippi

Coahoma County, Mississippi

Claiborne County, Mississippi

*Note: Shannon County’s name changed in 2014 and is now Oglala Lakota County, South Dakota.

In response to this report, the IRS has said that audit selections are blind to race and location: “To ensure an equitable process for all taxpayers, fairness and integrity are built into the foundation of our return selection process for audits, which is designed to select returns with the highest likelihood of noncompliance. Audit inventory selection uses systemic risk-based scoring criteria. The audit selection process applies the same business rules, filters and scoring to all returns to identify potentially non-compliant taxpayers. The selection criteria does not include any components or factors related to the geographic location or ethnicity of the taxpayers.”

But all it takes is one look at the darker shades of this map that show the highest rates of audits versus the lowest rates of audits.

Related: How to get more time to file your taxes

“The thing that stood out was what’s called the Black Belt across the south of Alabama and into the Mississippi delta, which dates back to the early nineteenth century when there was a land rush there, and that’s why you still have elevated African American populations there,” Kiel says.

Your earnings and tax audits

Analysts found the least likely to be audited are middle-income households earning between $50,000 to $100,000 in states with largely white populations like New Hampshire, Minnesota and Wisconsin.

While wage earners with a typical W2 don’t need to worry as much about audits, Kiel says freelancers, small business owners, and those who qualify for the earned income tax credit need to be able to prove their earnings and the status of the dependents they claim. These audits on average can take three to six months to resolve - a painstakingly long time for the households who are oftentimes counting on refunds to make ends meet.

WATCH MORE:

• How the brand-new Apple card compares to other credit cards

Yahoo Finance

Yahoo Finance