Can Target's Recent Outperformance Continue?

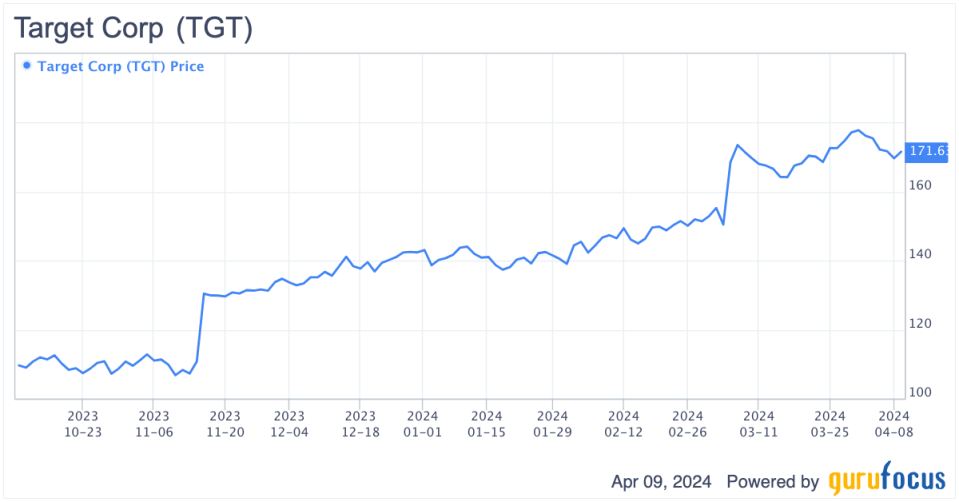

Shares of Target Corp. (NYSE:TGT) have rallied sharply over the past six months, delivering a total return of roughly 66%. Comparably, the S&P 500 has delivered a total return of roughly 21% over the same period.

The gain has been driven by improvements in the underlying business, increased estimates for 2024 earnings per share and a re-rating higher in the stock's valuation.

While Target has delivered an impressive performance, I believe it is now fully valued and thus, significant outperformance versus the broader market is unlikely.

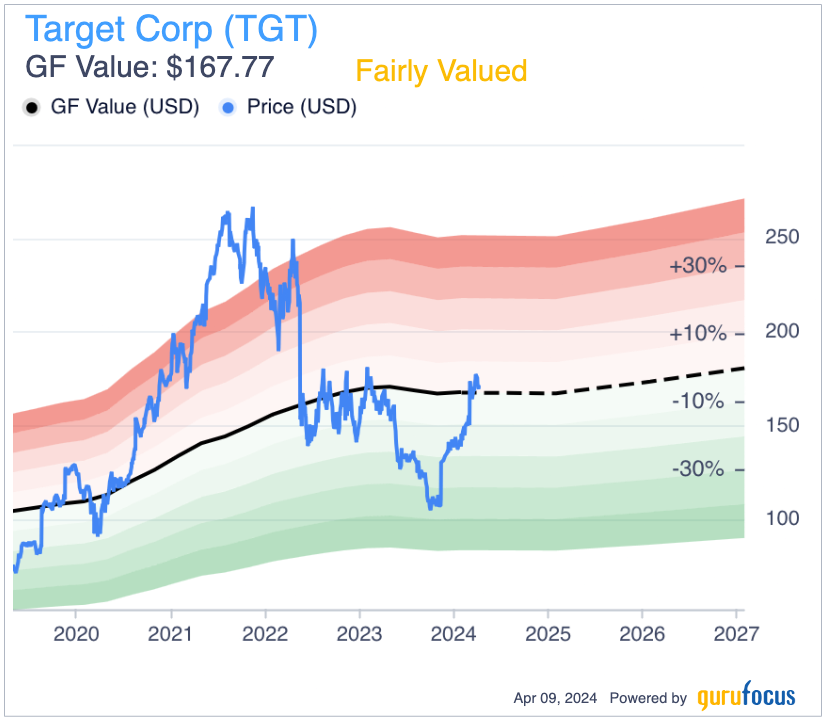

TGT Data by GuruFocus

Company overview

Target is a leading retailer with approximately 1,956 stores across the U.S. The company owns roughly 1,532 of its store properties and fully leases 264 of its locations. The company owns buildings on leased land for 160 of its locations. Thus, unlike most other retailers, the company's real estate holdings make up a significant portion of its value.

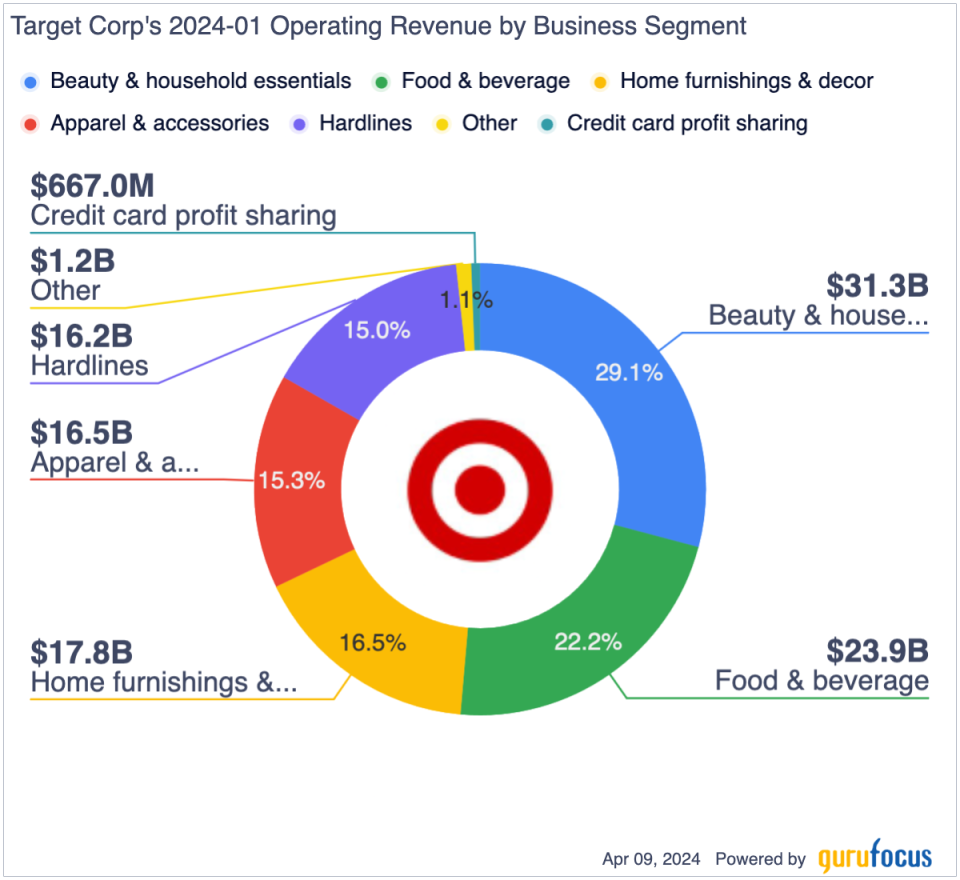

Key product categories include food and beverage, apparel and accessories, beauty and household essentials, home furnishings and decor and hardlines.

While the bulk of Target's revenue is generated through sales at its physical store locations, the company also has a large online business. For 2023, digitally originated sales accounted for roughly 18% of total sales.

Highly competitive business with thin profit margins

The retail business is highly competitive. Target competes with a wide range of competitors, including Walmart (NYSE:WMT), Amazon (NASDAQ:AMZN), Kroger (NYSE:KR), Costco (NASDAQ:COST), TJX Companies (NYSE:TJX), Dollar General (NYSE:DG), Temu, Shien and many others.

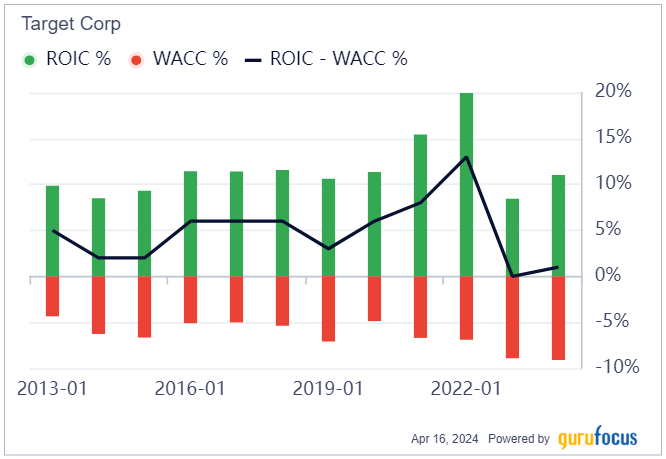

Despite operating with less scale than players such as Walmart, Amazon or Costco, the company has delivered reasonably strong financial performance. As shown by the chart below, Target has been able to fairly consistently deliver returns on invested capital in excess of its cost of capital.

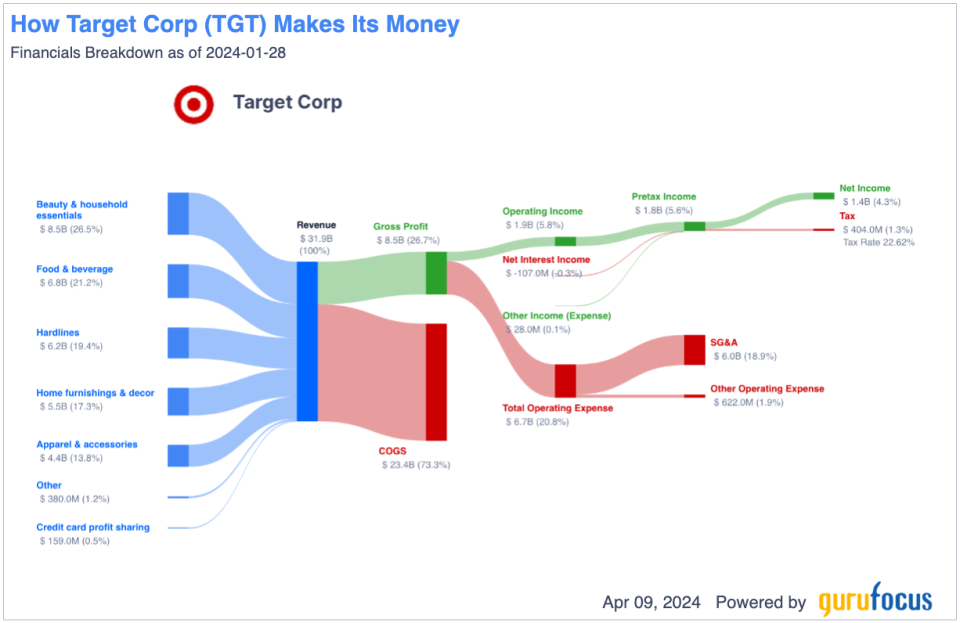

While Target has done a good job in terms of optimizing its current business and maintaining profitability, it has struggled to consistently grow revenue and profits. The company experienced a boost in sales due to Coid-19 and the ensuing inflation, but has struggled to grow its business since then. For fiscal 2023, the company reported a 1.70% year-over-year decline in total sales, driven by a 3.70% decrease in comparable store sales. Comparably, Walmart reported a 6% increase in total sales for the year.

Recent margin improvements and growth outlook

As previously noted, one of the key drivers of the recent rally has been improved business performance. Specifically, the company delivered extremely strong margin improvement in 2023, resulting in significant earnings per share growth.

Last year, Target reported adjusted earnings of $8.94 per share, which was a nearly 50% increase from $6.02 in 2022. The increase in earnings was driven entirely by margin expansion as total revenue declined by 1.70% for 2023. Margins benefited from better inventory management, lower freight and logistics costs and other efficiency initiatives.

The company believes it can deliver same-store sales growth of 0% to 2% and improve margins from 2023 levels of 5.30% toward a longer-term goal of 6%. Target expects 2024 adjusted earnings of $8.60 to $9.60. The midpoint of that estimate implies roughly 2% growth versus 2023, but a high single-digit increase after adjusting for the fact that 2023 included an extra week. Over the long term, the company believes it can deliver annual earnings per share growth in the high single-digit range.

Consensus estimates currently call for the company to report adjusted earnings of $9.39 per share for 2024, which is toward the high end of the company's guidance range.

Valuation

Currently, Target trades at roughly 18 times 2024 consensus earnings per share. Comparably, the S&P 500 trades at roughly 22 times estimated earnings. While the retailer has similar medium-term growth prospects to the broader market, I view the discount as appropriate given the highly competitive nature of its business. Additionally, Target's business is highly cyclical, which I believe also supports the argument for a valuation discount versus the broader market.

Target's closest peer, Walmart, trades at a forward price-earnings ratio of 25. While Walmart has similar near-term growth prospects, the company has much more scale and thus is able to offer lower prices, which gives it a competitive edge. Moreover, Walmart earnings tend to be less cyclical given the company's focus on being the low-cost option for consumers. For these reasons, I believe Walmart deserves to trade at a premium to Target.

Six months ago, Target had traded at a forward price-earnings ratio of 12.50 and, therefore, has experienced considerable margin expansion. Over the past 10 years, the stock has traded at an average price-earnings ratio of 17.40. As such, the current valuation does not strike me as particularly attractive and suggests significant multiple expansion is unlikely from here.

Additionally, the stock has a GF Value of roughly $168 per share, which suggests the stock is fairly valued at current levels.

Potential upside catalysts

One potential upside catalyst for Target would be if the company is able to deliver continued margin expansion from current levels, resulting in 2024 earnings coming in ahead of company guidance and current consensus estimates. The company's 5.30% operating margin remains well below the 6% level it experienced prior to the pandemic and the inflationary environment which followed. One potential driver of improved margins from current levels could be an improvement in shrink rates. For 2023, shrink increased by roughly $500 million from 2022 levels, representing a 1.20% operating margin headwind versus 2019.

Another potential upside catalyst is a stronger-than-anticipated economy, which results in better-than-anticipated consumer spending. As one of the largest retailers in the U.S., Target is highly levered to the strength of the consumer. Strong consumer spending has the potential to allow Target to deliver same-store sales growth in excess of the company's guidance for the year and, in turn, is likely to result in earnings per share coming in ahead of current consensus estimates.

Conclusion

Target shares have experienced strong outperformance versus the broader market over the past few months. The company delivered impressive financial results for 2023, driven by strong margin expansion due to improved operational efficiency.

While the company may be able to improve margins further from current levels, any improvement will be fairly limited in nature.

The stock currently trades at an earnings multiple which is only modestly lower than the broader market despite the fact the company is highly cyclical and operates in a highly competitive industry.

For these reasons, I view shares as fairly valued and believe it is unlikely that Target's outperformance can continue.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance