Tamarack Valley Energy (TSE:TVE) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Tamarack Valley Energy (TSE:TVE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Tamarack Valley Energy

Tamarack Valley Energy's Improving Profits

In the last three years Tamarack Valley Energy's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. In previous twelve months, Tamarack Valley Energy's EPS has risen from CA$0.75 to CA$0.78. That amounts to a small improvement of 4.1%.

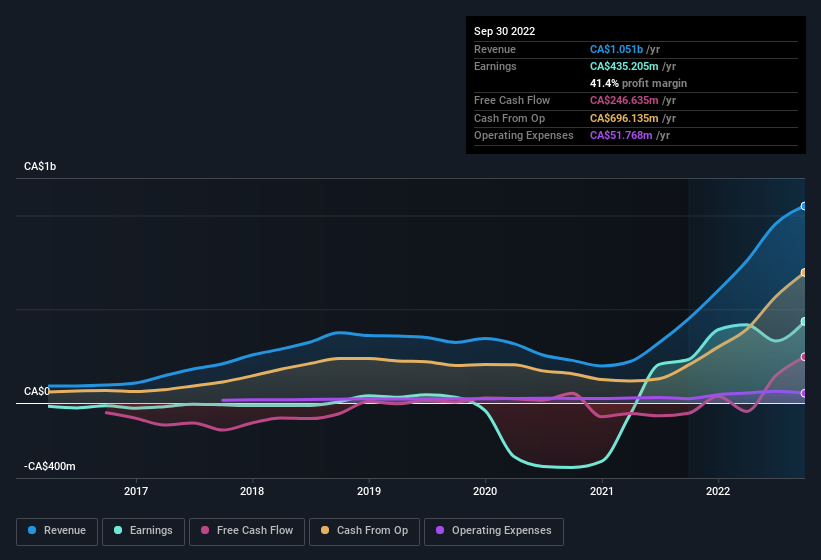

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, Tamarack Valley Energy has done well over the past year, growing revenue by 134% to CA$1.1b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Tamarack Valley Energy's balance sheet strength, before getting too excited.

Are Tamarack Valley Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold CA$588k worth of shares. But that's far less than the CA$3.3m insiders spent purchasing stock. This adds to the interest in Tamarack Valley Energy because it suggests that those who understand the company best, are optimistic. We also note that it was the President, Brian Schmidt, who made the biggest single acquisition, paying CA$500k for shares at about CA$3.75 each.

On top of the insider buying, it's good to see that Tamarack Valley Energy insiders have a valuable investment in the business. Indeed, they hold CA$59m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 2.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Tamarack Valley Energy To Your Watchlist?

One positive for Tamarack Valley Energy is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We don't want to rain on the parade too much, but we did also find 2 warning signs for Tamarack Valley Energy that you need to be mindful of.

The good news is that Tamarack Valley Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance