T. Rowe Price's (TROW) April AUM Declines 3.7% Sequentially

T. Rowe Price Group, Inc. TROW announced its preliminary assets under management (AUM) of $1.48 trillion for April 2024. The figure reflected a sequential decline of 3.7%.

TROW experienced net outflows of $7.8 billion in April 2024.

At the end of April, TROW’s equity products aggregated $762 billion, which dropped 5.1% from the previous month’s level. Fixed income (including money market) declined 1.2% to $169 billion. Further, multi-asset products were $506 billion, which dipped 2.7% from the previous month.

Alternative products of $48 billion remained unchanged from the prior month’s level.

T. Rowe Price registered $432 billion in target date retirement portfolios in April 2024, which declined 2.5% from the prior month.

The company’s diversified business model and efforts to broaden its distribution reach through strategic acquisitions will likely support its top-line growth in the future. However, the company’s overdependence on investment advisory fees is concerning. This is because market fluctuations and a sudden slowdown in overall business activities are likely to hurt its revenues.

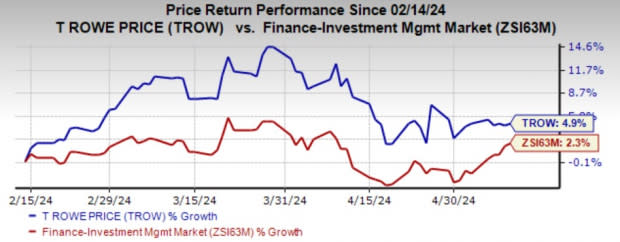

Over the past three months, shares of T. Rowe Price have risen 4.9% compared with the industry’s 2.3% growth.

Image Source: Zacks Investment Research

Currently, TROW sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Asset Managers

Franklin Resources, Inc. BEN reported its preliminary AUM of $1.60 trillion as of Apr 30, 2024. This reflected a decrease of 2.5% from the prior month’s level.

The decline in BEN's AUM balance was primarily due to the impact of negative markets and long-term net outflows, including $5.9 billion related to the $25 billion AUM received from the Great-West Lifeco acquisition.

Virtus Investment Partners, Inc. VRTS recorded a sequential decline of nearly 5.2% in its preliminary AUM balance for April 2024. The company reported a month-end AUM of $170.06 billion, which declined from $179.31 billion as of Mar 31, 2024.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance