T-Mobile US Inc (TMUS) Q1 2024 Earnings: Strong Growth and Surpassing Analyst Expectations

Net Income: $2.4 billion, up 22% year-over-year, surpassing the estimate of $2.261 billion.

Diluted EPS: $2.00, a 27% increase year-over-year, exceeding the estimate of $1.87.

Service Revenues: $16.1 billion, marking a 4% increase from the previous year, driven by a 6% growth in postpaid service revenues to $12.6 billion.

Adjusted Free Cash Flow: $3.3 billion, up 39% year-over-year, reflecting robust operational efficiency.

Operating Cash Flow: Increased by 25% year-over-year to $5.1 billion, setting a new record for Q1.

Stockholder Returns: Returned $4.3 billion to stockholders in Q1 2024 through stock repurchases and dividends.

5G Network Expansion: Nearly 95% of 5G traffic now carried on mid-band spectrum, enhancing network performance and customer experience.

T-Mobile US Inc (NASDAQ:TMUS) released its 8-K filing on April 25, 2024, showcasing a robust start to the year with significant growth in customer base, service revenue, and profitability. The company not only matched but surpassed analyst expectations for the first quarter of 2024, demonstrating a strong competitive stance in the telecommunications sector.

As a merged entity from T-Mobile USA and MetroPCS, and later with Sprint in 2020, T-Mobile now stands as the second-largest wireless carrier in the U.S. It aggressively targets the retail wireless market with approximately 76 million postpaid and 22 million prepaid phone customers. The company has also made significant inroads into the fixed-wireless broadband market, now serving nearly 5 million residential and business customers.

Financial Highlights and Performance Metrics

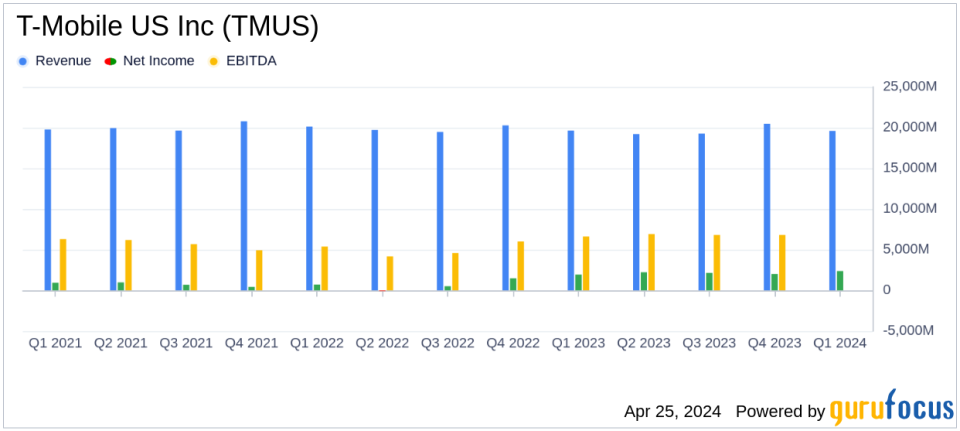

For Q1 2024, T-Mobile reported a net income of $2.4 billion, marking a 22% increase year-over-year, and a diluted earnings per share (EPS) of $2.00, up by 27% from the previous year. These figures comfortably exceed the analyst estimates which projected an EPS of $1.87 and a net income of $2.26 billion. Service revenues reached $16.1 billion, a 4% increase year-over-year, driven by a 6% growth in postpaid service revenues which totaled $12.6 billion.

The company's operational efficiency is reflected in its core Adjusted EBITDA of $7.6 billion, an 8% increase from the prior year, and a record high net cash provided by operating activities of $5.1 billion, up 25% year-over-year. Adjusted Free Cash Flow also saw a substantial rise of 39% to reach $3.3 billion.

Strategic Advances and Market Positioning

T-Mobile's strategic focus on enhancing its 5G network capabilities has positioned it as a leader in the U.S. telecom space. Nearly 95% of its 5G network traffic now utilizes mid-band spectrum, ensuring high-quality service across its customer base. This technological advancement supports the company's claim of having the largest, fastest, and most advanced 5G network in the nation.

The company's customer-centric approach continues to pay dividends, as evidenced by its postpaid phone churn rate matching its record low for a first quarter at 0.86%. Additionally, T-Mobile's aggressive push into high-speed internet services has resulted in surpassing 5 million customers, further diversifying its revenue streams and strengthening its market presence.

Future Outlook and Guidance

Encouraged by its current performance, T-Mobile has raised its guidance for 2024. The company now expects postpaid net customer additions to be between 5.2 million and 5.6 million, up from the previous estimate of 5.0 million to 5.5 million. Furthermore, core Adjusted EBITDA is projected to be between $31.4 billion and $31.9 billion, reflecting the company's optimistic financial trajectory.

In conclusion, T-Mobile US Inc's first quarter of 2024 sets a positive tone for the year. With its strategic initiatives yielding favorable outcomes and its financial metrics exceeding expectations, the company is well-positioned to maintain its growth momentum in the competitive telecommunications industry.

For more detailed financial analysis and future updates on T-Mobile US Inc, visit the Investor Relations section of their website or follow their upcoming earnings call scheduled for April 25, 2024, at 4:30 p.m. EDT.

Explore the complete 8-K earnings release (here) from T-Mobile US Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance