T-Bill Demand Spurs Tension on Wall Street as Fed Cuts Seen

(Bloomberg) -- The ramp-up in US Treasury-bill sales over the past year is fueling a debate on Wall Street as to whether there will be enough demand to avoid roiling the funding markets.

Most Read from Bloomberg

Biden Vows to Stay in 2024 Race Even as NATO Gaffes Risk His Campaign

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

US and Germany Foiled Russian Plot to Kill CEO of Arms Manufacturer Rheinmetall

Treasury has issued $2.23 trillion of bills since the beginning of 2023, ratcheting up supply recently to finance the government deficit. So far, the market appears to have taken down the issuance with ease as seen in the pricing of T-bills versus other risk-free rates, like those on overnight index swaps that has remained relatively stable.

But there’s concern that eventual Federal Reserve interest-rate cuts and balance sheet unwind — known as quantitative tightening, or QT — will cause strains in funding markets. Some worry the pressure could even resemble turmoil four years ago that forced the central bank to intervene.

For Torsten Slok, once the Fed starts cutting rates, possibly in September, there could be less appetite from households and money-market funds, resulting in upward pressure on short-term rates.

“Growing the amount of T-bills outstanding while the Fed at the same time is doing QT increases the risks of an accident in funding markets, which is what we saw in repo markets in September 2019,” the chief economist at Apollo Global Management wrote in a note last week.

Others on Wall Street disagree. Investors have piled into money markets, with assets totalling $6.14 trillion in the latest reading — just off the all-time high hit the prior week — to capture higher returns as the Fed hiked interest rates to the highest level in decades. And those funds will remain ample, they say.

“The idea of waning bill demand during the Fed’s easing cycle is a little bit overdone,” said Mike Bird, senior portfolio manager at Allspring Global Investments. “Just focusing on money funds in particular, we’ll continue to have appetite. That demand isn’t going anywhere.”

As the Fed gets closer to reducing rates, money funds start to extend the duration of their assets — buying further out the T-bill curve — in order to lock in higher yields even after cuts begin. That means corporations, which have been directly buying T-bills, will instead shift cash to funds to take advantage of the lagging yields, which results in even more appetite from the money-market complex.

“For the past three cutting cycles, money doesn’t move out of money market funds until the Fed is much further along in the easing cycle, so that money continues piling in,” said Teresa Ho, head of US short-term interest rates at JPMorgan Chase & Co. “At least for right now 4% to 5% yield is still pretty high.”

Since the Fed first raised interest rates in March 2022, about $1.33 trillion has flowed into the US money-fund complex and over half of that has come from mom-and-pop investors. Deborah Cunningham, chief investment officer for global liquidity markets at Federated Hermes, has said previously assets could reach $7 trillion, especially since a majority of the cash from institutional investors such as corporations hasn’t moved yet.

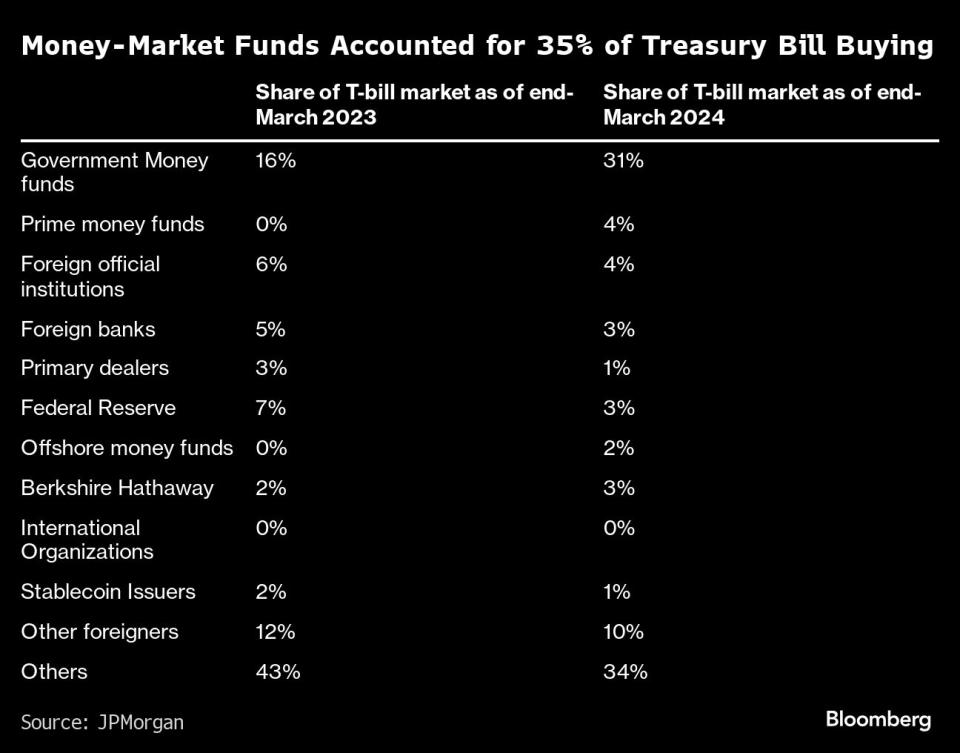

Moreover, money-market funds — already the largest buyers of bills — are likely to become even bigger purchasers in the face of new requirements from the Securities and Exchange Commission. Those measures, scheduled to take effect in October, will make it more expensive to yank money by imposing mandatory liquidity fees on some funds during times of financial stress. That stands to boost demand for instruments like T-bills at the expense of riskier assets.

On the supply side, the market will likely face lower issuance as the debt ceiling is set to be reinstated on Jan. 1. Once that happens the department will deploy measures to remain under the cap before exhausting its borrowing authority, and that includes dramatic cuts to bill sales.

That risks creating an imbalance in the front-end akin to the 2021 to 2023 period where cash overwhelmed the amount of investable assets available.

In the meantime, Treasury will continue issuing bills to fund larger deficits.

“Treasury doesn’t just issue securities willy nilly,” Allspring’s Bird said. “It’s where they can get the most funding done when they need it. They make sure demand for product needs to be there.”

(Updates money-market fund flows in sixth paragraph.)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance