Is Synovus Financial (SNV) Worth a Look on 4.7% Dividend Yield?

Amid the ongoing regional banking crisis and probable recession in the near term, investors must keep an eye on high dividend-yielding stocks. One such stock is Synovus Financial SNV.

This Columbus, GA-based bank provides a range of integrated financial services, including commercial and consumer banking, investment, and mortgage services, to its customers. The services are provided through locally branded divisions of its wholly-owned subsidiary, Synovus Bank.

Synovus Financial has been increasing its quarterly dividend on a regular basis, with the last hike of 11.8% to 38 cents per share announced in March 2023. Over the past five years, the company increased its dividend four times, with an annualized dividend growth rate of 6.94%.

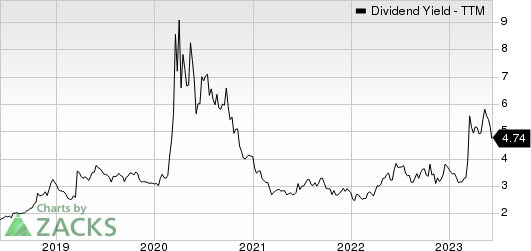

Considering the last day’s closing price of $32.10, Synovus Financial’s dividend yield currently stands at 4.74%. This is impressive compared with the industry average of 2.96% and attractive for income investors as it represents a steady income stream.

Synovus Financial Corp. Dividend Yield (TTM)

Synovus Financial Corp. dividend-yield-ttm | Synovus Financial Corp. Quote

Should you keep an eye on Synovus Financial’s stock to earn a high dividend yield? Let’s check out the company fundamentals to understand the risk and rewards. This will help us make a proper investment decision.

Synovus Financial has been repurchasing its common stock periodically. It was authorized with a $300-million share repurchase program in January 2023. But no buybacks were executed in first-quarter 2023. The company might not buy back shares in the near term due to an uncertain economic and regulatory environment.

Nonetheless, given its strong balance sheet and liquidity positions, the continuation of its capital deployment activities will drive investors’ confidence in the stock.

Synovus Financial is focused on its organic growth strategy. This is reflected by continued loan and deposits growth over the past few years. Loans witnessed a compound annual growth rate (CAGR) of 7.2% in the last three years (2020-2022).

Additionally, total deposits saw a CAGR of 2.3% over the same time frame, backed by continued growth in core transaction deposit accounts. With the rising trend continuing in first-quarter 2023, the company’s balance sheet remained strong. Management expects total loan balances to grow 4-8% and core deposits (excluding brokered accounts) growth to be in the low to mid-single-digit range.

Moreover, SNV is expected to keep benefiting from higher rates. In first-quarter 2023, the net interest margin rose 42 basis points to 3.43% year over year. With the Federal Reserve expected to keep the rates high in the near term to control inflation, the company’s net interest margin will likely improve further.

A favorable lending environment and asset-sensitive balance sheet are well-poised to bolster Synovus Financial’s net interest income (NII). The company’s NII witnessed a CAGR of 4% in the last four years (2019-2022), with the rising trend continuing in the first quarter of 2023. While management expects the metric to decline in second-quarter 2023, it is likely to stabilize in the second half of 2023.

Long-term debt of $5.1 billion, as of Mar 31, 2023, increased substantially from $4.1 billion as of Dec 31, 2022. Cash, cash equivalents, and restricted cash were $3.36 billion as of the same date. Nonetheless, given the company’s decent earnings strength, it is expected to continue meeting debt obligations and sustain capital disbursements in the upcoming period.

Again, Synovus Financial’s trailing 12-month return on equity (ROE) reflects its superiority in utilizing shareholders' funds. The company's ROE of 19.92% compares favorably with the industry's 12.04%.

Hence, despite near-term headwinds like rising expenses and greater exposure to commercial loans, SNV stock is fundamentally solid. In the past 30 days, shares of SNV have gained 17.3% compared with the industry’s rise of 15.1%.

Image Source: Zacks Investment Research

Therefore, income investors should keep this Zacks Rank #3 (Hold) stock on their radar as it will help generate robust returns over time.

Other Bank Stocks Worth a Look

A couple of other bank stocks, such as Associated Banc-Corp ASB and Huntington Bancshares HBAN, are worth a look as these have robust dividend yields.

Considering the last day’s closing price, Associated Banc-Corp’s dividend yield currently stands at 4.94%. ASB carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based on the last day’s closing price, Huntington Bancshares’ dividend yield currently stands at 5.42%. HBAN also carries a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synovus Financial Corp. (SNV) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance