Swelling losses haven't held back gains for Digihost Technology (CVE:DGHI) shareholders since they're up 994% over 1 year

Digihost Technology Inc. (CVE:DGHI) shareholders might be concerned after seeing the share price drop 19% in the last month. But over the last year the share price has taken off like one of Elon Musk's rockets. In that time, shareholders have had the pleasure of a 994% boost to the share price. Arguably, the recent fall is to be expected after such a strong rise. While winners often keep winning, it can pay to be cautious after a strong rise. Anyone who held for that rewarding ride would probably be keen to talk about it.

While the stock has fallen 13% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Digihost Technology

Digihost Technology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Digihost Technology saw its revenue grow by 497%. That's stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 994% as previously highlighted. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

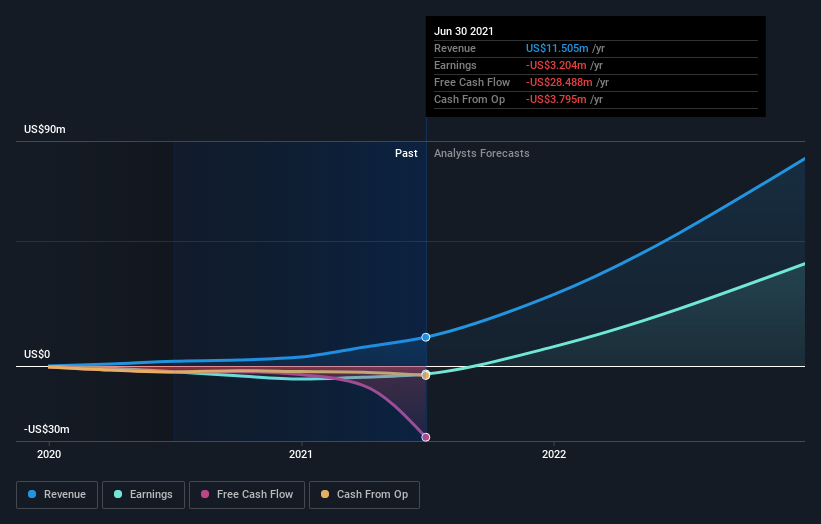

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Digihost Technology will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Digihost Technology shareholders have gained 994% over the last year. That's better than the more recent three month gain of 31%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Digihost Technology is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Digihost Technology is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance