Swedish Growth Companies With High Insider Ownership To Watch In July 2024

As global markets navigate through varying degrees of economic turbulence and political uncertainty, particularly in Europe with upcoming elections influencing market sentiments, Sweden's market presents intriguing opportunities. High insider ownership in Swedish growth companies can be a signal of confidence from those who know the companies best, making such stocks potentially attractive against the current backdrop of cautious investor sentiment.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Let's explore several standout options from the results in the screener.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

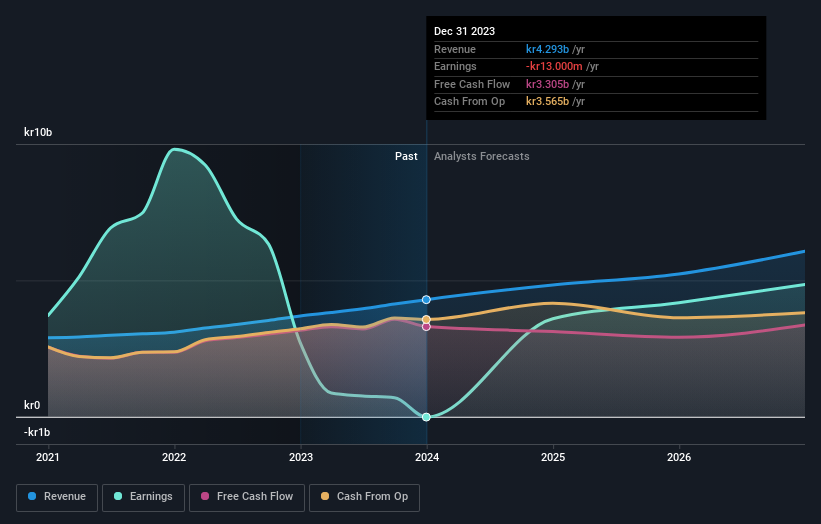

Overview: Pandox AB (publ) is a global hotel property company that owns, develops, and leases hotel properties, with a market capitalization of approximately SEK 35.89 billion.

Operations: The company generates revenue primarily through its own operations and rental agreements, totaling SEK 3.24 billion and SEK 3.76 billion respectively.

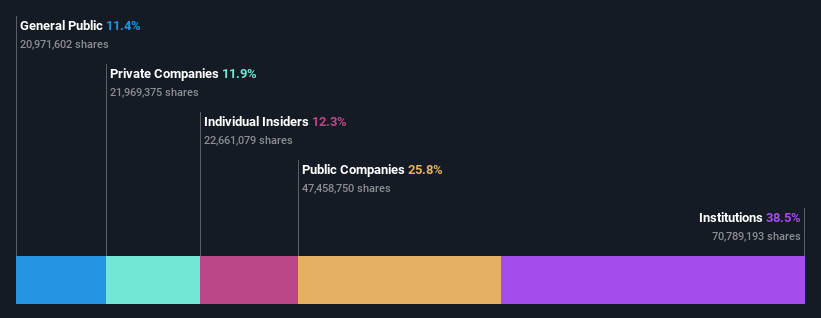

Insider Ownership: 12.3%

Pandox AB, a Swedish hotel operator, shows a robust turnaround with its Q1 2024 earnings rebounding to SEK 447 million from a loss of SEK 216 million the previous year. Despite this growth and a dividend increase to SEK 4.00 per share, challenges persist: profit margins are thin at 1.1%, and revenue growth projections are modest at 2.2% annually. Insider trading has been quiet over the last three months, indicating potential stability but also lack of aggressive confidence from insiders about future performance.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

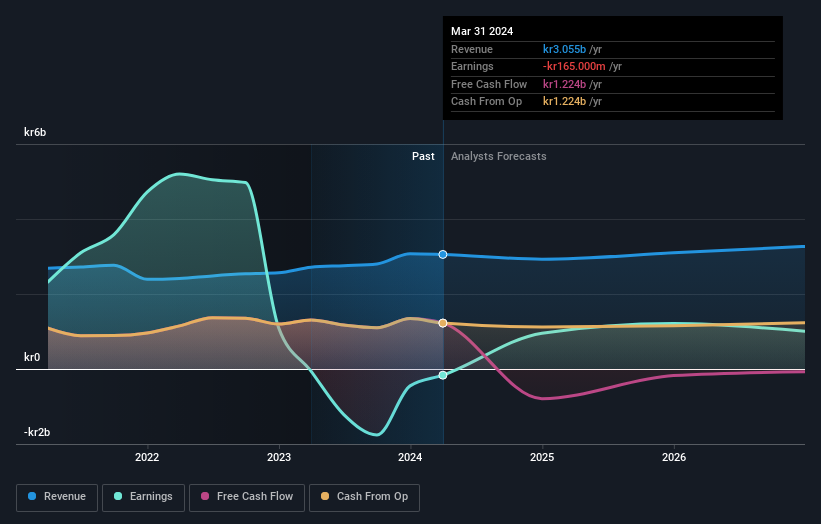

Overview: AB Sagax (ticker: OM:SAGA A) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of SEK 100.83 billion.

Operations: The company generates its revenue primarily from real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish property investment firm, has recently completed multiple green bond issuances totaling nearly €1 billion, signaling robust financial activity and commitment to sustainable practices. Despite this proactive market behavior and a substantial dividend increase to SEK 3.10 for ordinary shares, the company faces challenges. Shareholders experienced dilution over the past year, and debt coverage by operating cash flow is weak. However, Sagax's revenue and earnings are expected to outpace the Swedish market significantly in upcoming years, reflecting potential for growth amidst financial pressures.

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of approximately SEK 33.64 billion.

Operations: The company generates its revenue primarily from two segments: SEK 920 million from Stockholm and SEK 1.89 billion from Gothenburg.

Insider Ownership: 35%

Wallenstam AB, a Swedish real estate company, has shown a modest uptick in insider buying over the last three months. Recent developments include the environmentally focused renovation of Kaserntorget 6, attracting tenants with its sustainable features and green certifications. Despite these positives, Wallenstam faces challenges such as a recent dividend cut to SEK 0.50 per share and an earnings forecast suggesting that revenue growth (3% per year) will lag behind more aggressive market averages. The company's financial positioning is also strained with interest payments poorly covered by earnings.

Navigate through the intricacies of Wallenstam with our comprehensive analyst estimates report here.

Make It Happen

Click here to access our complete index of 86 Fast Growing Swedish Companies With High Insider Ownership.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:PNDX B OM:SAGA A and OM:WALL B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance