Swedish Growth Companies With High Insider Ownership Expecting Up To 72% Earnings Growth

As global markets exhibit mixed signals with regions like Europe showing resilience amidst economic adjustments, Sweden's market context remains a focal point for investors looking for growth opportunities. In such a landscape, identifying Swedish growth companies with high insider ownership could be particularly compelling, as these firms often demonstrate alignment between management’s interests and those of shareholders, potentially driving robust earnings growth in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's review some notable picks from our screened stocks.

Humble Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB operates in the refining, development, and distribution of fast-moving consumer goods both in Sweden and internationally, with a market capitalization of approximately SEK 4.27 billion.

Operations: The company generates revenue through four primary segments: Future Snacking (SEK 935 million), Sustainable Care (SEK 2.24 billion), Quality Nutrition (SEK 1.51 billion), and Nordic Distribution (SEK 2.62 billion).

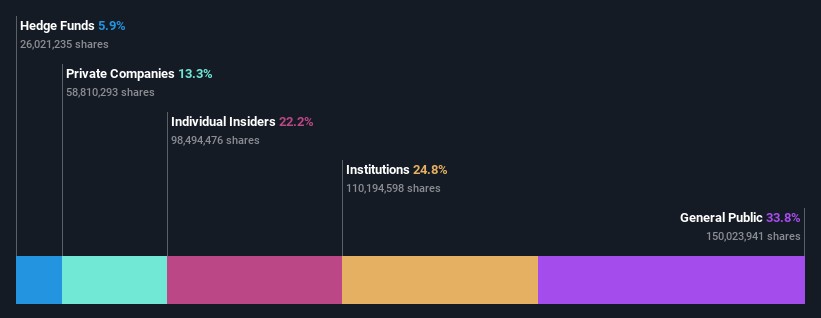

Insider Ownership: 22.2%

Earnings Growth Forecast: 72.8% p.a.

Humble Group, a Swedish growth company with high insider ownership, has shown promising financial improvements. In Q1 2024, sales increased to SEK 1.84 billion from SEK 1.61 billion year-over-year, turning a net loss into a profit of SEK 23 million. Despite some shareholder dilution over the past year, insider activities have been balanced with more purchases than sales in recent months. The company trades at significant undervaluation and is expected to grow profits substantially by an average of 72.77% annually over the next few years, although its forecasted revenue growth of 12% per year lags behind some peers.

Sectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 49.52 billion.

Operations: The company's revenue is primarily generated from its Imaging IT Solutions and Secure Communications segments, which respectively contributed SEK 2.55 billion and SEK 367.40 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 19.3% p.a.

Sectra, a Swedish firm with substantial insider ownership, reported robust annual growth with sales reaching SEK 3.04 billion and net income of SEK 428.39 million for the fiscal year ending April 2024. Recent innovations include a genomic diagnostics IT module developed with the University of Pennsylvania Health System, enhancing precision medicine capabilities. Despite its strong earnings growth forecast at 19.33% annually, revenue growth projections remain moderate at 14.7% per year, slightly above the market average in Sweden.

Yubico

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 21.44 billion.

Operations: The company generates revenue primarily through its Security Software & Services segment, totaling SEK 1.93 billion.

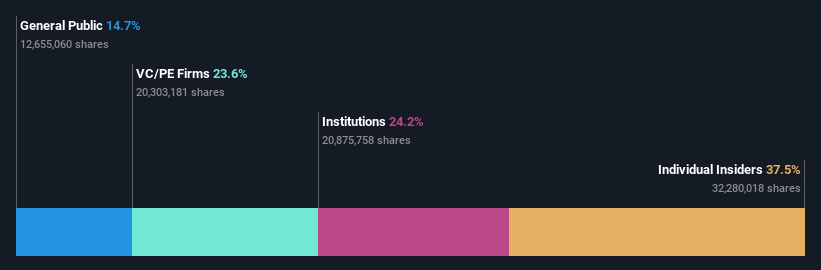

Insider Ownership: 37.5%

Earnings Growth Forecast: 43.4% p.a.

Yubico AB, a Swedish growth company with high insider ownership, has shown promising performance with a 19.9% increase in revenue over the past year. Despite this growth, profit margins have declined from 16.9% to 8.6%. The company recently announced significant product updates aimed at enhancing enterprise security solutions, potentially boosting future revenues and market position. However, there has been no substantial insider buying in the last three months, and shareholders experienced substantial dilution over the past year.

Delve into the full analysis future growth report here for a deeper understanding of Yubico.

Our expertly prepared valuation report Yubico implies its share price may be too high.

Taking Advantage

Gain an insight into the universe of 81 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:HUMBLEOM:SECT B OM:YUBICO and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance