Swedish Growth Companies With High Insider Ownership To Watch In July 2024

As of June 2024, the Swedish market reflects a cautious optimism, mirroring the broader European economic landscape which is marked by political uncertainties and mixed confidence indicators. In such an environment, growth companies with high insider ownership in Sweden could offer intriguing stability and potential for investors, as these insiders often have a deep commitment to their companies' long-term success.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

Biovica International (OM:BIOVIC B) | 12.9% | 73.8% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

InCoax Networks (OM:INCOAX) | 18% | 104.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's uncover some gems from our specialized screener.

Betsson

Simply Wall St Growth Rating: ★★★★☆☆

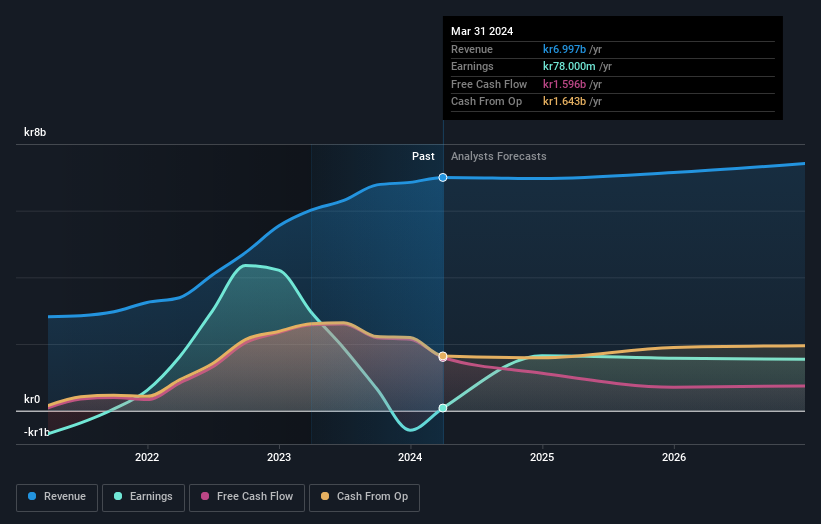

Overview: Betsson AB (publ) operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and other global markets with a market cap of approximately SEK 17.87 billion.

Operations: The company generates revenue primarily from its Casinos & Resorts segment, totaling €974.50 million.

Insider Ownership: 10.9%

Return On Equity Forecast: 23% (2027 estimate)

Betsson, a Swedish company, is experiencing substantial insider buying with no significant selling in the past three months, signaling strong confidence from insiders. Its earnings are expected to grow by 14% annually, slightly outpacing the Swedish market's 13.8%, while revenue growth forecasts at 9.9% also exceed local market expectations significantly. Recent strategic expansions include entering Peru's regulated online casino and sports betting markets, enhancing its South American footprint. However, Betsson has an unstable dividend track record which might concern some investors focused on income stability.

Dive into the specifics of Betsson here with our thorough growth forecast report.

The valuation report we've compiled suggests that Betsson's current price could be quite moderate.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB operates globally, focusing on owning, developing, and leasing hotel properties with a market capitalization of approximately SEK 35.30 billion.

Operations: The company generates its revenue primarily through two segments: own operation, which brought in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Return On Equity Forecast: N/A (2027 estimate)

Pandox, a Swedish hotel operator, has shown a robust recovery with its Q1 2024 net income reaching SEK 447 million from a loss the previous year, alongside a revenue increase to SEK 1.5 billion. Despite this positive turnaround and substantial earnings growth forecasts of 41.6% annually, concerns linger due to low profit margins and insufficient coverage of interest payments by earnings. Furthermore, the approved dividend is not well supported by these earnings, highlighting potential risks in financial sustainability.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of approximately SEK 99.07 billion.

Operations: The company generates its revenue primarily from real estate rentals, amounting to SEK 4.47 billion.

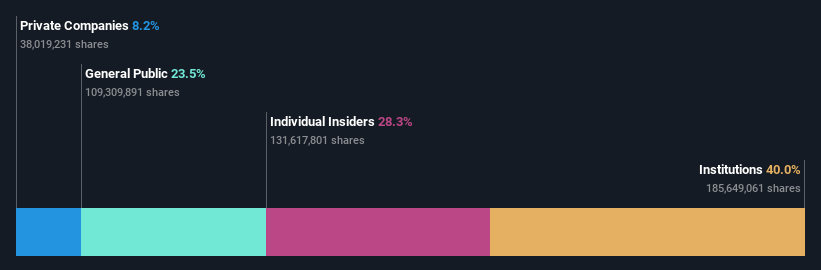

Insider Ownership: 28.3%

Return On Equity Forecast: N/A (2027 estimate)

AB Sagax, a Swedish property investment firm, has recently engaged in significant financial activities, including issuing €500 million in green bonds and proposing increased dividends. Despite these positive strides, its revenue growth is expected at a moderate 9.3% per year, underperforming the high expectations for growth companies. However, its earnings are anticipated to surge by 33.49% annually, outpacing the broader Swedish market's growth rate. Challenges include shareholder dilution over the past year and large one-off items impacting financial results.

Make It Happen

Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 83 more companies for you to explore.Click here to unveil our expertly curated list of 86 Fast Growing Swedish Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BETS B OM:PNDX B and OM:SAGA A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance