Swedish Exchange Stocks Estimated as Undervalued for June 2024

As global markets exhibit mixed signals with some regions showing modest gains while others face economic slowdowns, the Swedish stock market offers unique opportunities for investors looking at potentially undervalued stocks. In this context, understanding what constitutes a good investment involves evaluating companies with strong fundamentals that may be overlooked in the current economic climate.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK55.60 | SEK102.20 | 45.6% |

Boule Diagnostics (OM:BOUL) | SEK10.80 | SEK21.06 | 48.7% |

Alleima (OM:ALLEI) | SEK70.60 | SEK138.09 | 48.9% |

Nordic Waterproofing Holding (OM:NWG) | SEK161.80 | SEK297.13 | 45.5% |

Net Insight (OM:NETI B) | SEK5.02 | SEK9.84 | 49% |

Nolato (OM:NOLA B) | SEK58.35 | SEK111.73 | 47.8% |

MilDef Group (OM:MILDEF) | SEK68.50 | SEK132.01 | 48.1% |

Humble Group (OM:HUMBLE) | SEK10.11 | SEK19.51 | 48.2% |

Hexatronic Group (OM:HTRO) | SEK49.85 | SEK98.83 | 49.6% |

Gigasun (OM:GIGA) | SEK3.95 | SEK7.58 | 47.9% |

Let's dive into some prime choices out of from the screener

Dometic Group

Overview: Dometic Group AB operates in providing mobile living solutions across various sectors including food and beverage, climate, power and control, with a market capitalization of approximately SEK 22.24 billion.

Operations: Dometic's revenue is segmented into Marine (SEK 6.56 billion), Americas (SEK 5.05 billion), Europe, Middle East and Africa (EMEA) at SEK 8.14 billion, and Asia Pacific (APAC) contributing SEK 4.70 billion, alongside a global segment generating SEK 5.92 billion in sales.

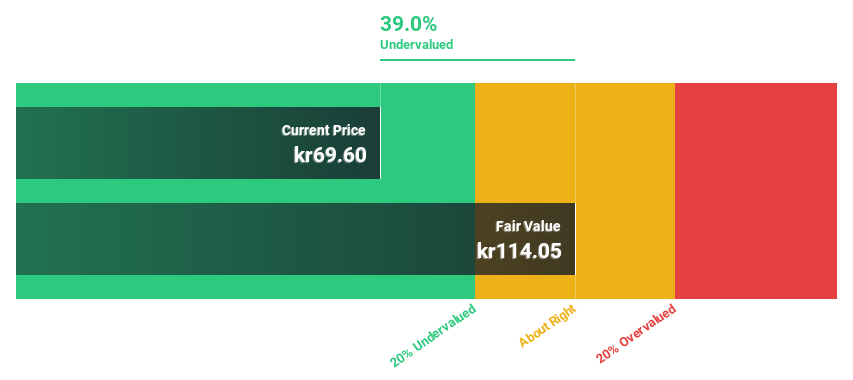

Estimated Discount To Fair Value: 39%

Dometic Group, despite a recent dip in quarterly sales and net income, remains an attractive proposition based on cash flow analysis. Currently trading at SEK 69.6, the stock is assessed to be significantly undervalued with a fair value estimate of SEK 114.05, indicating it is trading at about 39% below its estimated value. While its revenue growth forecast of 2.3% per year modestly outpaces the Swedish market's 1.8%, concerns include a high level of debt and an unstable dividend track record. However, earnings are expected to surge by approximately 21.78% annually, suggesting potential for substantial medium-term appreciation.

Lindab International

Overview: Lindab International AB specializes in manufacturing and selling products and solutions for ventilation systems across Europe, with a market cap of approximately SEK 18.34 billion.

Operations: The company generates revenue primarily through two segments: Profile Systems, which brings in SEK 3.30 billion, and Ventilation Systems, accounting for SEK 9.78 billion.

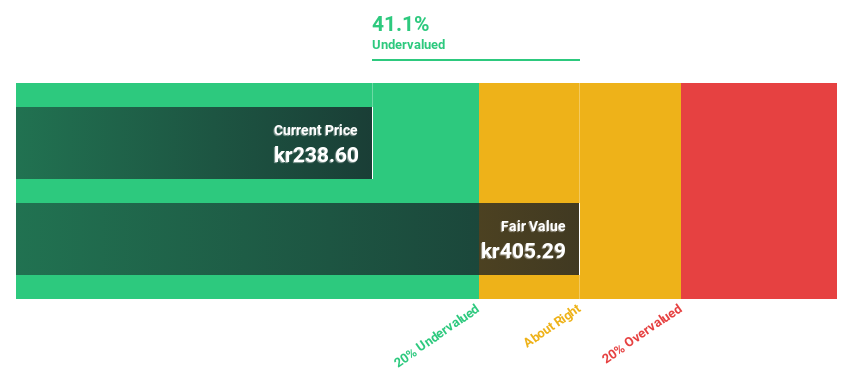

Estimated Discount To Fair Value: 41.1%

Lindab International, trading at SEK 238.6, is considered significantly undervalued with a fair value estimate of SEK 405.29, marking it about 41% below its potential market value. Despite a recent decrease in quarterly sales and net income, the company's earnings are expected to grow by 20.33% annually, outstripping the Swedish market's growth rate. However, its return on equity is projected to remain low at 14.2%, and it has an inconsistent dividend history with a recent increase to SEK 5.40 per share distributed semi-annually.

RVRC Holding

Overview: RVRC Holding AB (publ) specializes in active lifestyle clothing with operations across Sweden, Germany, Finland, and other international markets, boasting a market cap of SEK 5.39 billion.

Operations: The company generates SEK 1.80 billion from its online retail segment.

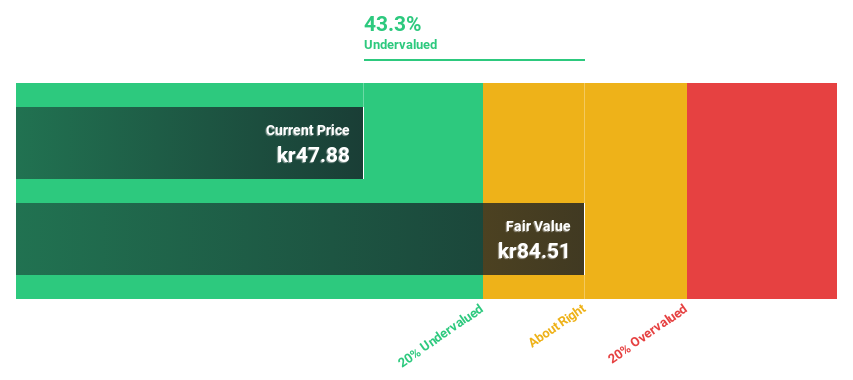

Estimated Discount To Fair Value: 43.3%

RVRC Holding, priced at SEK 47.88, shows a promising cash flow perspective, valued 43.3% below its estimated fair value of SEK 84.51. Despite recent board changes and M&A discussions potentially stirring volatility, its revenue growth forecast at 17.4% annually surpasses the Swedish market's average. However, with an unstable dividend track record and moderate earnings growth projections (16.44% per year), it presents a mixed investment profile focused on long-term capital appreciation rather than immediate income stability.

Our growth report here indicates RVRC Holding may be poised for an improving outlook.

Take a closer look at RVRC Holding's balance sheet health here in our report.

Key Takeaways

Click here to access our complete index of 46 Undervalued Swedish Stocks Based On Cash Flows.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:DOM OM:LIAB and OM:RVRC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance