Swedish Exchange Stocks Estimated Below Intrinsic Values in July 2024

As of July 2024, the Swedish stock market is showing signs of resilience amidst a complex global economic landscape marked by heightened political uncertainties in Europe and fluctuating bond yields. Investors seeking value might find opportunities in stocks that are currently estimated to be trading below their intrinsic values, particularly in an environment where cautious investment strategies could prevail due to the broader market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK56.80 | SEK105.94 | 46.4% |

Paradox Interactive (OM:PDX) | SEK143.40 | SEK252.97 | 43.3% |

Biotage (OM:BIOT) | SEK158.80 | SEK314.53 | 49.5% |

Nordic Waterproofing Holding (OM:NWG) | SEK160.00 | SEK305.52 | 47.6% |

Lindab International (OM:LIAB) | SEK226.80 | SEK422.23 | 46.3% |

RaySearch Laboratories (OM:RAY B) | SEK137.00 | SEK280.55 | 51.2% |

Flexion Mobile (OM:FLEXM) | SEK8.34 | SEK15.87 | 47.4% |

Stille (OM:STIL) | SEK208.00 | SEK391.21 | 46.8% |

Image Systems (OM:IS) | SEK1.465 | SEK2.81 | 47.9% |

Nordisk Bergteknik (OM:NORB B) | SEK17.12 | SEK31.82 | 46.2% |

Let's dive into some prime choices out of from the screener

AcadeMedia

Overview: AcadeMedia AB (publ) is an independent education provider operating in Sweden, Norway, the Netherlands, and Germany, with a market capitalization of SEK 5.39 billion.

Operations: AcadeMedia's revenue is primarily derived from its operations in upper secondary schools (SEK 6.20 billion), preschool and international education (SEK 6.07 billion), compulsory schooling (SEK 4.25 billion), and adult education (SEK 1.79 billion).

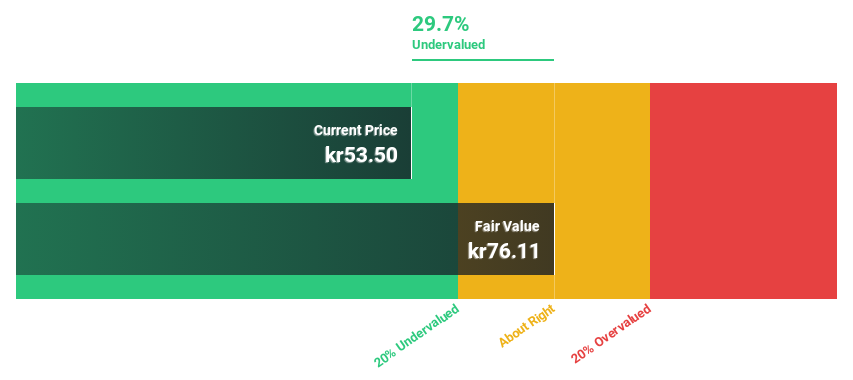

Estimated Discount To Fair Value: 26.8%

AcadeMedia, with its current share price of SEK 52.8, is trading significantly below our fair value estimate of SEK 72.4, indicating a potential undervaluation based on discounted cash flow analysis. Despite an unstable dividend track record, the company has shown robust growth with earnings up by 9.9% over the past year and forecasted to grow at an impressive rate of 23.33% annually. Recent financial results reflect strong performance with a notable increase in sales and net income for both the quarter and nine-month period ending March 2024, supporting its growth trajectory albeit slower expected revenue growth compared to some market benchmarks.

CellaVision

Overview: CellaVision AB, based in Sweden, specializes in developing and selling instruments, software, and reagents for the analysis of blood and body fluids globally, with a market capitalization of approximately SEK 5.89 billion.

Operations: The company generates revenue primarily through its Automated Microscopy Systems and Reagents in the field of Hematology, totaling SEK 708.28 million.

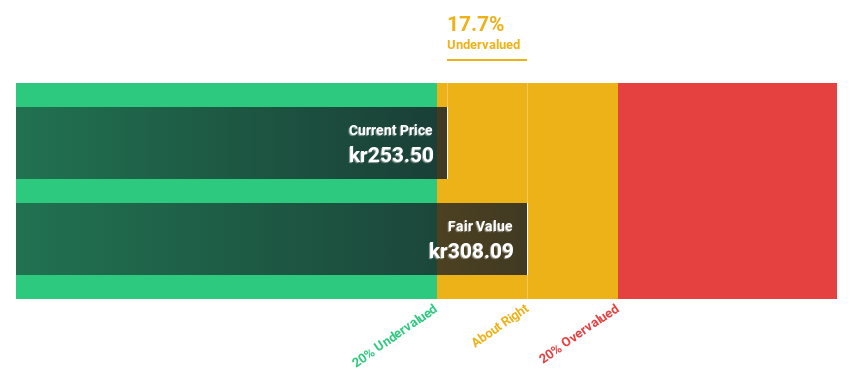

Estimated Discount To Fair Value: 23.2%

CellaVision, priced at SEK 249, appears undervalued with a fair value estimate of SEK 321.68 based on discounted cash flow analysis. The company's earnings are poised for significant growth, forecasted to expand by 24% annually over the next three years, outpacing the Swedish market's 14.2%. Recent financials show robust year-on-year increases in sales and net income for Q1 2024. Additionally, CellaVision maintains a healthy dividend policy with a recent payout of SEK 2.25 per share.

Sweco

Overview: Sweco AB (publ) offers architecture and engineering consultancy services globally, with a market capitalization of SEK 54.14 billion.

Operations: Sweco's revenue is generated from various regional segments, including SEK 8.52 billion from Sweden, SEK 3.94 billion from Belgium, SEK 3.67 billion from Finland, SEK 3.39 billion from Norway, SEK 2.98 billion from Denmark, SEk 2.89 billion from the Netherlands, and SEK 2.62 billion from Germany & Central Europe.

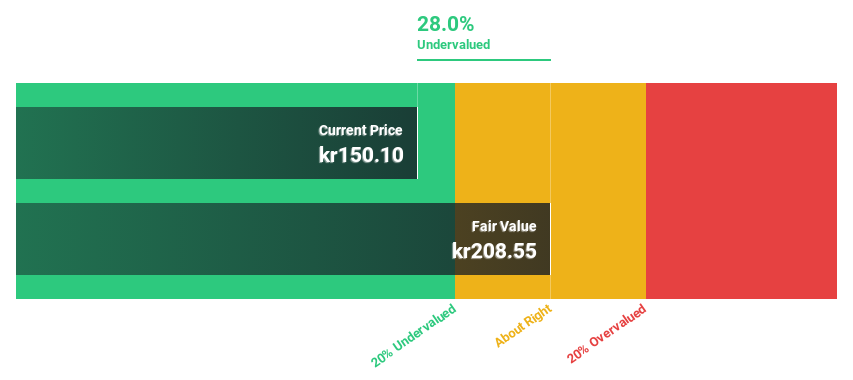

Estimated Discount To Fair Value: 30.2%

Sweco, trading at SEK 149.4, is valued below its estimated fair value of SEK 216.16, suggesting it's undervalued based on discounted cash flow analysis. Despite a recent dip in net income and earnings per share in Q1 2024, Sweco is poised for steady growth with revenue and earnings forecasted to grow at 5.3% and 16.41% annually, respectively—both rates exceeding the Swedish market averages. However, its dividend track record remains unstable amidst expanding strategic roles in green hydrogen projects across Europe.

Where To Now?

Click this link to deep-dive into the 44 companies within our Undervalued Swedish Stocks Based On Cash Flows screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:ACAD OM:CEVI and OM:SWEC B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance