Swedish Exchange Showcases Three Growth Companies With High Insider Ownership

Amidst a landscape of fluctuating global markets, Sweden's economic steadiness presents a unique backdrop for investors seeking growth opportunities. The Swedish stock exchange highlights several companies characterized by high insider ownership, signaling strong confidence from those closest to the operations and strategic directions of these firms. In current market conditions, where transparency and stability are highly valued, companies with significant insider ownership can be particularly appealing. These entities often benefit from aligned interests between shareholders and management, fostering long-term strategic planning and potentially more resilient performance in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

We'll examine a selection from our screener results.

NIBE Industrier

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB specializes in developing, manufacturing, marketing, and selling energy-efficient solutions for indoor climate comfort and intelligent heating and control systems across the Nordic countries, Europe, North America, and globally. The company has a market capitalization of approximately SEK 98.26 billion.

Operations: NIBE Industrier AB generates revenue from three primary segments: Stoves (SEK 5.62 billion), Element (SEK 13.62 billion), and Climate Solutions (SEK 36.83 billion).

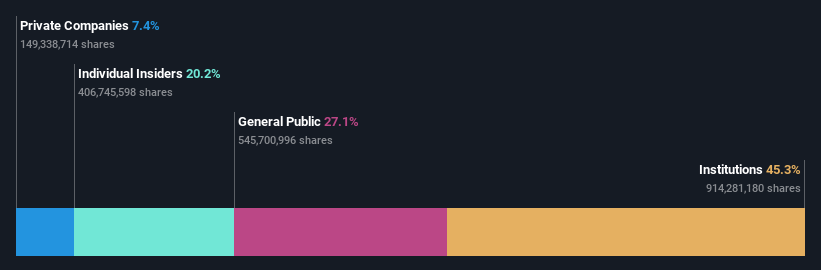

Insider Ownership: 20.2%

Earnings Growth Forecast: 27.6% p.a.

NIBE Industrier, a Swedish company, recently saw insiders Sofia Schörling Högberg and Märta Schörling Andreen acquire a minority stake, signaling strong insider confidence despite its challenges. The firm's revenue growth is projected to outpace the Swedish market average significantly, with earnings expected to increase notably over the next three years. However, NIBE faces issues like poor debt coverage by operating cash flow and declining profit margins. New leadership under Simon Karlin could drive future strategic expansions.

Nolato

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nolato AB specializes in developing, manufacturing, and selling plastic, silicone, and thermoplastic elastomer products across various sectors including medical technology, pharmaceuticals, and consumer electronics; it operates globally with a market capitalization of approximately SEK 15.72 billion.

Operations: The revenue for the Medical Solutions segment is SEK 5.34 billion.

Insider Ownership: 28.9%

Earnings Growth Forecast: 22.7% p.a.

Nolato AB, a Swedish growth company with high insider ownership, is poised for substantial earnings growth over the next three years, significantly outpacing the Swedish market. Despite a recent dividend cut and underwhelming return on equity forecasts, its strategic investments in medical devices for obesity and diabetes treatment indicate robust future capabilities. Additionally, the recent board changes could infuse fresh perspectives into its strategic directions.

Click here and access our complete growth analysis report to understand the dynamics of Nolato.

Our valuation report here indicates Nolato may be undervalued.

Vimian Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates globally in the animal health sector and has a market capitalization of approximately SEK 18.15 billion.

Operations: The company generates revenue from several key segments: Medtech (€109.03 million), Diagnostics (€21.14 million), Specialty Pharma (€153.26 million), and Veterinary Services (€51.63 million).

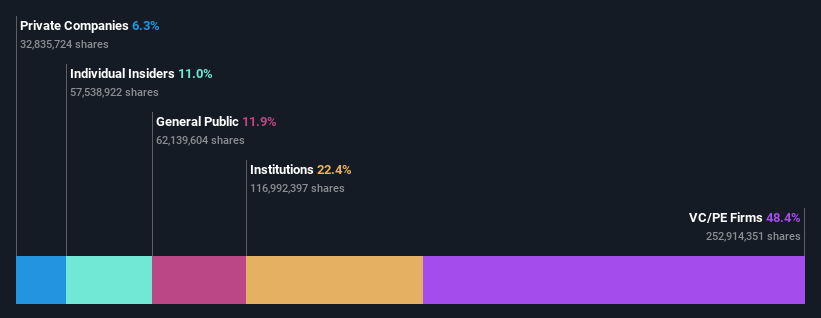

Insider Ownership: 11%

Earnings Growth Forecast: 58.6% p.a.

Vimian Group, a Swedish company with high insider ownership, is trading at 33.8% below its estimated fair value and has seen more insider buying than selling recently, though not in large volumes. The company's earnings are expected to grow by 58.6% annually over the next three years, outperforming the Swedish market forecast of 13.9%. However, its return on equity is projected to remain low at 8%, and shareholder dilution occurred over the past year.

Take a closer look at Vimian Group's potential here in our earnings growth report.

Upon reviewing our latest valuation report, Vimian Group's share price might be too pessimistic.

Key Takeaways

Reveal the 84 hidden gems among our Fast Growing Swedish Companies With High Insider Ownership screener with a single click here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:NIBE BOM:NOLA B OM:VIMIAN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance