Swedish Exchange Showcases Humble Group Among 3 Growth Companies With Strong Insider Ownership

Amid fluctuating global markets, Sweden's economy showcases resilience, with certain sectors demonstrating robust growth and strong insider ownership. This trend highlights the potential stability and confidence insiders have in their companies, making such stocks particularly interesting to investors during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's explore several standout options from the results in the screener.

Humble Group

Simply Wall St Growth Rating: ★★★★☆☆

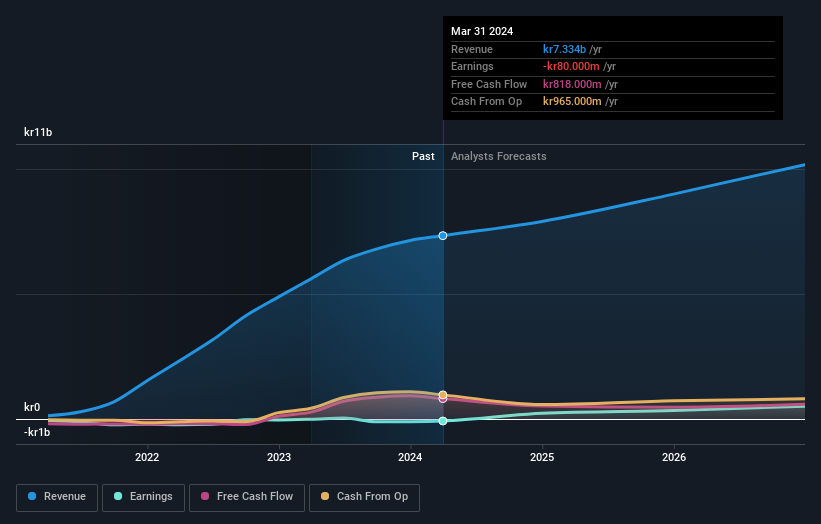

Overview: Humble Group AB operates in the refinement, development, and distribution of fast-moving consumer goods both in Sweden and internationally, with a market capitalization of approximately SEK 4.27 billion.

Operations: The company generates revenue through four primary segments: Future Snacking (SEK 935 million), Sustainable Care (SEK 2.24 billion), Quality Nutrition (SEK 1.51 billion), and Nordic Distribution (SEK 2.62 billion).

Insider Ownership: 22.2%

Earnings Growth Forecast: 72.8% p.a.

Humble Group, a Swedish company, is expected to achieve profitability within the next three years, with earnings forecasted to grow by 72.77% annually. Despite trading 50.4% below its estimated fair value and experiencing shareholder dilution last year, insider activities reflect more buying than selling in recent months. Revenue growth at 12% per year outpaces the national market's 2%, positioning Humble for above-average market growth amidst a backdrop of solid insider ownership engagement and favorable valuation compared to peers.

Dive into the specifics of Humble Group here with our thorough growth forecast report.

Our valuation report here indicates Humble Group may be undervalued.

Sectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK 49.52 billion.

Operations: The company's revenue is primarily generated from its Imaging IT Solutions and Secure Communications segments, contributing SEK 2.55 billion and SEK 367.40 million respectively.

Insider Ownership: 30.3%

Earnings Growth Forecast: 19.3% p.a.

Sectra, a Swedish firm specializing in medical imaging and cybersecurity, reported a robust year with revenues reaching SEK 3.04 billion, up from SEK 2.41 billion the previous year, and net income increasing to SEK 428.39 million. With earnings growth of 14.2% last year and forecasted annual earnings growth of 19.33%, Sectra is outpacing the Swedish market's expectations. Additionally, its recent launch of a genomic diagnostics IT module highlights its innovation edge, despite no significant insider trading activity reported recently.

Click here and access our complete growth analysis report to understand the dynamics of Sectra.

Our expertly prepared valuation report Sectra implies its share price may be too high.

Storytel

Simply Wall St Growth Rating: ★★★★☆☆

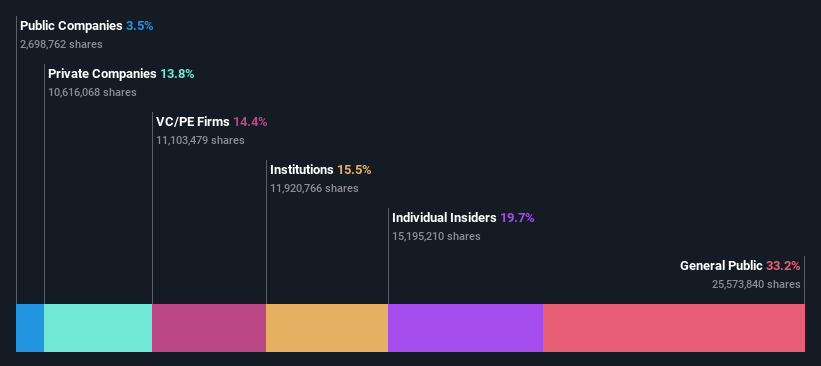

Overview: Storytel AB (publ) operates as a provider of streaming services for audiobooks and e-books, with a market capitalization of approximately SEK 4.24 billion.

Operations: Storytel's revenue is primarily generated from its streaming services, with SEK 2.25 billion from the Nordics and SEK 1.09 billion from non-Nordic regions, alongside SEK 793.48 million from book sales.

Insider Ownership: 19.7%

Earnings Growth Forecast: 98.3% p.a.

Storytel, a Swedish growth company with high insider ownership, is set to outperform the market with an expected revenue increase of 10.7% per year. Insiders have shown confidence by buying more shares than they sold in the past three months. Although its return on equity is predicted to be low at 17.8% in three years, Storytel's earnings are forecasted to surge by 98.28% annually. Recent leadership changes, including a new Chair of the Board and upcoming CEO transition, signal strategic shifts ahead.

Summing It All Up

Navigate through the entire inventory of 81 Fast Growing Swedish Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:HUMBLE OM:SECT B and OM:STORY B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance