Swedish Exchange Highlights Three Stocks Estimated As Undervalued

As global markets navigate through a period of political uncertainties and economic adjustments, Sweden's stock market presents a unique landscape for investors seeking value. Amidst mixed performances across major European indices and heightened economic sentiment, certain Swedish stocks appear undervalued, offering potential opportunities in the current environment. Understanding what constitutes an undervalued stock is crucial, especially in a market influenced by regional economic shifts and global financial trends. Stocks that are priced below their perceived intrinsic value, yet have strong fundamentals, may stand out as attractive investments during these fluctuating times.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

RVRC Holding (OM:RVRC) | SEK45.70 | SEK84.90 | 46.2% |

Björn Borg (OM:BORG) | SEK55.70 | SEK101.95 | 45.4% |

Alleima (OM:ALLEI) | SEK68.80 | SEK127.70 | 46.1% |

Nordic Waterproofing Holding (OM:NWG) | SEK161.40 | SEK297.88 | 45.8% |

Biotage (OM:BIOT) | SEK163.10 | SEK298.04 | 45.3% |

RaySearch Laboratories (OM:RAY B) | SEK141.40 | SEK280.69 | 49.6% |

Nolato (OM:NOLA B) | SEK57.50 | SEK111.76 | 48.6% |

MilDef Group (OM:MILDEF) | SEK66.30 | SEK131.92 | 49.7% |

Humble Group (OM:HUMBLE) | SEK10.05 | SEK19.45 | 48.3% |

Hexatronic Group (OM:HTRO) | SEK50.90 | SEK99.25 | 48.7% |

Let's dive into some prime choices out of from the screener

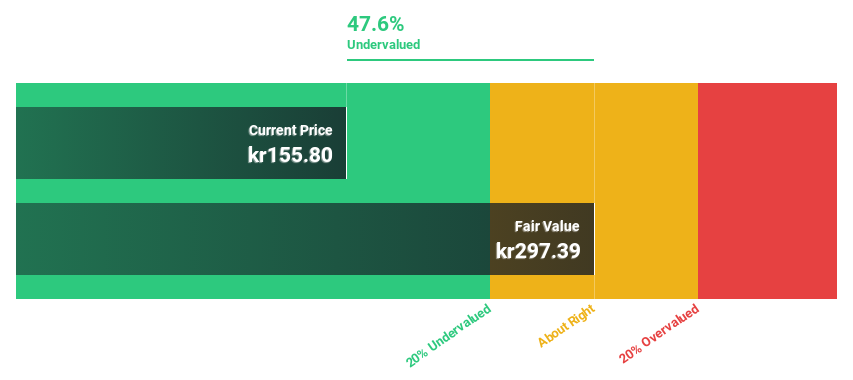

Biotage

Overview: Biotage AB (publ) specializes in providing solutions and products for drug discovery and development, analytical testing, as well as water and environmental testing, with a market capitalization of SEK 13.05 billion.

Operations: The company generates SEK 1.98 billion from its healthcare software segment.

Estimated Discount To Fair Value: 45.3%

Biotage, trading at SEK 163.1, is significantly undervalued based on DCF analysis with a fair value of SEK 298.04, representing a substantial discount. Despite recent earnings dip to SEK 33 million from last year's SEK 43 million, the company's revenue and earnings are expected to outpace the Swedish market with forecasts of 11.2% and 20% annual growth respectively. However, its return on equity is projected to remain low at around 12.2% in three years' time.

Our growth report here indicates Biotage may be poised for an improving outlook.

Navigate through the intricacies of Biotage with our comprehensive financial health report here.

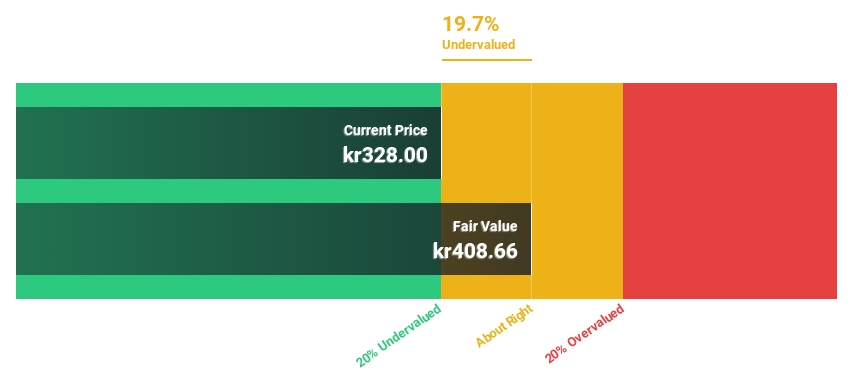

Lime Technologies

Overview: Lime Technologies AB (publ) specializes in providing SaaS-based customer relationship management (CRM) solutions across the Nordic region, with a market capitalization of approximately SEK 4.65 billion.

Operations: The company generates revenue primarily through the sale and implementation of CRM systems, amounting to SEK 601.83 million.

Estimated Discount To Fair Value: 14.4%

Lime Technologies, priced at SEK 350, is considered undervalued with a DCF-based fair value of SEK 409. The company's earnings are projected to grow by 21.5% annually, outperforming the Swedish market forecast of 13.8%. Despite this strong growth potential and a robust return on equity forecast at 36.2%, Lime's revenue growth is somewhat moderate at an expected rate of 14.7% per year. Additionally, the firm maintains a high level of debt which could pose financial constraints.

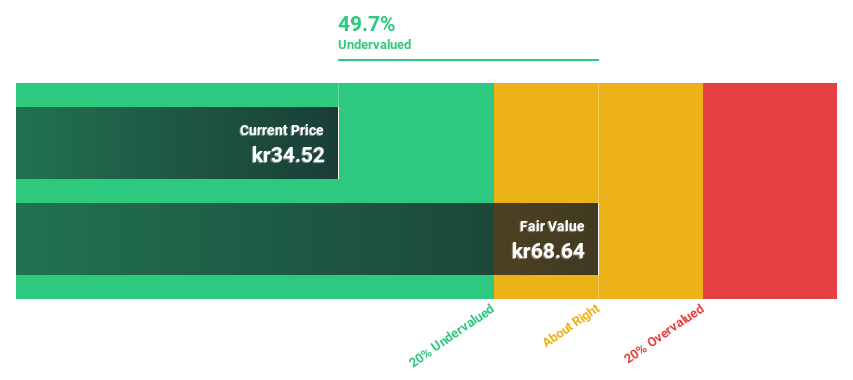

Truecaller

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individual and business use across India, the Middle East, Africa, and globally, with a market capitalization of SEK 13.29 billion.

Operations: The company generates revenue primarily from its communications software segment, totaling SEK 1.78 billion.

Estimated Discount To Fair Value: 44%

Truecaller, with a current price of SEK 35.48, is significantly undervalued based on a DCF valuation of SEK 63.31. Its earnings are expected to grow by 17.6% annually, surpassing the Swedish market's average growth rate of 13.8%. Despite past shareholder dilution, Truecaller’s revenue growth forecast at 18% per year outstrips the market prediction of 1.7%. Additionally, its Return on Equity is anticipated to be very high at 43.8% in three years.

Next Steps

Reveal the 51 hidden gems among our Undervalued Swedish Stocks Based On Cash Flows screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BIOT OM:LIME and OM:TRUE B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance