Swedish Exchange Growth Companies With A Minimum Of 10% Insider Ownership

As global markets navigate through a period of heightened uncertainty and mixed performance across various regions, the Swedish stock market presents a unique landscape for investors interested in growth companies with significant insider ownership. This characteristic can often signal strong confidence in the company's future prospects from those who know it best—its insiders.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 34% | 50.9% |

Biovica International (OM:BIOVIC B) | 12.9% | 73.8% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

InCoax Networks (OM:INCOAX) | 18% | 104.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Yubico (OM:YUBICO) | 37.5% | 43.8% |

SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

We're going to check out a few of the best picks from our screener tool.

Betsson

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Betsson AB operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and other international markets with a market capitalization of approximately SEK 17.87 billion.

Operations: The company generates revenue primarily from its Casinos & Resorts segment, totaling €974.50 million.

Insider Ownership: 10.9%

Betsson AB, a Swedish company, is trading at 69.5% below its estimated fair value, suggesting potential undervaluation compared to industry peers. While revenue growth (9.9% per year) lags behind the high-growth benchmark of 20%, it outpaces the Swedish market's average (1.7%). Earnings have increased by 32.9% over the past year with further growth expected at 14% annually, slightly above the market forecast of 13.8%. Insider activities show more buying than selling in recent months, aligning interests with shareholders despite an unstable dividend track record. Recent expansions into new regulated markets like Peru could support future growth.

Pandox

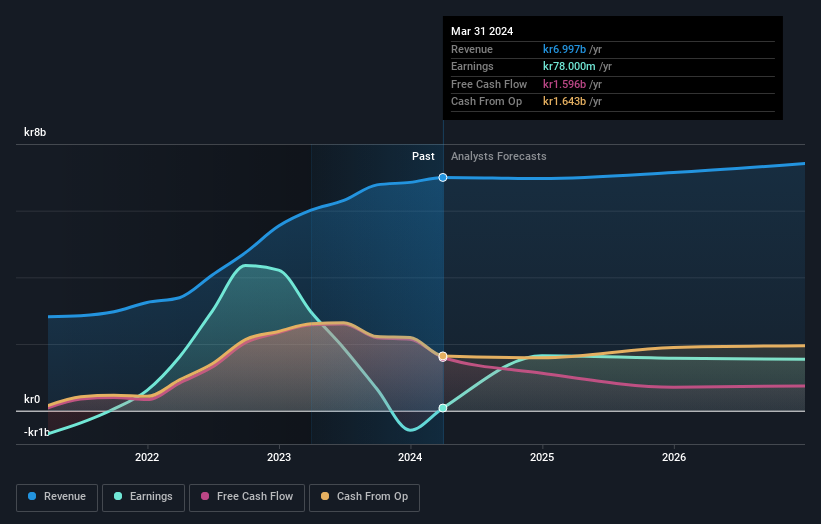

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB, a global hotel property company, engages in owning, developing, and leasing hotel properties with a market capitalization of approximately SEK 35.30 billion.

Operations: The company generates revenues primarily through two segments: Own operation (SEK 3.24 billion) and Rental Agreement (SEK 3.76 billion).

Insider Ownership: 12.3%

Pandox AB, a Swedish hotel operator, has shown a robust turnaround with its Q1 2024 earnings rebounding to SEK 447 million from a previous loss. Despite this recovery and an expected significant earnings growth of 41.64% annually, challenges persist such as low profit margins at 1.1% and insufficient coverage of interest payments by earnings. Recent dividend increase to SEK 4.00 per share reflects confidence but the payout ratio raises sustainability concerns amidst these financial pressures.

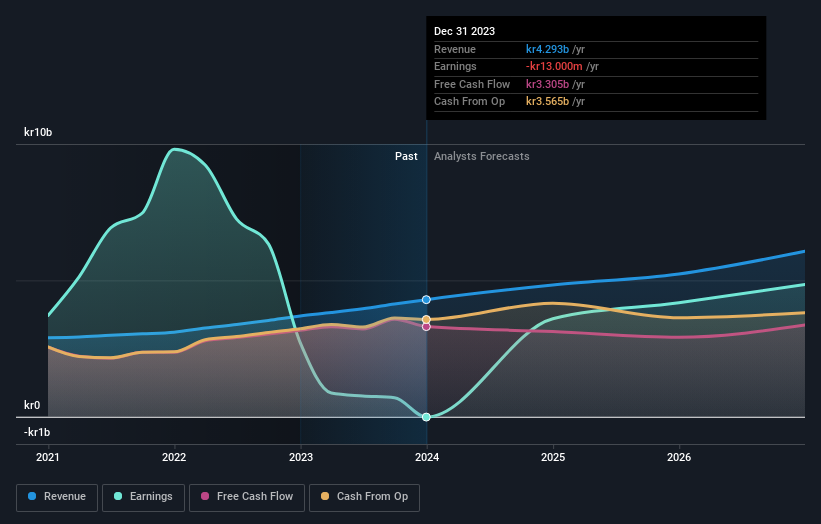

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (ticker: OM:SAGA A) is a property company that operates across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market capitalization of approximately SEK 99.07 billion.

Operations: The company generates its revenue primarily from real estate rentals, totaling SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish real estate company, has recently raised €499.56 million through green bond offerings, highlighting its commitment to sustainable financing. The firm reported a substantial increase in Q1 2024 earnings to SEK 1.08 billion from a loss the previous year and approved an increased dividend of SEK 3.10 per share for series A and B shares. Despite these positive developments, concerns linger due to shareholder dilution over the past year and debt not being well covered by operating cash flow. Earnings are expected to grow by 33.5% annually, outpacing the Swedish market forecast of 14.2%.

Make It Happen

Explore the 86 names from our Fast Growing Swedish Companies With High Insider Ownership screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BETS B OM:PNDX B and OM:SAGA A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance