Swaraj Engines And Two More Leading Dividend Stocks To Consider

The Indian market has shown robust growth, rising 2.4% in the past week and an impressive 46% over the last year, with earnings expected to grow by 16% annually. In such a thriving environment, dividend stocks like Swaraj Engines can be particularly appealing for investors looking for steady income combined with potential capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.01% | ★★★★★★ |

Gulf Oil Lubricants India (NSEI:GULFOILLUB) | 3.10% | ★★★★★☆ |

D. B (NSEI:DBCORP) | 3.57% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.17% | ★★★★★☆ |

Bharat Petroleum (NSEI:BPCL) | 6.85% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.17% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.41% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.66% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.34% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.58% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Swaraj Engines

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹35.90 billion.

Operations: Swaraj Engines Limited generates its revenue primarily from the sale of diesel engines, components, and tractor spare parts, totaling approximately ₹14.19 billion.

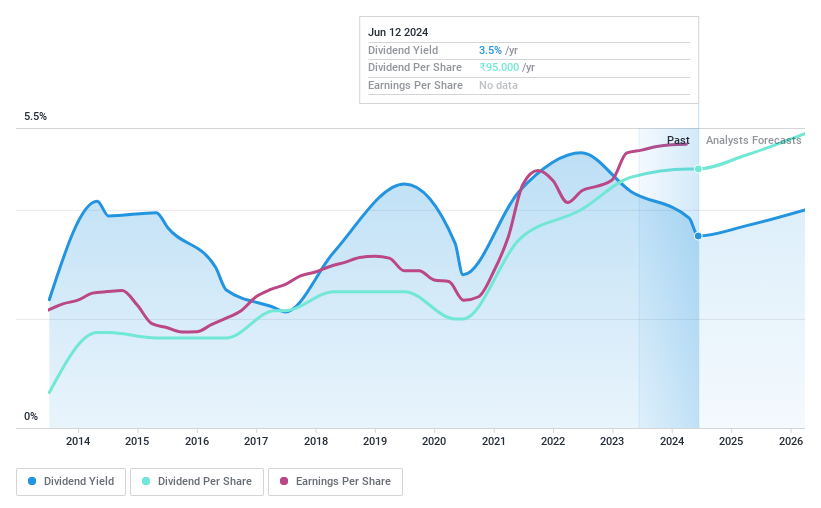

Dividend Yield: 3.2%

Swaraj Engines offers a dividend yield of 3.21%, placing it in the top 25% of Indian dividend payers. However, its dividends are not well-covered by earnings or cash flows, with a payout ratio of 83.7% and a cash payout ratio over 100%. Despite this, Swaraj Engines has increased its dividend payments over the past decade, although these payments have shown volatility. Earnings growth is modest at around 9.13% annually, supported by a strong historical earnings growth rate of 15.4% per year over the past five years. The company's recent penalty under CGST Act is not expected to impact financials materially.

Get an in-depth perspective on Swaraj Engines' performance by reading our dividend report here.

The valuation report we've compiled suggests that Swaraj Engines' current price could be inflated.

Ujjivan Small Finance Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ujjivan Small Finance Bank Limited offers a range of banking and financial services across India, with a market capitalization of approximately ₹86.66 billion.

Operations: Ujjivan Small Finance Bank Limited delivers a variety of financial services throughout India.

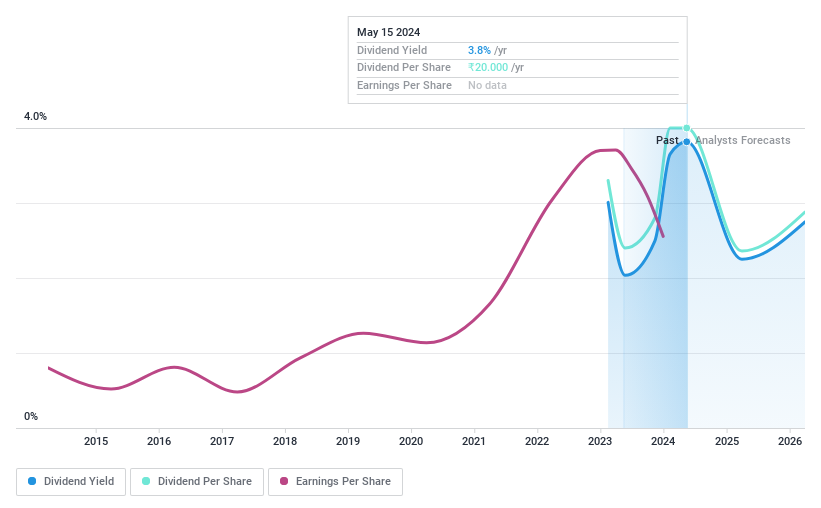

Dividend Yield: 3.3%

Ujjivan Small Finance Bank, recently initiating dividends, offers a yield of 3.35%, ranking in the top quartile of Indian dividend stocks. Its dividend sustainability is bolstered by a low payout ratio of 22.6%, with future earnings expected to cover dividends comfortably (17.2% forecasted payout ratio in three years). However, its short dividend history and high bad loans ratio (2.3%) introduce elements of uncertainty regarding long-term reliability. The bank's recent leadership changes could influence operational strategies moving forward.

Uniparts India

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited is a company that manufactures and sells engineering systems, solutions, assemblies, and components for off-highway vehicles across various global markets including India, the United States, Asia Pacific, Europe, and Japan, with a market capitalization of approximately ₹22.87 billion.

Operations: Uniparts India Limited generates revenue primarily through its linkage parts and components segment for off-highway vehicles, totaling ₹11.40 billion.

Dividend Yield: 3.9%

Uniparts India reported a notable decline in annual revenue and net income for the fiscal year ending March 2024, with sales dropping to INR 11.40 billion from INR 13.66 billion the previous year, and net income falling to INR 1.25 billion from INR 2.05 billion. Despite this downturn, Uniparts maintains a reasonable dividend coverage with a payout ratio of 62.6%. The company has recently initiated dividend payments, making it premature to judge the stability or growth of these dividends. Trading at a P/E ratio of 18.3x, Uniparts offers value compared to its peers and the broader Indian market's average of 34.4x P/E, with dividends yielding at an attractive top quartile rate of 3.86%.

Click to explore a detailed breakdown of our findings in Uniparts India's dividend report.

Our valuation report unveils the possibility Uniparts India's shares may be trading at a discount.

Summing It All Up

Investigate our full lineup of 16 Top Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:SWARAJENG NSEI:UJJIVANSFB and NSEI:UNIPARTS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance