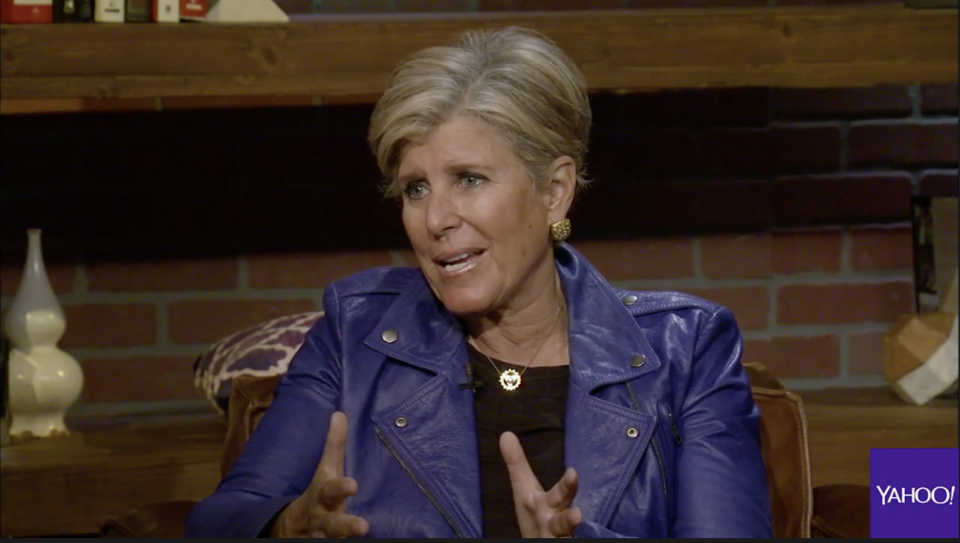

Suze Orman to average investors: Don't sell during downturns

Worried investors are at the edge of their seats after Wednesday’s dramatic market sell-off. The Dow dropped 831 points, the third largest one-day point loss in history. But what does this mean for the average investor?

Suze Orman, personal finance expert and best-selling author of “Women and Money,” says investors should keep their money in the market – as long as they don’t need it right away.

“Rather than coming out of the markets now…if you keep dollar-cost averaging, where you take your dollars every single month and put them into the stock market – you should be hoping that the recession is coming,” Orman told Yahoo Finance.

Orman advises her viewers to practice dollar-cost averaging, an investment strategy where you take the same fixed amount of money to buy investments regularly, regardless of the share price; this way you end up buying more shares when prices are low and fewer shares when prices are high. The point is to mitigate the risk you’re taking in investing in the market all at one time.

“The markets are so high — you know, I wish for 2008 again. That’s when the fortune was made,” Orman said. “That’s when you could buy stocks for pennies on the dollar. If you just bought them and kept buying them, do you have any idea of the amount of wealth that was made?”

For those who are playing the long game and can wait 10 to 30 years before they need to tap into their retirement funds, Orman says staying invested is a better alternative to cashing out and plopping your money in a low-yield savings account.

Looking back on her biggest investment mistakes, Orman said she regrets selling her Amazon (AMZN) shares in 2001 that she originally bought for $18 in 1997. Amazon shares are now trading at a whopping $1,727. “That’s when I learned. You like a stock? It makes sense? Possibly has a future? Just stick with it. If I had just kept it, I would’ve made tens of millions of dollars.”

Follow Jeanie Ahn on Twitter.

More from our Women + Money series:

Barbara Corcoran: Women should ‘pretend they’re a man’ during salary negotiations

‘It gets confusing fast’: FAFSA financial aid for students, explained

This story was originally featured on October 11, 2018.

Yahoo Finance

Yahoo Finance