Suzano (SUZ) to Report Q1 Earnings: What's in the Cards?

Suzano SUZ is scheduled to report first-quarter 2023 results on Apr 27, after the market close.

Q1 Estimates

The Zacks Consensus Estimate for SUZ’s first-quarter earnings is pegged at 93 cents per share, indicating a year-over-year slump of 36%. Earnings estimates have remained unchanged in the past 7 days.

Q4 Performance

In the last reported quarter, Suzano witnessed year-over-year improvements in earnings and revenues. The company has an average surprise of 53.8% in the trailing four quarters.

Suzano S.A. Sponsored ADR Price and EPS Surprise

Suzano S.A. Sponsored ADR price-eps-surprise | Suzano S.A. Sponsored ADR Quote

Factors to Note

In the Pulp segment, the company has been witnessing solid demand for sanitary paper. However, a slowdown has been noticed in printing and writing demand as well as specialties paper due to their ample stock with distributors, converters and printers who are beginning to destock. In China, the demand has been impacted mainly due to an increase in Covid infection rates as well as the tight margin for paper producers. This has impacted pulp orders for paper and board producers in this market. This is likely to have reflected in the segment’s results in the first quarter.

Elevated input costs have been observed due to higher chemical prices (especially of caustic soda) as well as higher energy and wood costs. The segment’s margins are expected to have been affected by the elevated input costs.

In the Paper segment, sales in the traditional Printing & Writing paper segment in Brazil are expected to have been solid through the quarter, driven by the publishing and educational materials markets, as well as school and office supplies. Demand is also expected to have remained strong in international markets. The normalization of the logistical situation has brought freight prices closer to historic levels, in addition to reducing congestion. Supply imbalances have been reported to be dissipating and markets are returning to historical trends. A favorable price is also expected to have favored the segment’s results.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Suzano this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: Suzano has an Earnings ESP of 0.00%.

Zacks Rank: The company currently sports a Zacks Rank of 1.

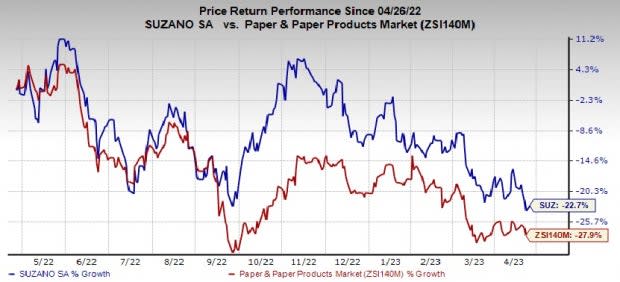

Price Performance

Image Source: Zacks Investment Research

Shares of Suzano have declined 22.7% in the past year compared with the industry's 27.9% fall.

Stocks to Consider

Here are some Basic Materials stocks, which according to our model, have the right combination of elements to post an earnings beat in their upcoming releases.

B2Gold Corp BTG is scheduled to release first-quarter 2023 earnings on May 9. The company currently has an Earnings ESP of +16.67% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for B2Gold’s first-quarter earnings has moved up 20% in the past 60 days. The consensus mark for BTG’s earnings for the quarter is pegged at 6 cents.

Air Products and Chemicals APD is scheduled to release first-quarter 2023 earnings on May 9. The company has an Earnings ESP of +2.25% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Air Products’ first-quarter earnings has been unchanged in the past 60 days. The consensus estimate for APD’s earnings for the first quarter is pegged at $2.64.

Koppers KOP is expected to release first-quarter 2023 earnings on May 5. The company has an Earnings ESP of +12.66% and currently carries a Zacks Rank of 3.

The Zacks Consensus Estimate for Koppers’ first-quarter earnings is pegged at 76 cents.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

Suzano S.A. Sponsored ADR (SUZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance