Supported by Cloud, AI Units, Microsoft Is on a Path of High Growth

Microsoft Corp. (NASDAQ:MSFT) is often considered a reference stock for the technology sector, being one of the two largest stocks by market cap along with Nvidia (NVDA) (they have been swapping places over the last few weeks). Despite exceeding a whopping $3 trillion market capitalization and sitting at the top of the market, the company has exciting days ahead with double-digit growth thanks to the quality of its cloud business and its ability to incorporate artificial intelligence in all major business units and customer solutions.

Decentralized structure is main growth engine

Stock analysts often highlight the products of Microsoft when referring to its growth. The company's growth potential is, however, rooted in its organization and not in specific products like Azure or Copilot.

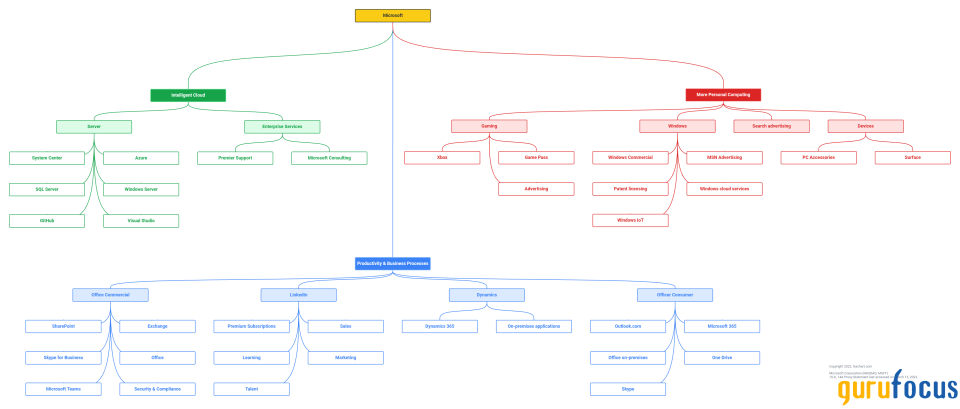

Microsoft is a very large corporation with a complex structure. If I had to compare it to an animal, it would be the octopus as the company has three primary arms that have a number of subdivisions under each, which support the overall company. The main divisions are Intelligent Cloud (including the high-growth Azure unit), Personal Computing (including Windows and Gaming, which holds the recently acquired Activision Blizzard subsidiary) and Productivity & Business Processes, which encompasses all the corporate solutions (Teams, Skype, Outlook, etc.).

Source: Lexchart

One of the reasons I believe the company will continue to grow is there will always be a business unit (or several) that will fuel the overall growth of the company. The highly decentralized structure has been in the DNA of the company since the years of Bill Gates (Trades, Portfolio), and seemingly encouraged by current CEO Satya Nadella. Autonomy of business units leads to innovation and ultimately consistent growth of the overall company, independently of potential market cycle and trend shifts.These units power Microsoft's growth engine

Microsoft's current growth catalyst is Intelligent Cloud, in particular its cloud solution Azure. The company managed to implement AI technology into the software to create rapid and custom-built solutions for its customers. According to the earnings report released on April 25, the Intelligent Cloud has been the fastest-growing business unit with 21% year-over-year revenue growth, second only to Xbox's 62% growth, of which 61% is a net impact of the Activision acquisition.

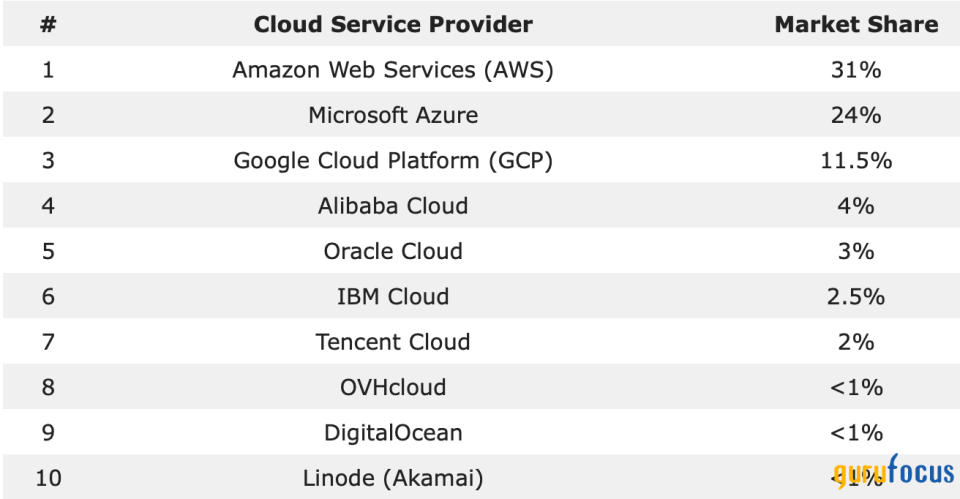

Within the Intelligent Cloud segment, server products and cloud services (which includes Azure) grew 24%. This growth rate is well above Amazon Web Services' 17% growth, showing the software is catching up. Amazon's (NASDAQ:AMZN) AWS is still in first place with 31% market share, but Azure is trailing close behind with 24% market share.

Source: Mordor Intelligence

The company is likely to continue outperforming its competitors, particularly AWS, given it is a few steps ahead in terms of AI relative to Amazon. Being the main investor in OpenAI (Microsoft invested around $13 billion) helped and will continue to help it stay ahead of competition in terms of AI, with perhaps the only serious threat being Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL). Despite the competition, the space is large enough for all these companies to continue on a path of growth. Indeed, the cloud computing market is expected to grow at a 16.40% compounded annual rate in the next five years. Therefore, given Azure's AI capabilities and backing by other business units of Microsoft, it is not unreasonable to assume continued growth above 20%.

Financials

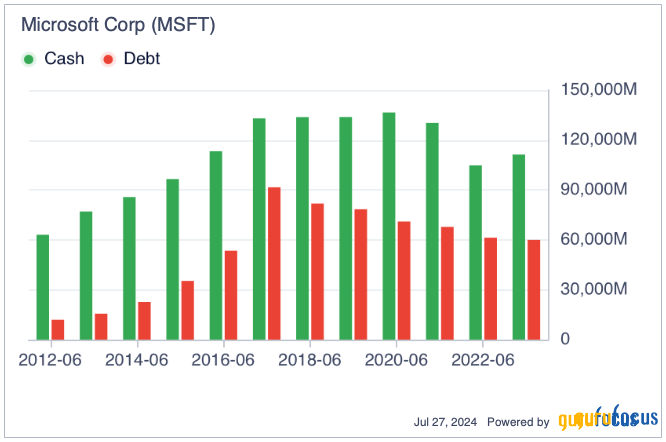

Microsoft's financials are solid and enviable. Its balance sheet is pristine. Despite the $68.70 billion acquisition of Activision Blizzard to boost its stagnant Gaming & Personal Computing segment, the company still has $80 billion in cash on hand, which is sufficient for another large acquisition. Its total debt amounts to $106 billion and with $70 billion of expected free cash flow it would generate in 2024, the company could easily repay all of its debt in a hypothetical scenario.

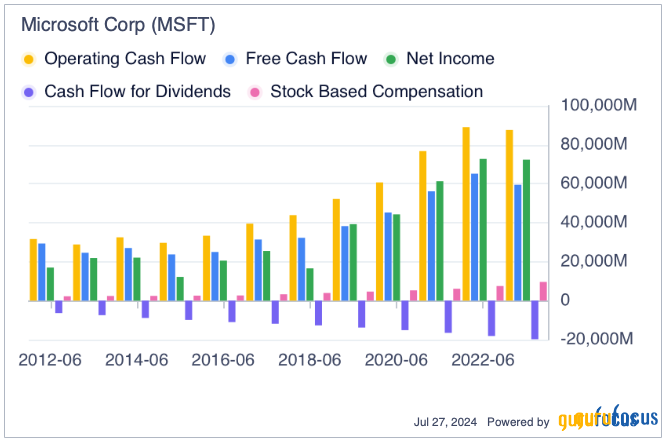

Further, free cash flow continues to trend higher year after year. Free cash flow is an indicator that is appreciated by investors as it shows the ability of a company to efficiently manage its business. Rising free cash flow is also an excellent indicator for the coming years; the cash generated by the company can support acquisitions and investments into the business that will in turn trigger new growth catalysts (i.e., investment in OpenAI, acquisition of Activision).

Free cash flow is also a reassurance for shareholders as an uptrend also increases the likelihood of cash returned to investors in the form of share buybacks. Microsoft already returned $8.4 billion to shareholders in the form of share buybacks and dividends in the last quarter, according to its latest earnings report. The dividend yield is rather low (0.67%) - in part due to fast-paced stock price growth - but the dividend payments have been rising consecutively for 19 years.

Revenue has been growing at an average rate of 14% over the last five years. Its return on capital averaged 30% per year and its earnings margin averaged 40% in the same period, which altogether further confirm the business is efficiently managed and the cash it generates continues to support and fuel its growth.

Valuation

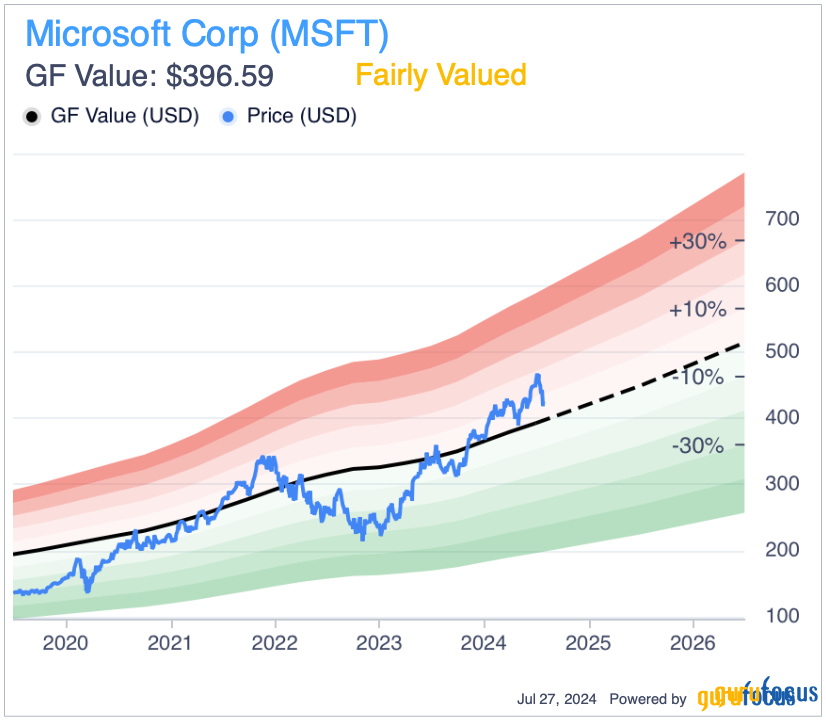

At first glance, the stock may appear slightly overvalued. It is trading at 23 times last 12 months earnings and 27 times forward earnings, which puts it on the higher range of its historical valuation. However, it is important to note Microsoft's valuation has been on the rise since the Global Financial Crisis, with earnings multiples expanding. This is typical of companies that show sustained high growth, and it is likely that the multiples will continue expanding in the coming years.

From a pure multiple perspective, the stock may indeed not be undervalued, as shown by the GF Value chart above.

But when computing the valuation via a discounted cash flow model, we can see the stock may actually be undervalued by approximately 20% to 25%. For the calculation, I used the actual total earnings per share in the last 12 months and a (very) conservative 7.50% growth rate for earnings per share. This gave me a stock value of $496 per share. Interestingly, this is in line with Citi analyst Tyler Radke's initial price target ($495) before he hiked it to $520, citing recent media reports in relation to OpenAI's doubled annualized revenue and Microsoft's cloud deal with Oracle (NYSE:ORCL).

Main risk factor to my case

In the technology sector, the main threat is always obsolescence, which is rooted in lack of innovation and results in the competition overtaking it. Especially for large and successful companies, staying at the top for decades is particularly hard. This requires consistency in the management team. There is one large exception here, however: the company's octopus-like structure and continued investments in distinct business units. These numerous tentacles of innovation and growth allow Microsoft to remain one of the top-performing companies and to minimize any adverse impacts when one or even multiple business units are struggling.

Bottom line

Despite having reached an impressive market cap, Microsoft still has wonderful years ahead of double-digit growth. Artificial intelligence is yet another tailwind that is already boosting its cloud business and putting the company as one of the likely AI leaders.

Its direct exposure to OpenAI additionally increases the likelihood of Microsoft staying ahead of the competition in the sphere of generative AI. Its structure ensures innovation and finds new growth catalysts in a rapidly changing technological landscape. The stock is attractively valued and represents a buying opportunity for long-term tech-focused or diversified investment portfolios.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance