Sunrun (RUN) Q4 Earnings Miss Estimates, Revenues Surpass

Sunrun Inc. RUN reported fourth-quarter 2019 earnings of 10 cents per share, which missed the Zacks Consensus Estimate of 27 cents by 63%. However, the bottom line improved from a loss of 5 cents per share in the prior-year quarter.

The year-over-year upside can be attributed to income tax benefits worth $8.1 million that the company gained in the reported quarter.

For 2019, the company generated earnings of 21 cents per share, which surpassed the Zacks Consensus Estimate of 18 cents by 16.7%. However, the bottom line declined 8.9% from 23 cents per share generated in 2018.

Revenues

Sunrun’s revenues of $243.9 million in the quarter surpassed the Zacks Consensus Estimate of $218.4 million by 11.7%. Revenues also rose 1.6% from the year-ago quarter’s $240.1 million.

In 2019, the company generated revenues of $858.6 million, which surpassed the Zacks Consensus Estimate of $824.2 million by 4.2%. Revenues also rose 13% from $760 million in 2018.

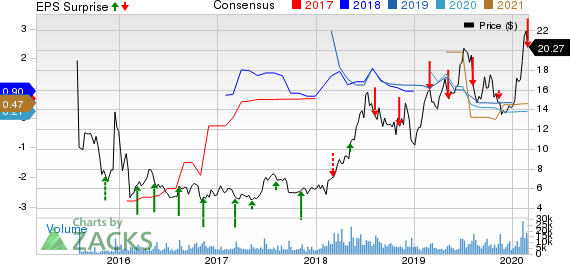

Sunrun Inc. Price, Consensus and EPS Surprise

Sunrun Inc. price-consensus-eps-surprise-chart | Sunrun Inc. Quote

Operational Highlights

Total operating expenses were $292.4 million in the fourth quarter, up 18.5% year over year. Operating expenses in the reported quarter grew on escalated cost of customer agreements and incentives, solar energy systems and product sales, increased sales and marketing expenses as well as higher general and administrative costs.

Interest expenses were $46.7 million, up approximately 25.4% on a year-over-year basis.

Total cost of revenues was $182.2 million, increasing 18% year over year.

Key Highlights

In the reported quarter, Megawatt (MW) deployed grew 1.7% to 117 MW from 115 MW in the fourth quarter of 2018.

Creation cost per watt was $2.87 in the fourth quarter of 2019 compared with $3.17 in the year-ago quarter. Net present value (NPV) created in the quarter was $100 million, reflecting 13.8% year-over-year decline from $116 million in the fourth quarter of 2018.

Sunrun’s net earning assets as of Dec 31, 2019 were $1.5 billion, up 8% from the prior-year quarter.

The company’s customer base expanded 22% year over year to 285,000.

Financial Performance

Sunrun had $102 million of cash, as of Dec 31, 2019, up $66.3 million from 2018.

Net cash outflow from operating activities was $204.5 million at the end of 2019 compared with $62.5 million used for operating activities in 2018.

Total recourse and non-recourse debt, net of current portion, was $2,219.6 million at the end of 2019 compared with $1,713.4 million as of Dec 31, 2018.

Q1 Guidance

For the first quarter of 2020, Sunrun expects deployments of 102 MW.

Zacks Rank

Sunrun currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Solar Releases

SolarEdge Technologies SEDG reported fourth-quarter 2019 adjusted earnings of $1.65 per share, which surpassed the Zacks Consensus Estimate of $1.30 by 26.9%.

Enphase Energy ENPH reported fourth-quarter 2019 adjusted earnings of 39 cents per share, which surpassed the Zacks Consensus Estimate of 33 cents by 18.2%.

First Solar FSLR reported fourth-quarter 2019 adjusted earnings of $2.02 per share, which missed the Zacks Consensus Estimate of $2.79 by 27.6%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Sunrun Inc. (RUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance