Sun is Shining on Solar: 3 Top Stocks to Buy

Solar: Impressive Performance in the Face of Tough Markets

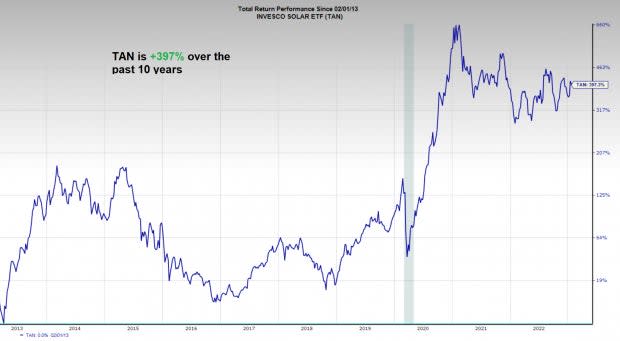

In the face of four major market corrections (flash crash of ‘15, ‘18 EOY slide, Pandemic of ’20, & ’22 correction), the Invesco Solar ETF TAN has produced returns of nearly 400% over the past 10 years.

Image Source: Zacks Investment Research

What is Driving the Performance of Solar Stocks?

The solar industry has benefitted from several tailwinds in recent years, including:

· Wider Adoption: A growing number of developing nations worldwide are adopting solar amid environmental concerns.

· Technological Improvements: Advancements in solar technology, such as higher efficiency, upgraded energy storage means, and lower prices, drive adoption even further.

· Global Energy Consumption: As developing nations consume more energy, alternative energy sources can help with supply.

Below are 3 solar stocks poised to move higher in 2023:

Array Technologies ARRY manufactures ground-mounting systems used in solar energy products. What makes the stock attractive is:

· Recent Insider Buys: No one knows more about a stock than its insiders. While insiders may sell shares of stock for various reasons (they need cash, are exercising options, etc.), they only buy for one reason – they believe shares will move higher. Over the past year, three insiders purchased more than $100,000 worth of stock in the open market, including the CEO, who bought a half million dollars worth of stock in July.

Image Source: Zacks Investment Research

· Tendency to Beat EPS Estimates: Though ARRY holds a mid-tier Zack’s Rank of 3, the stock has surprised to the upside on EPS every quarter since going public outside of one.

Image Source: Zacks Investment Research

· Triple-digit Revenue Growth: Few stocks in the market exhibit this type of healthy growth.

Image Source: Zacks Investment Research

Jinko Solar JKS is a Chinese-based solar manufacturer. What makes the stock attractive is:

· High Zack’s Rank: JKS sports a best-possible Zack’s Rank of 1. Stocks with high Zack’s Ranks tend to outperform.

· Strong Fourth Quarter Results: EPS rose from $0.05 in Q4 2021 to $0.90 in Q4 2022.

· China Exposure: China has shown outstanding strength thus far in 2023. The Ishares China Large-Cap ETF FXI is up five weeks in a row.

Image Source: Zacks Investment Research

First Solar FSLR is a leading global provider of PV solar energy solutions. What makes the stock attractive is:

· Liquidity: Institutions tend to have the largest bearing on the movement of stocks. Large institutions such as pension funds, banks, and hedge funds require high liquidity. First Solar has a market cap of $19 billion and trades nearly 2.8 million shares per day on average.

· Low Beta: Although FSLR is a member of the high-flying solar group, it has a relatively low beta (1.30) compared to its peers – meaning it does not swing wildly. Low-beta stocks tend to be easier to hold than high-beta.

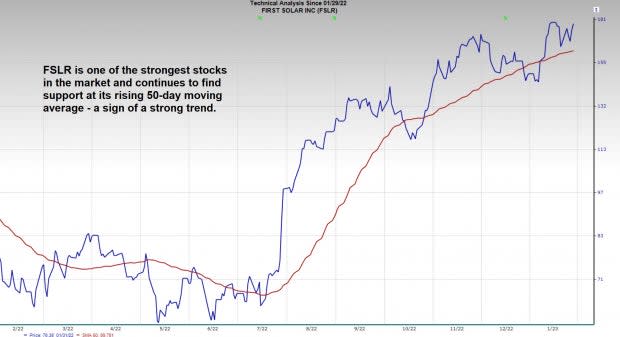

· Relative Strength: FSLR has been one of the strongest trending stocks in any industry group over the past year. While most solar stocks are well off their highs, FSLR is just 3.2% off its 52-week high and was recently supported at its 50-day moving average.

Image Source: Zacks Investment Research

Takeaway

Expect solar stocks to continue their momentum in 2023. ARRY, JKS, and FSLR offer investors attractive opportunities. However, investors who want to play the industry as a whole with less volatility should opt for shares in the Solar ETF TAN.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JinkoSolar Holding Company Limited (JKS) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Array Technologies, Inc. (ARRY) : Free Stock Analysis Report

iShares China Large-Cap ETF (FXI): ETF Research Reports

Invesco Solar ETF (TAN): ETF Research Reports

Yahoo Finance

Yahoo Finance